HFZ Capital Group continues to have trouble meeting its debt obligations.

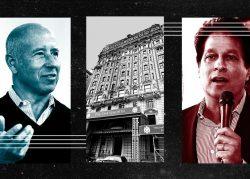

The lender at HFZ’s planned project on Manhattan’s Upper East Side claims the prolific condo developer owes more than $18 million on defaulted loans, according to a motion for summary judgement filed in New York Supreme Court on Tuesday. HFZ principals Ziel Feldman and Nir Meir are named as co-defendants for personally guaranteeing the debt.

The lender, identified as YH Lex Estates, claims it loaned HFZ a total of $20.5 million between 2017 and 2019 to develop the project on an assemblage around 1135 Lexington Avenue. The lawsuit alleges that after HFZ defaulted on the initial loan agreement in November 2019, it agreed to a repayment plan. In July, the two parties again agreed to extend the repayments, allowing the developer to repay the loans in six installments by October.

But HFZ only paid $1 million towards the balance of these loans, the suit alleges. At one point, the lender claims a $750,000 check that Meir sent from HFZ was returned for insufficient funds.

Read more

In addition to seeking the principal and interest of the loans, the lender said that “because of the history of HFZ’s noncompliance with its debt obligations, HFZ explicitly agreed to pay all legal fees and costs incurred.”

A spokesperson for HFZ Capital said in a statement the claim is baseless and is in the process of being dismissed.

The attorney representing YH Lex Estates, Mark H. Hatch-Miller of Susman Godfrey, did not return a request for comment. PincusCo first reported the news.

HFZ has become one of the most active condo developers in New York City in recent years, with high-profile projects like the XI, the Bjarke Ingels-designed condo-hotel hybrid next to the High Line, and the Bryant, the David Chipperfield-designed condo near Bryant Park. It also bet on rental conversions, including the Belnord on the Upper West Side, which it transformed into condos.

But recently the company has seen its share of problems. In December, federal officials alleged that HFZ managing director John Simonlacaj let the mob skim hundreds of thousands of dollars from the XI, as well as other Manhattan projects. (He was fired from HFZ.) And in September, CIM Group tapped a brokerage to market junior mezzanine loans tied to four of the developer’s condominium projects — including 88-90 Lexington Avenue and The Astor at 235 West 75th Street — through a foreclosure sale.

Last month, Starwood Property Trust filed suit against HFZ alleging the firm defaulted on loan payments at the Chatsworth, an Upper West Side co-op conversion.