A few days into classes in August, students at the University of North Carolina at Chapel Hill were in panic mode.

Covid-19 cases were breaking out in dorm rooms and frat houses at the state’s flagship university, which rapidly began pulling the plug on on-campus instruction and pivoted to online classes.

It’s a chain of events playing out at many public and private universities across the country, with Notre Dame and Michigan State also forced to do an about-face on on-campus teaching.

This forced adoption of remote learning, combined with uncertain federal policy on international students, has asked serious questions of the once-booming student housing market and is leading institutions of higher education to rethink their own sprawling real estate portfolios. If student enrollment numbers continue to fall, universities could be preparing for a mass selloff of their assets. And with falling rents and rising delinquencies, the student housing sector is on alert for waves of distress, according to some industry experts.

“People are just waiting for dislocations,” said Tim Bradley, whose firm TSB Capital Advisors arranges financing for student housing projects. “You are going to hear about most of the carnage over the next two months.”

Oh, the humanities

In March, about when Covid-19 was declared a pandemic, CUNY’s board of trustees tapped Real Estate Solutions Group to value its 300 building-portfolio.

Brian Obergfell, an attorney who chairs CUNY’s facilities planning and management, confirmed only that CUNY could sell its properties and declined further comment.

People are just waiting for dislocations. You are going to hear about most of the carnage over the next two months.

Kathryn Wylde, CEO of the pro-business group Partnership for New York City, noted that “public universities are perpetually scrambling” for money. And since their budgets flow from state and city budgets, which are being slashed in the wake of the pandemic, they are now “scrambling even harder.”

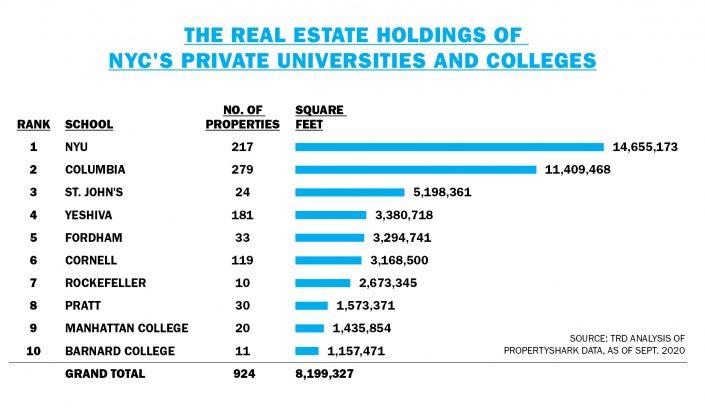

Universities are among the largest landlords in New York City, rivaling the city’s top development companies and dynastic firms. NYU owns 217 properties totaling 14.65 million square feet, while Columbia University owns 279 properties totaling 11.4 million square feet, according to an analysis by The Real Deal. Columbia is also in the process of transforming West Harlem, tapping starchitect Renzo Piano to develop its Manhattanville megaproject.

But industry insiders claim that it and other universities with large endowments are unlikely to be forced into property sales.

“I don’t think with NYU or Columbia there is a specific cash need,” said Brett Siegel, who co-heads Newmark Knight Frank’s capital markets and investment sales division. NYU did not respond to requests for comment, while a spokesperson for Columbia declined comment.

Rather, it’s the private schools with smaller endowments that could cough up assets.

Siegel is marketing Pace University’s Lower Manhattan development site near the Brooklyn Bridge, which includes an 18-story tower that houses dorms, classrooms and a library. A Pace spokesperson said the university its plans to sell predated the pandemic.

“Like most with a large real estate footprint,” the spokesperson said, “we are assessing our real estate needs and the costs associated with them.”

Seth Pinsky, CEO of the nonprofit 92nd Street Y and the former head of New York City’s Economic Development Corporation, said it was tricky for universities to figure out asset strategies given the lack of long-term clarity about remote learning.

“The open question that has not been answered exactly is: How permanent are these changes? he said.

Four more years

In a remote, heavily wooded part of central Maine, Unity College’s president Melik Peter Khoury is pondering the future of colleges.

The school avoided bankruptcy in the early ‘90s, but Khoury asserts it is on firmer ground today. His focus, he said, is on trying to figure out if the four-year on-campus college experience is still viable.

Even before Covid, “there was a clear decline in residential enrollment unless you are a Tier 1 school,” he said.

About a third of four-year private colleges analyzed are at risk of folding in the next six years, according to Edmit, a Boston-based college consultancy.

Unity is exploring selling its 240-acre central campus, a move that has drawn pushback from students and alumni. For other colleges struggling with financial pressures, sales have already begun.

In upstate New York, Nyack College recently sent a letter to the New York Attorney General asking approval to sell its 107-acre campus to a Hasidic Yeshiva for about $45 million, according to the Rockland County Business Journal. And in July, a nonprofit tied to a charter school network reportedly went into contract to buy Marlboro College’s campus in southern Vermont for $225,000 and assumed $1.5 million in debt obligations.

Dorm room woes

Student housing is as much a part of the college experience as dining hall pizza and socks on the door handle.

In the last decade, developers swooped into the sector, in some cases competing with university-owned campus housing by offering state-of-the-art luxury apartments with pools, gyms and tanning beds. International students were among their most lucrative targets.

47M SQ. FT.

But as health concerns at U.S. universities are growing, interest from foreign students is waning. Anxieties also heightened when the Trump administration announced in July that it would require international students to leave the country if their colleges held classes entirely online. The administration eventually rescinded its plan, but in late August, Secretary of State Mike Pompeo said during an interview that President Trump was looking at restricting Chinese students from studying in the U.S.

International student enrollment in U.S. universities increased by just 0.05 percent in the 2018 to 2019 school year, compared to 7.1 percent in 2015 to 2016, before Trump took office, according to the Institute for International Education.

“The overall theme of the administration is placing greater emphasis on American citizens versus having competition from overseas,” said Joe Shmigelsky, assistant vice president at ratings agency DBRS Morningstar.

Industry sources say investors were initially drawn to the student housing market’s cap rates — a metric that measures the rate of a return on a commercial real estate investment. Cap rates for student housing assets at Division I non-Power 5 universities averaged 5.43 percent in the first half of 2019, according to CBRE, well below the 5.83 percent for non-Division I universities.

Signs of distress in student housing were popping up prior to the pandemic, largely due to oversupply. Since 2010, developers built more than 400,000 new beds nationwide, according to data from the National Multifamily Housing Council.

“We believe that the increase in supply has provided too much competition between the student housing properties, resulting in concessions,” Shmigelsky said.

Many of these student housing operators who flooded the market had turned to the commercial mortgage-backed securities for financing. Between 2016 and 2019, securitizations of student housing loans totaled an annual average of 87 loans, totaling $2.0 billion each year, according to DBRS Morningstar.

CMBS loans are considered to be riskier than most other commercial mortgages since they have covenants with bondholders that make restructuring the loans more difficult.

For non-government backed CMBS loans, the delinquency rate for student housing loans rose to a record high of 13.7 percent in July 2020, far above the 2.2 percent for all other multifamily assets, according to Trepp.

Projects like the Wolf Creek Apartments, a nearly 1,400-unit rental property in Raleigh that primarily houses students of North Carolina State University, are among those to watch. Due to tenants vacating and not renewing leases, the property’s occupancy fell from about 90 percent in 2016 to roughly 60 percent at the end of 2019, Trepp data show.

The owner of the property, VIE Management, remains current on its debt payments but the loan backing the apartments is now on Trepp’s watchlist, due to concerns of a possible default.

VIE Management did not return a request to comment.

A different animal

Despite these challenges, student housing developers and brokers said leasing in the fall semester remains strong.

Students want to have the [college] experience that they are envisioning. I am pretty sure plenty of college students didn’t show up to their classes anyways.

James Jago, a principal of the Boca Raton-based real estate investment firm Pebb Capital, said leasing rates were at about 82 percent in July, compared to 85.5 percent a year ago. Pebb is developing a 153-bed, 80-unit student housing development in Morningside Heights across from Columbia University.

“We are still bullish,” said Jago. “Nationwide, things are pretty good.”

In mid-September, Bloomberg reported that private-equity firm TPG is in discussions to buy a student housing portfolio from REIT Preferred Apartment Communities in a deal that would value the properties at $480 million.

Ryan Freedman, whose firm Corigin has invested in five student housing projects surrounding NYU’s Manhattan campus, said schools that move to 100 percent virtual classes will certainly see a decline in student housing occupancy. But for the schools that provide part online and part on-site classes, Freedman believes students will still find their way to campus.

“Students want to have the [college] experience that they are envisioning,” he said. “I am pretty sure plenty of college students didn’t show up to their classes anyways.” He declined to provide occupancy figures for Corigin’s student housing portfolio, which includes over 2,600 beds.

Not all investors are as optimistic about the sector. The lone publicly traded student housing real estate company, American Campus Communities, saw its share price fall 17 percent since March. And Preferred Apartment Communities, which has significant exposure to student housing, saw shares fall over 50 percent this year, compared to 12 percent for the U.S. REIT sector overall, according to Bloomberg.

Student housing operators in larger cities also have to deal with greater competition from apartments and condos that are rented out at discounts due to the pandemic. In Manhattan, rental vacancies hit 4.33 percent in July, a record since Douglas Elliman started tracking the market 14 years ago.

In places like Miami, students could look to rent condos and take advantage of an inventory glut, according to the Miami-based real estate consultancy CondoVultures.

And while student housing has been put by some investors in the same bucket as multifamily, the two are different animals because of how leases are signed.

“The cap rates have become more in line with multifamily over the last decade, but student housing is a riskier asset for many reasons like students typically all sign leases at roughly the same time,” said Billy Meyer, managing director of real estate lending at Seattle-based Columbia Pacific Advisors.

“You are either all good or all bad,” he added.