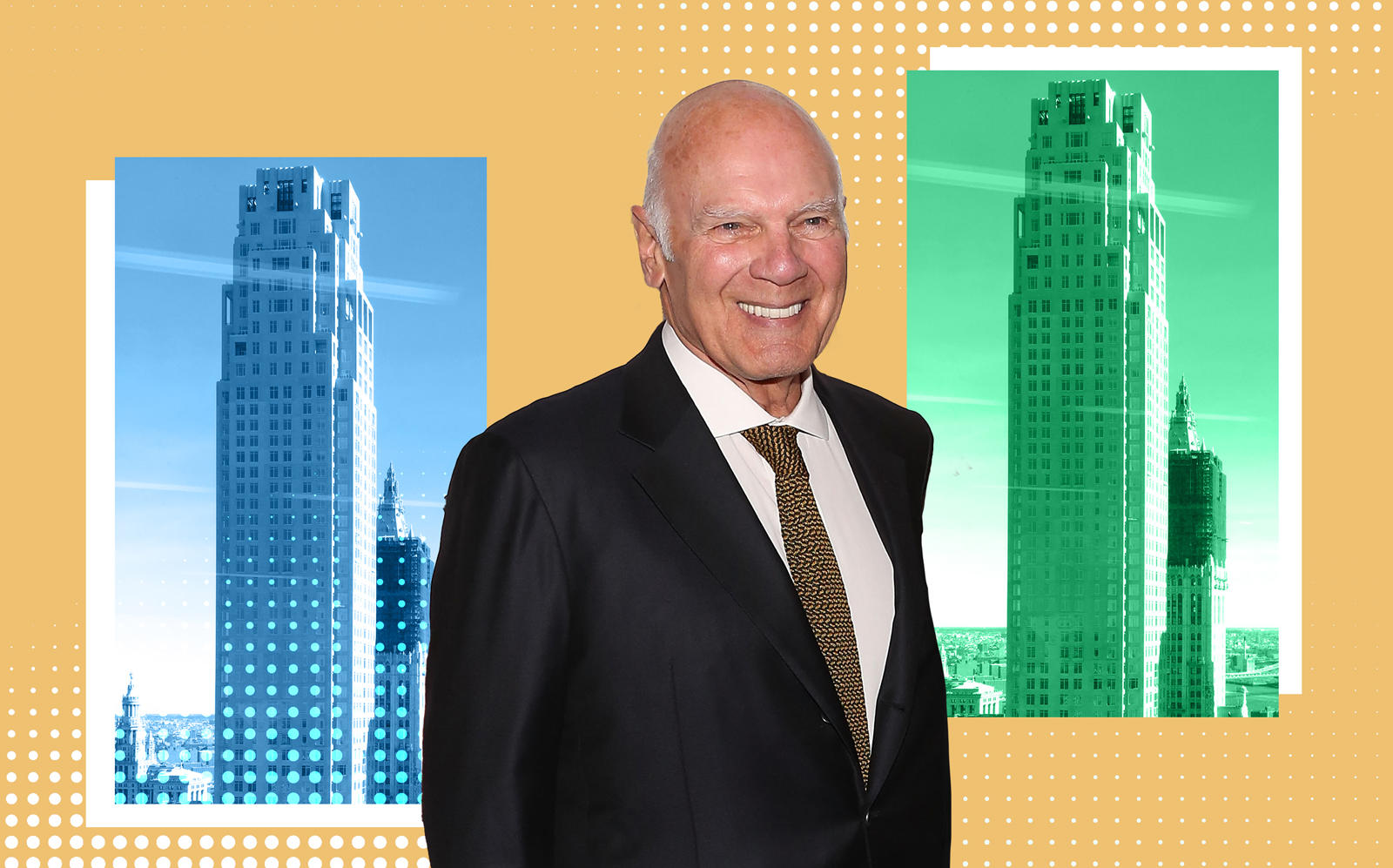

It’s been another solid month for big-ticket sales at 220 Central Park South.

Deals for two condo units at Vornado Realty Trust’s Billionaires’ Row tower closed this month for a combined $109 million. Both buyers are unnamed in property records.

The pricier of the four-bedroom units, on the 68th floor, traded for $55.5 million. The buyer, a foreign limited liability company KMZM LLC, went into contract for the property in October 2018.

Read more

The 5,935-square-foot unit was listed at $60 million, according to the most recently amended condo offering plan. Vornado increased the price from the original offering plan’s asking price of $51.5 million. The sale closed July 21.

A week earlier, a unit of the same size on the 64th floor closed for $53.9 million. Purchased through an LLC, it went into contract in 2015. The final listing price for the four-bedroom pad was $58 million, up from the original $49 million.

A similar pair of deals closed in April for a combined haul of $110 million. Those transactions were on the 63rd and 65th floors. Weeks earlier, sales of units on the 61st and 62nd floors closed.

Vornado’s luxury condominium continues to be a cash cow for the real estate investment trust as the coronavirus pandemic has forced a massive writedown on some of its retail properties. In the second quarter, the REIT reported a $49 million after-tax net gain from sales at 220 Central Park South.

Write to Erin Hudson at ekh@therealdeal.com