Deep into a marathon set of high-pressure meetings to save bankrupt retailer Aeropostale from being chopped up and sold for parts, Jamie Salter thought some comic relief was in order.

Shaquille O’Neal (Getty)

The Authentic Brands Group founder and CEO pulled out his phone and called Shaquille O’Neal — his company’s second-largest individual investor — to crack wise with the attorneys and investment bankers who had spent days in a General Motors Building office putting together an 11th-hour, $350 million deal.

“He dialed up Shaq on Facetime and went around turning his phone to everyone in the room to joke around and relieve some of the tension,” James Doak of Miller Buckfire, the investment bank that Aeropostale tapped to navigate a bankruptcy sale, recalled of that summer night four years ago.

“Everyone just lost it,” he said.

As one of the busiest opportunistic investors of the retail apocalypse, Salter — who earned a reputation as a “dead-celebrity dealmaker” for buying the licensing rights to Marilyn Monroe, Elvis Presley and other famous figures — is redeploying a novel strategy he cooked up in 2016.

Simon Property Group CEO David Simon (Getty)

To make the Aeropostale deal work, he teamed up with Simon Property Group and General Growth Partners to invest in the struggling retailer, while cutting rents, to help keep about 400 of its stores open. The two landlords had been looking for a way to prevent the mall staple from falling into the hands of private equity firm Sycamore Partners, which had plans to liquidate the casual apparel brand.

Four years and many retail bankruptcies later, Salter and his landlord partners are at it again. After buying Nautica in 2018, Authentic Brands and Simon came back to the table earlier this year alongside Brookfield Property Partners — which acquired GGP in 2018 — to buy Forever 21 out of bankruptcy for $81 million.

The trio are now in talks to purchase J.C. Penney, while Authentic Brands and Simon also have their eyes on Brooks Brothers.

As the economic shutdown caused by the coronavirus pummels retailers, Salter and his partners have plenty of deals to consider. In some ways, though, it’s an odd coupling.

Salter’s 10 year-old firm is designed to make big profits off branding rights. The model is based on finding distressed retailers that, despite their troubles, have value locked in their brands that Salter can strip away and license off. And with companies like J. Crew, Neiman Marcus and Pier 1 filing for bankruptcy due to the pandemic, the list of possible acquisitions is growing bigger by the week.

But the existential threat to brick-and-mortar stores remains a huge concern for Simon and Brookfield, who have clear incentives to keep their malls packed with rent-paying tenants. To some, their partnership with Salter is a shotgun marriage.

“I would say they’re more partners of convenience or necessity than partners of love,” one attorney, who’s worked across the table from Authentic Brands, said on the condition of anonymity.

New playing fields

Salter, who declined to comment for this article, operates in a niche sector of the investment world that got a big push from private equity after the 2008 financial crisis.

Firms looking for an asset-light way to profit off retail quickly found that they could juice their returns by investing in the brands and letting someone else deal with the burdens of store operations.

Authentic Brands is now one of a small handful of companies that specialize in buying intellectual property rights and selling them off through licensing agreements and its largest investor is BlackRock. Salter told CNBC in early June that he’s once again on the hunt for opportunistic deals.

“My strategy is simple: buy low, sell high,” he said. “We make sure, if we get into retail, that [the company] has a purpose. If it doesn’t have a purpose, we find a purpose.”

The fallout from the pandemic presents a unique situation for Authentic Brands and other distress investors, as it propels the number of retailers filing for bankruptcy. At the same time, Salter’s got some deep-pocketed partners. Brookfield Asset Management, one of the world’s largest investment firms, has set aside $5 billion to invest in struggling retailers.

Brookfield Property Partners CEO Brian Kingston

Brian Kingston, CEO of Brookfield’s publicly traded real estate arm, told The Real Deal in May that the new retail strategy is consistent with the firm’s contrarian investment model.

“The $5 billion program is designed to allow us to make investments in what we see as very strong, high-growth businesses at a time when capital is scarce, and we think we’ll be able to generate high returns because we’ll be able to pick and choose,” he said.

“There are going to be winners that come out of this, and if we can invest in some of those, it’s good for us, and it’s good for them,” Kingston added.

But the future of retail is arguably less certain now that it’s ever been, certainly more so than in 2016 when the trio did the Aero deal or following the 2008 financial crisis when investors feasted on distressed opportunities.

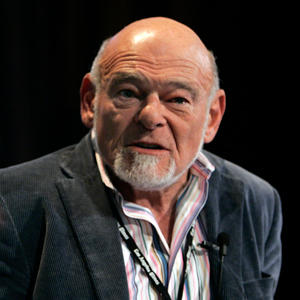

Equity Group Investments founder Sam Zell (Getty)

“I don’t think there’s any comparison,” Equity Group Investments founder Sam Zell told Bloomberg News in May, referring to the level of uncertainty in the investment world compared to past crises. “I would say retail is probably going to take the biggest hit.”

Retail experts question how much upside there will be in backing struggling bricks-and-mortar stores this time around, considering the increased competition from online shopping and the new challenges of in-door shopping while practicing social distancing guidelines.

And as the pandemic keeps many stores shuttered, Simon and Brookfield are gearing up to invest in their tenants more heavily than they ever have before. But the two can’t buy up every bankrupt retailer in their malls and some observers say they should let stores fail instead of propping them up.

“It can’t work for all stores,” said Miller Buckfire’s Doak, who added that Simon and Brookfield “aren’t here to save stores in other people’s malls.”

Doak argued that any survivors in retail will also need to have “intellectual property that people give a darn about.”

Brand ambassador?

Salter, 57, grew up in Canada and started a snowboarding manufacturing company in 1992 that he took public in just two years.

He later co-founded Hilco Consumer Capital, the private equity arm of Hilco Trading, which specializes in liquidating retailers. It was there that he realized he could build a niche business focused on intellectual property rights, and he struck out on his own in 2010 with backing from private equity firm Leonard Green & Partners, followed by Lion Capital and General Atlantic.

The model relied on a network of big third-party operators that purchased the rights from the branding firms and put them to work. But in recent years some of those operators have consolidated, requiring Salter to tweak his model, according to observers.

“There are fewer places for people to go to find operating entities that could support the valuations these brand accumulators are looking to achieve in these deals,” said Andy Postal, a managing partner at the consumer-brands investment bank MMG Advisors.

Salter “had to be creative in getting involved in operating businesses simply because he didn’t have a lot of people to do that independently,” Postal added.

Doak noted that the playful move with Shaq in 2016, as random as it seemed, was characteristic of Salter’s way of doing business as well as his personality.

When it came to the Aeropostale deal, Salter originally came into the process with his former colleagues at Hilco. The idea was that Authentic Brands would buy the IP rights and Hilco would buy the merchandise and sell it off. But Aeropostale’s creditors and landlords, including Simon and GGP, wanted to keep as many of the 700-plus stores open and preserve some 6,000 jobs.

It’s not clear who first came up with the idea of the landlords teaming up with Authentic Brands, but there’s no shortage of people claiming they put the creative deal together.

“I think you could find four different people who say they suggested it,” said Doak.

What’s clear is that Salter’s group asked the investment banker for permission to speak with Simon and GGP, and they hammered out a unique deal in a high-pressure situation.

Authentic Brands bought the IP rights to Aeropostale as well as a 25 percent stake in the operation that ran the stores, with Simon and GGP owning the other 75 percent.

Simon later restructured its stake so that it owns a piece of Authentic Brands.

Bradford Sandler, who worked as an attorney for Aeropostale’s creditors, said he thought the partnership was such a good fit that it would be a model for retail bankruptcies going forward.

“I thought it was potentially a new paradigm for retail,” said Sandler, co-chair of the creditors’ committee at the law firm Pachulski Stang Ziehl & Jones. “You didn’t really see that happen right away but it finally started to click as the retail apocalypse progressed and retailers left and right were filing for bankruptcy.”

To those who have watched him action, Salter’s a shrewd dealmaker with a knack for unlocking value. But he’s also gained a reputation for making a big splash.

In 2018 he went toe-to-toe with shoe giant DSW in an auction to buy Nine West out of bankruptcy. Salter outbid one of the biggest names in shoes with a winning check of $340 million — about $140 million more than Authentic Brands’ original stalking-horse bid.

“From what I’ve seen, when he makes up his mind about something, he’ll overpay like it’s nobody’s business,” said the attorney who has worked across the table from Authentic Brands.

Differing properties

While Authentic Brands and its landlord partners remain aligned for now, conflicts of interest could quickly arise if the deals don’t go as planned.

Salter’s main line of business is getting the most value from his intellectual property rights, while Simon and Brookfield want tenants that will pay top rents in the long run. With many U.S. malls still shuttered and the country’s retail market in utter chaos, there’s common ground between both sides.

But if those partnerships start to go sideways and the stores fail to gain traction, Authentic Brands has strong rights that could allow the company to cancel its licensing agreements, according to retail experts.

If Salter feels the licensee isn’t maintaining the brand properly, he can terminate the contract and pull forward future payments owed under the deal, analysts at Moody’s Investor Service pointed out.

“With all the pressure these real estate guys are under, it becomes imperative … to figure out ways to keep these brands in their stores,” said MMG’s Postal.

“It’s become a very complicated and challenging space,” he noted.

Contact Rich Bockmann at rb@therealdeal.com or 908-415-5229