The country’s leading mall owner continues to struggle amid a pandemic that has decimated foot traffic and plunged many retailers into bankruptcy.

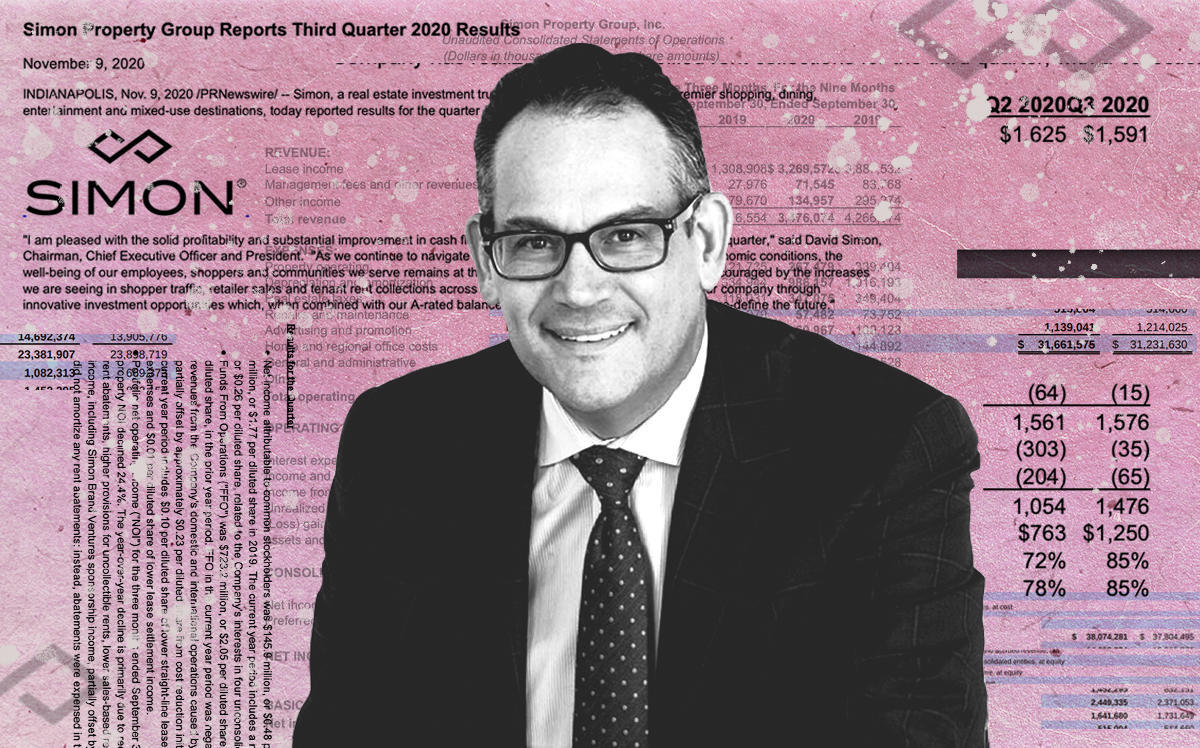

In the third quarter, Simon Property Group saw its net income plummet to just $145.9 million, the retail REIT reported on a Monday earnings call. That’s well below the $544.3 million it made during the same time last year, and even under the $254.2 million it accrued last quarter.

That’s due, in part, to tenants missing rent payments. Even though the company’s rent collections were up in the third quarter — it collected 85 percent of billed rents as of Nov. 6, up from 72 percent the previous quarter — its lease income decreased $315.1 million compared to the same time last year.

Non-paying tenants have also cost the company, along with ongoing litigation surrounding Taubman. The company lost $20.6 million compared to the previous year, primarily related to an increase in legal fees and expenses.

Read more

Occupancy was 91 percent as of Sept. 30, a slight decrease from last quarter’s 93 percent, but base minimum rent increased 2.9 percent year-over-year to $56.13.

Despite this, CEO David Simon sounded a note of optimism during the company’s earnings call.

“We have withstood Covid,” he said.

As part of Sparc, its venture with Authentic Brands, and a separate partnership with Brookfield Property Partners, Simon has been aggressively acquiring bankrupt companies that fill its malls. The real estate giant recently rescued J.C. Penney from bankruptcy, along with Lucky Brands and Brooks Brothers.

“We’re going to make a billion plus on that investment without question,” Simon said of Brooks Brothers in particular. “We know the brands. We do a lot of research.”

While the company is rumored to be in talks with Amazon to place fulfillment centers in malls, Simon said that there has yet to be a signed deal with the e-commerce giant, neither confirming nor denying the rumors.