In a big investment portfolio, some part of it will inevitably underperform. For the city’s biggest pension fund, that part has been private equity real estate.

The New York City Employees’ Retirement System ramped up its exposure to that category, only to see it underperform the stock market by $260 million and rack up at least $110 million in fees between 2016 and 2019, New York Focus reported.

During those years, the fund increased its portfolio in private equity real estate by 45 percent, including the investment of $150 million of new assets into the Blackstone Group, the publication reported.

“Even on the reported values, NYCERS’ private equity real estate portfolio has dramatically underperformed,” former Securities and Exchange Commission attorney Edward Siedle told New York Focus.

The actual numbers are probably even worse. Jeff Hooke, an investment banker and senior lecturer at Johns Hopkins University, said that unreported fees charged by private equity managers might have brought the cost of the pension fund’s fees up to $183 million.

Read more

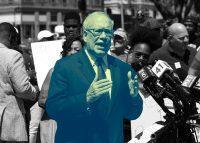

The city’s pension funds, unlike the state’s Common Retirement Fund, are not controlled by a single fiduciary. But no one has more responsibility for them than the city comptroller, who for the past seven years has been Scott Stringer. As it happens, Stringer has made the real estate industry the whipping boy of his 2021 mayoral campaign.

“No more giving away the store to developers,” he said last month at his campaign launch, repeating his catchphrase “gentrification industrial complex.” But in 2015 he pushed for changes in state law to allow the city’s pension funds to put more money into alternative investments such as private equity real estate. Before his election as comptroller in 2013, he pledged to reduce the fees paid by the pension funds.

New York Focus analyzed a three-year period during which the stock market did extraordinarily well, so it is no surprise that alternative investments underperformed during that time.

The publication noted that NYCERS’ 2019 financial reports show a 10.4% annualized return for its private equity real estate portfolio over the last decade — versus 14.7% for the Russell 3000 index — but the actual return was lower because it does not take certain fees into account. Private equity investments can also have their reported values inflated by asset managers, Siedle said. [New York Focus] — Sasha Jones