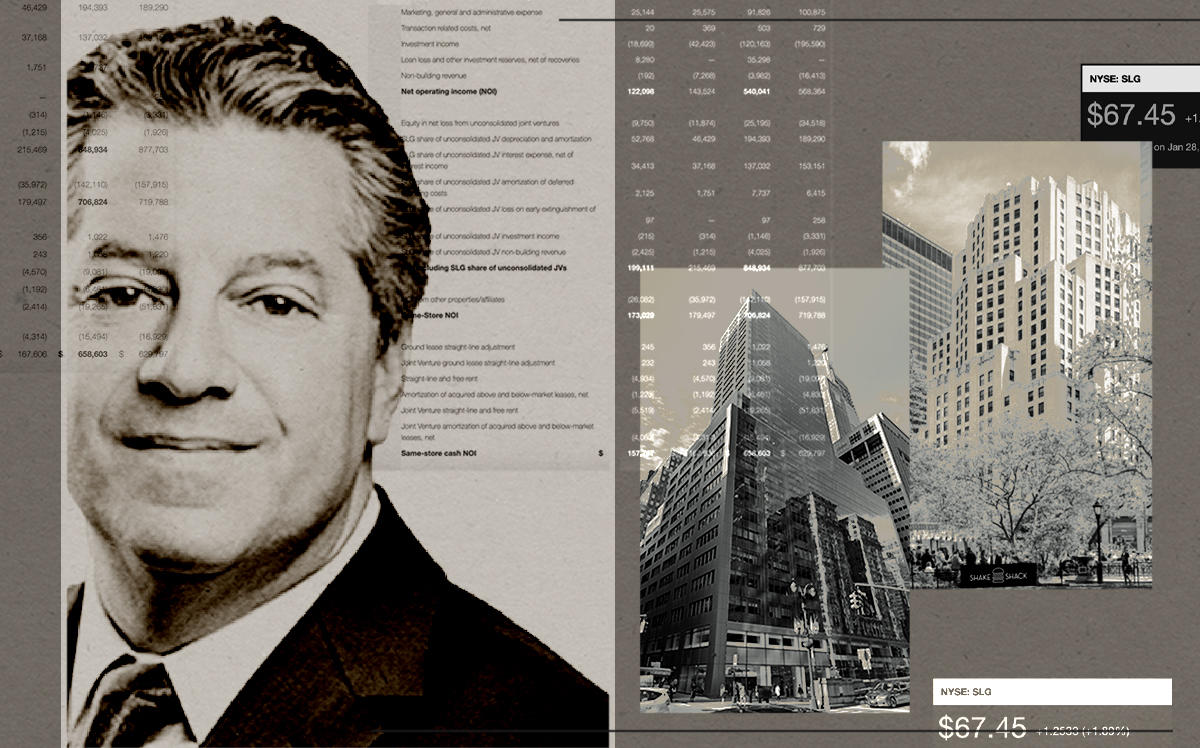

On Thursday’s earnings call, SL Green CEO Marc Holliday linked the company’s upcoming shift in headquarters from the Graybar Building to One Vanderbilt with his sunny outlook on the New York office market. The real estate investment trust owns both buildings.

He noted an improvement in “the psychology and the market vibe” in recent months, as tenants have made plans to return to the offices by late summer. SL Green’s new chapter, Holliday said, “coincides with the reconstruction of New York City.” That will be marked by the Covid vaccine rollout, “the easing of Covid restrictions, the promise of federal stimulus for cities and states, and a gradual return of the workforce to offices and other places of business,” he said during the Q4 call’s opening remarks.

From October through December, Manhattan’s largest office landlord signed 463,927 square feet in new leases, a major increase from the 187,469 square feet signed in the third quarter. This month, the company also announced a 100,000-square-foot lease with liquor giant Beam Suntory at 11 Madison Avenue, and two new leases totaling 43,000 square feet at One Vanderbilt.

While SL Green is looking ahead, a look back at last quarter’s performance shows the firm recorded $119.2 million in funds from operations — or $1.56 per share — down from $147.6 million in the same quarter of 2019. The REIT collected 98 percent of office rents due in the quarter and 81 percent of retail rents — a 10-percentage-point improvement from the prior quarter.

Holliday acknowledged that gearing up for tenants’ summer return-to-office “sounds like a long way away, but it’s a blink of an eye.” He was confident, he said, “that there will be a significant return by mid-, end-of-summer, and hopefully by end of summer we’ll be completely back, completely vaccinated.”

SL Green executives noted they are on track to lease 1.3 million square feet in 2021, and to reach 85 percent occupancy at One Vanderbilt by year end — objectives they announced at last month’s investor conference. Holliday noted the 1.6 million-square-foot tower had “several hundred” people working in the building.

“All we need is velocity in the marketplace,” executive vice president and director of leasing Steven Durels said. “We have a good enough portfolio and a good enough leasing team that we’re going to get more than our fair share of the deals that are in the market.”

In addition to leasing in its own portfolio, SL Green also announced that it had recently secured three leases totalling 224,000 square feet at 245 Park Avenue, where the company acts as agent for landlord HNA.

Read more

As in previous quarterly calls, SL Green executives fielded questions about the future of New York’s office market, and reiterated their view that work-from-home would not become a widespread phenomenon — and that a trend toward de-densification would help offset that, in any case.

Durels also addressed the issue of Manhattan’s soaring sublease space, which has reached a record high in terms of square footage, but has yet to pass previous peaks as a percentage of total space.

“What we see a lot of the time is that tenants come and dump a lot of space on the market, but then they rapidly pull it off the market as well when things start to improve,” Durels said. He pointed to a tenant in Grand Central that has put 500,000 square feet on the market, while also publicly saying it only intended to sublease up to 250,000 square feet of that — potentially skewing the statistics. Durels added that 40 percent of sublease space has four years or fewer remaining on the lease term, making that space less competitive and reducing its impact on the overall leasing market.

“New York City’s rebound will be driven by the fact that we have a very diversified tenant base, as opposed to the West Coast which is sort of a one-trick pony,” Durels said.