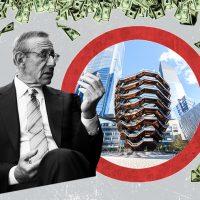

A group of Chinese EB-5 investors is pushing Related Companies to open its books after the developer halted payments in June because of the pandemic.

A lawyer representing 30 investors sent a letter July 16 to Related CEO Jeff Blau demanding an on-site inspection of the company’s financial records so investors could see whether Related was able to repay them. In a separate letter, they requested written assurances that their distributions would be paid.

The lawyer, Douglas Litowitz, said his clients were alarmed by news that Related was pausing distributions to EB-5 investors in Hudson Yards, and became even more alarmed when they dug into their contracts and realized that payments were considered discretionary.

“The investors fear that you have tricked them into a perpetual state of nonpayment,” Litowitz wrote in the letter, a copy of which was reviewed by The Real Deal. A lawyer for the developer replied that the investors had no rights to inspection — a point he argued was backed up by both the agreement and a body of prior cases.

Litowitz is calling for arbitration. Related did not respond to requests for comment. In June, a representative for the developer told TRD that the distributions were optional, and all mandatory payments had been made.

The dispute is yet another headache for Related, which is contending with slow condo sales, construction delays and the closure of its Hudson Yards mall on account of the pandemic. Compounding matters, Neiman Marcus last week announced that it was walking away from the site some 16 months after it opened as its anchor tenant. Related is now marketing the mall as an office location.

Read more

The EB-5 visa program is a system where foreigners invest money into job-creating businesses in the U.S. in exchange for green cards. Over the years it has been both hugely popular and rife with fraud — triggering a slew of lawsuits and intervention from the federal government.

Chicago-based Litowitz is a vocal critic of the EB-5 program, and specializes in fraud cases on behalf of Chinese investors. He claims his clients were told by an agency representing Related in China that they would be repaid after they got their green cards, and were not notified that payment was at the discretion of the developer.

But Daniel B. Lundy of Klasko Immigration Law Partners, an expert in EB-5 matters who is not involved in the Related dispute, said the United States Citizenship and Immigration Services prohibits agreements from outlining certain specifics about payments, meaning “the timing and amount of distributions to EB-5 investors is generally subject to the discretion of the managers [of the entity].”

“This is not to say that the manager has unfettered discretion,” he added. “It is still bound by the terms of the investment documents and any fiduciary duty it might have to investors.”

Related’s investment offering is unusual in one way: Litowitz said his clients invested through a preferred-equity model. That is less clear cut than the majority of EB-5 investments, which are set up as debt — the investors put money into a fund that makes a loan to a developer, and that money is repaid after the loan matures.

Litowitz said the model was central to his clients’ concern. “Since there is no loan date by which the money must be returned [to the entity], that makes the discretion all the more important,” he said.

“Otherwise it could be a perpetual investment — forever.”

Write to Sylvia Varnham O’Regan at so@therealdeal.com