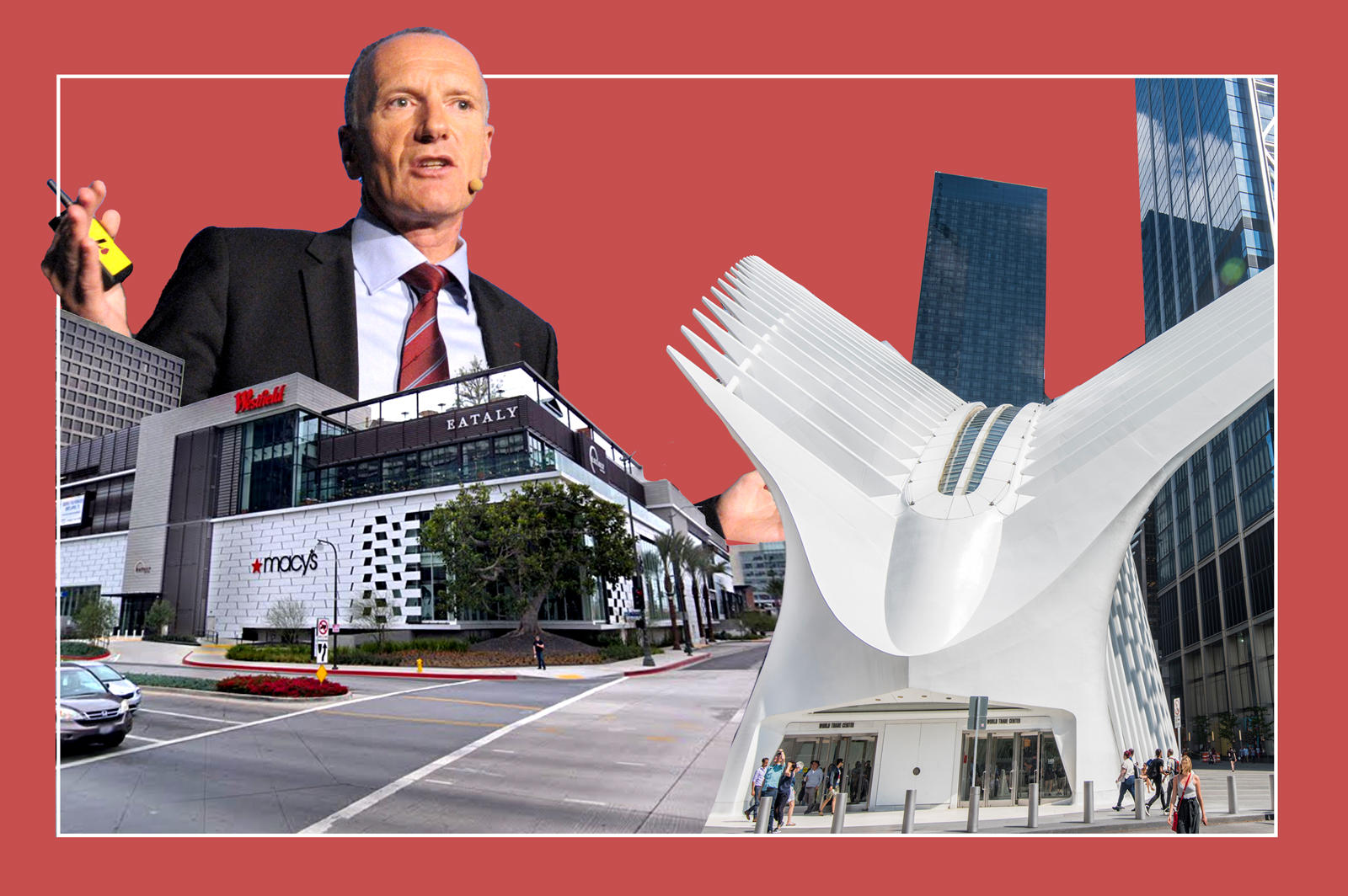

While operations at Unibail-Rodamco-Westfield’s European holdings are returning to normal, the retail giant’s U.S. holdings are contending with different reopening — and in some cases re-closing — timelines.

Some of the landlord’s European malls have already been back open for 12 weeks, with foot traffic recovering to nearly 90 percent of pre-coronavirus levels. Meanwhile, concerns about a second wave of infections and protests after the killing of George Floyd have contributed to a “particularly hectic” situation in the U.S., CEO Christophe Cuvillier said Wednesday on the firm’s half-year earnings call. He also pointed to re-closures, such as California Gov. Gavin Newsom rolling back the reopening of enclosed malls.

“As we see our footfall and sales improving weekly, our focus is now on rent collections and on finalizing tenant negotiations,” Cuvillier said on the call, its first since the coronavirus crisis began.

For the first half of the year, URW’s American shopping centers saw a 15.3 percent year-over-year decline in net rental income. That’s worse than the portfolio-wide average of 11.3 percent but better than malls in Austria and the U.K., which saw declines of 27.5 and 34.1 percent respectively.

URW’s U.S. holdings account for 25 percent of the firm’s portfolio by gross market value, with France accounting for 34 percent and no other country making up more than 10 percent.

Read more

In the early days of the coronavirus crisis, the company focused on building up liquidity and cutting costs, amassing an unprecedented 12.7 billion euro cash balance with the help of credit lines and bond issuances. The firm also automatically deferred tenants’ rent payments for the months of April and May.

“We took the stance to not make any immediate decision on potential rent relief in the middle of the crisis, so as not to negotiate in the dark without even knowing when the centers would be allowed to reopen, nor having an idea of how the customers would respond in the early weeks post-reopening,” Cuvillier said.

The mall owner has so far collected just 38 percent of rent due for the second quarter, while providing relief for 3 percent of the rent bill and deferring 20 percent to later in the year.

Ad hoc rent negotiations with tenants began in May, and URW says it is currently about 25 percent through the process. “Such negotiations are conducted on a case by case basis on the principle of a fair sharing of the burden, and include a request for concessions from tenants,” the firm’s earnings report notes.

Concessions URW may seek from tenants in exchange for relief include lease extensions, waivers of co-tenancy provisions, increases in percentage rent, or even signing leases for new stores.

While the company hopes to wrap up the majority of tenant negotiations by September, “there will obviously be the odd negotiation that lingers on, and there will be examples where we don’t agree, and if we don’t agree, then we’ll see what we do,” Cuvillier said. “You’ve probably heard that some landlords have started lawsuits against tenants that do not pay, so this is also an option.”

“We do not grant any rent relief, i.e. we do not conclude the negotiations, until we get payment for June and July or any arrears that we have,” he emphasized.

In the longer term, one of the firm’s major goals is to deleverage its portfolio with the sale of another 4 billion euro in assets, about half of which is retail. A recent decline in property values pushed the landlord’s loan-to-value ratio up to 41.5 percent, above its target range of 30 to 40 percent.

In May, URW received approval from Los Angeles’ city planning commission for a 34-acre mixed-use project in the Warner Center neighborhood, which will include 1,400 residential units, 280,000 square feet of retail, 731,500 square feet of office space and 572 hotel rooms. This reflects the company’s increasing focus on mixed-use developments, with retail accounting for just 32 percent of its roughly 10 million-square-foot development pipeline.

Contact Kevin Sun at ks@therealdeal.com