The coronavirus could soon claim another victim in Thor Equities’ real estate portfolio.

East West Bank filed a lawsuit in New York State Supreme Court to foreclose on Thor’s mixed-use property at 17 West 125th Street in Harlem. The lender claims that Thor is delinquent on three loans totaling about $20 million.

In 2015, California-based East West Bank provided three loans to Thor for the property: a $13.5 million acquisition loan, a $3.82 million building loan and a $5.6 million project loan. The developer subsequently renovated the properties.

In 2019, Thor allegedly missed two loan payments and reached an agreement with

the bank to extend the loan into 2021, according to the complaint. Thor then reached a payment deferral and repayment agreement in April 2020 after the pandemic began. But the complaint alleges that Thor missed its loan payments in November and December, triggering new defaults.

In the months that followed, East West Bank alleges it sent multiple default notices to Thor that have gone unanswered. The lender also sent Thor a notice of hardship declaration due to Covid-19 that went unreturned, according to the complaint.

“Overall, our global portfolio has performed well for the past year but, unfortunately, the difficulty some tenants are having paying their rent in this challenging environment, have thrust us into this situation,” Katie Smith, Thor’s director of marketing and communications, said in a statement to The Real Deal.

Read more

New York state has banned commercial foreclosures and evictions until at least May 1. But East West Bank alleges that because Thor failed to sign a notice of hardship declaration, it is able to proceed with the foreclosure. An attorney for East West Bank declined to comment, citing pending litigation.

The lawsuit also named the commercial brokerage Avison Young as a defendant, alleging that it has an interest in the property. Avison Young declined to comment.

Thor purchased the five-story rental building in 2015 for $30 million. It has 50 rental units along with more than 9,000 square feet of retail space. Its tenants include Insomnia Cookies and Smile Direct Club.

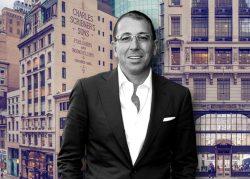

Thor, led by Joe Sitt, has faced other challenges in its portfolio — some that predate the pandemic. The company is facing another possible foreclosure on its Charles Scribner’s Sons Building at 597 Fifth Avenue. And last year, SL Green took control of 590 Fifth Avenue after Thor defaulted on its mezzanine debt in August.

The company has recently tried to pivot away from retail toward industrial. In 2019, the company started ThorLogis, to buy and develop logistics properties. Late last year, Amazon took more than 300,000 square feet at 280 Richards Street, a warehouse the developer owns in Red Hook.