The coronavirus crisis led to a mandatory work-from-home experiment for office workers across the country, and while some seem to have enjoyed the experience, others have been less enthusiastic.

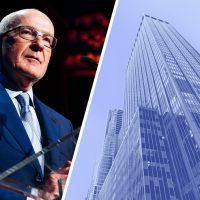

Count employees of office landlord Paramount Group in the latter category, according to its chief executive.

“The positive was that work got done, and we did not miss any of our deadlines or delay any of our filings,” CEO Albert Behler said Thursday on an earnings call about the company’s second quarter. “The negatives, which there are quite a few to speak of, seem to far outweigh the positives.”

Read more

The CEO’s comments were not a surprise, given the company’s financial interest in advancing the narrative that working from home is not as productive.

“Based on the feedback from our own employees, the amount of time and effort in accomplishing their tasks was far more than that required while being in the office,” Behler said, attributing this to “inefficiencies resulting from poor Wi-Fi connections, the need to schedule time for simple questions that could have been answered by simply walking over to their supervisors, and other distractions.”

Behler added that while employers were more likely to adopt flexible work arrangements in the aftermath of the pandemic, certain benefits of a physical office space remain irreplaceable.

“You cannot cultivate a positive culture through team-building and innovation, and furthermore, you cannot mentor the future leaders of our country, without building a rapport in person in the office,” he concluded.

In the second quarter, Paramount recorded a net loss attributable to common stockholders of $6.3 million, or $0.03 per share, in contrast to net income of $0.01 per share a year ago. The firm collected 97.8 percent of office rents and 57.6 percent of retail and other rents for the quarter, or 96.4 percent overall.

The New York-based office REIT leased 300,570 square feet in the quarter, with an average initial rent of $93.47 per square foot. Most of this activity consisted of renewals and primarily addressed leases expiring in 2021 and beyond, executive vice president of leasing Peter Brindley said on the call.

One of the larger leases of the quarter went to Industrial and Commercial Bank of China, which inked a five-year extension for 50,000 square feet at 1633 Broadway with an initial rent of $82 per square foot.

The firm is focused on filling an upcoming 500,000-square-foot vacancy at 1301 Sixth Avenue, which Brindley argued was “ even more compelling in today’s environment” because of the property’s proximity to transit and a private welcome center for tenants.

Another likely effect of the coronavirus crisis, Behler noted, could be the reversal of the densification trend of the past decade.

“The pendulum has, in this cycle, swung too far with the rise of co-working, and now it will swing back,” he predicted. “In fact, we have had tenants who have come to us and said they need more space as they evaluate how best to reconfigure their offices.”

Contact Kevin Sun at ks@therealdeal.com