Boston Properties is moving forward with its plans to replace the MTA’s old Madison Avenue headquarters with a supertall tower.

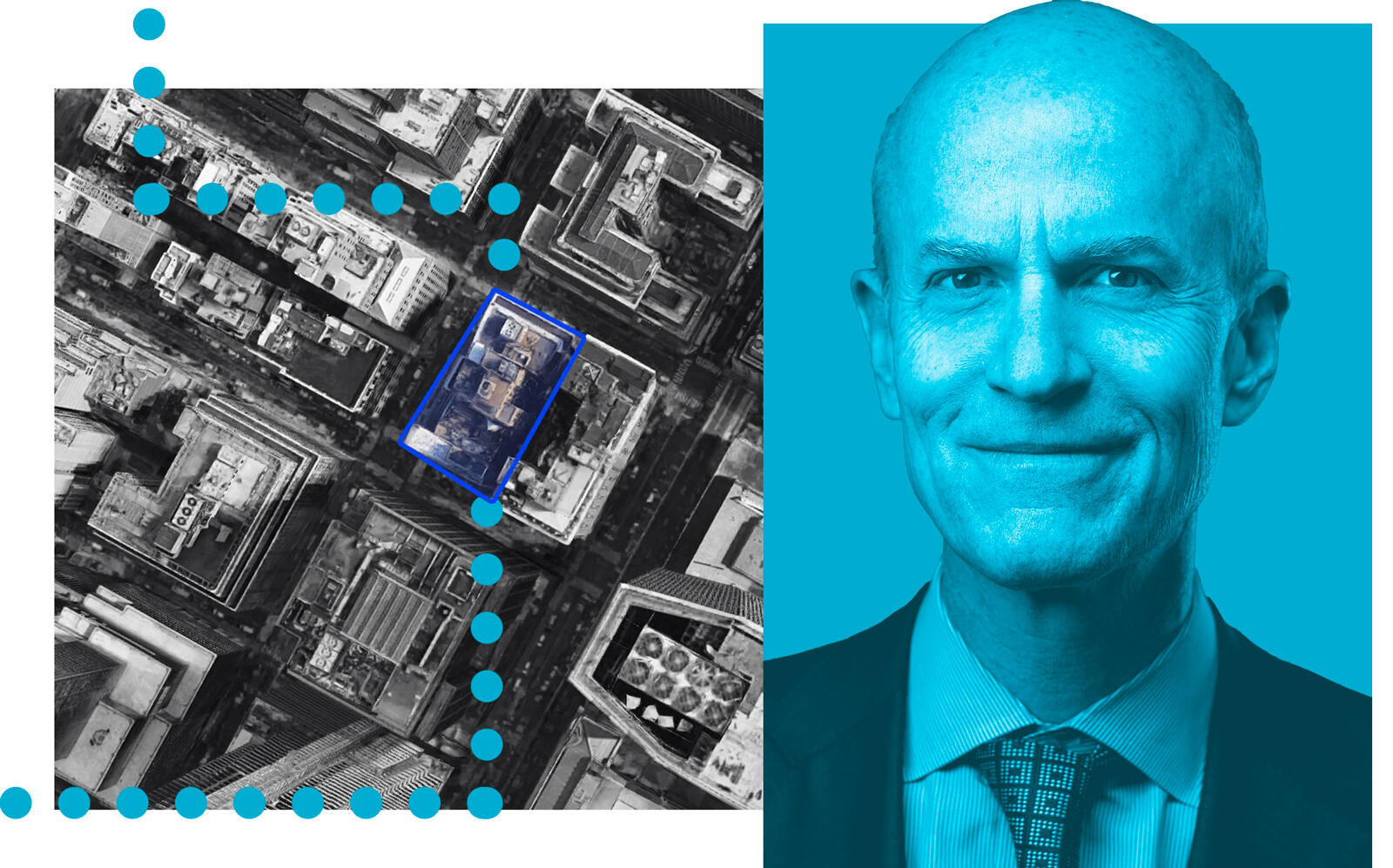

The developer filed a land use application with the Department of City Planning for the site at 341-347 Madison Avenue in Midtown. Boston Properties wants to replace the former MTA HQ, as well as three adjacent MTA-owned lots, with a skyscraper that could rise 1,050 feet.

The developer is seeking zoning changes for its proposed building, meaning the project must go through the city’s uniform land use review procedure; submitting the application to the planning department kickstarts that process. If the application is certified, it triggers the seven-month public review process, which would ultimately end with approval (or not) from the City Council and the mayor.

Boston Properties has proposed a 925,000-square-foot mixed-use commercial, office and retail building, according to a draft scope of work released last summer.

The developer is seeking two zoning changes to make that happen: It wants to double the building’s floor-area ratio — from 15 to 30 FAR — in exchange for improving pedestrian and mass transit circulation. It’s also seeking a smaller setback distance to accommodate a larger building, which is projected to have 200 feet of frontage along Madison Avenue and 125 feet of frontage along both East 44th and 45th Streets. Assuming all goes according to plan, construction would wrap up in 2026, according to the draft scope.

Boston Properties did not respond to a request for comment. The developer filed applications to demolish the three buildings earlier this year.

Read more

It’s been quite a journey to get to this point: The MTA bought 347 Madison Avenue for $11.9 million in 1979, and the adjacent sites for $12.25 million and $23.75 million, respectively, in 1991, the New York Times reported. It began seeking bids from developers in 2013 to demolish and rebuild the site. Soon after, the MTA moved its headquarters to 2 Broadway, but continued to pay about $4 million per year to maintain the Madison Avenue building.

Boston Properties was selected in 2016 to develop the site, but the city objected to the deal over the allocation of property taxes. But shortly after the coronavirus caused financial issues for both the transit agency and the city, the two sides came to an agreement.

It’s projected that the site could generate more than $1 billion in revenue for the MTA over a 99-year ground lease, with the proceeds benefiting capital improvements.

After the 2015 rezoning of the Vanderbilt Corridor — in which the MTA’s former HQ sits — and the broader Midtown East rezoning of 2017, developers flocked to the area to build new skyscrapers. SL Green’s 1.6 million-square-foot One Vanderbilt opened last year, and JPMorgan Chase is planning a new, 2.2 million-square-foot headquarters at 270 Park Avenue. And next to Grand Central Terminal, TF Cornerstone and RXR Realty are hoping to build a skyscraper that could rise 1,600 feet.

While the immediate future of the office market is murky — a recent Partnership of New York City survey found 10 percent of Manhattan office employees had returned to the workplace as of early March, unchanged since October — Boston Properties’ 2026 construction deadline looks past the date when the sector is expected to recover from the pandemic.