Businesses and individuals are taking stock of their losses stemming from the coronavirus pandemic, as reopenings begin in major cities across the country.

The full impact has yet to be seen, as office buildings, stores and hotels open back up at reduced capacities and people slowly adjust to new routines. But for the first time since the pandemic hit, the U.S reported job growth.

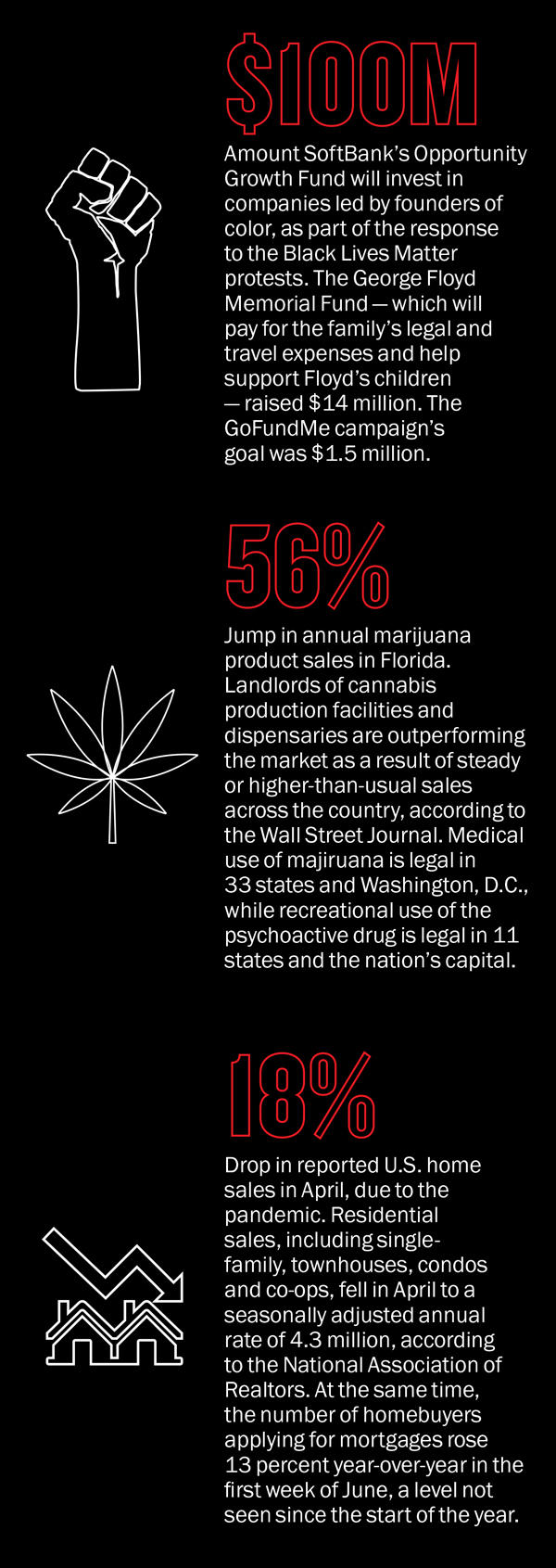

At the same time, tens of thousands of people have taken to the streets to protest the killing of George Floyd in late May. Floyd’s death, ruled a homicide by two medical examiners, sparked outrage and calls for change around the country with many real estate executives joining the chorus — and asking for peaceful demonstrations.

SoftBank, which backs WeWork, Compass and dozens of other companies inside and outside of real estate, pledged a series of initiatives, including the launch of a new fund to invest in companies run by people of color. WeWork also announced it would direct business grants to black-owned member businesses.

Here’s a closer look at some of the latest numbers.

2.5M

Reported U.S. employment gains in May, following the loss of more than 22 million jobs in March and April. The surprising rebound came as many states began to reopen their economies. The leisure and hospitality industries added 1.2 million jobs in May, following losses of 7.5 million in April and 743,000 in March, according to the Labor Department, while the construction industry saw employment gains of 464,000. The reported unemployment rate in May stood at 13.3 percent.

10,020 Pts.

The Nasdaq Composite’s record close on June 10 — bringing the stock index up nearly 10 percent month-over-month. The highest-performing real estate stock tracked by TRD belonged to CoStar, which closed at a price of $969.59 per share on June 10. Despite the broad economic slowdown caused by the coronavirus, the Nasdaq remains up more than 11 percent since the start of 2020.

The Nasdaq Composite’s record close on June 10 — bringing the stock index up nearly 10 percent month-over-month. The highest-performing real estate stock tracked by TRD belonged to CoStar, which closed at a price of $969.59 per share on June 10. Despite the broad economic slowdown caused by the coronavirus, the Nasdaq remains up more than 11 percent since the start of 2020.

$267B

Total amount of federal stimulus payments to individuals under the Coronavirus Aid, Relief, and Economic Security Act, as of June 3. The IRS has sent out a reported 159 million payments in the span of two months. At the same time, unemployment claims totaled 1.54 million in the first week of June. While the number of unemployment claims filed is the lowest since the pandemic began, it’s still historically high.

$25M+

Cost to property insurers in Minneapolis from looting, following some of the protests over Floyd’s death. Property Claim Services, an insurance industry company, estimated the losses will exceed $25 million, labeling the property destruction and looting as a “riot and civil disorder event.” Local governments across the country are stepping in to help businesses. New York City allocated $500,000 in grants for looted stores in the Bronx.

Cost to property insurers in Minneapolis from looting, following some of the protests over Floyd’s death. Property Claim Services, an insurance industry company, estimated the losses will exceed $25 million, labeling the property destruction and looting as a “riot and civil disorder event.” Local governments across the country are stepping in to help businesses. New York City allocated $500,000 in grants for looted stores in the Bronx.

$32B

Total value of CMBS loans on commercial properties that were stuck in special servicing as of May, per Moody’s Investors Service. Insiders told The Real Deal that the fraught servicing process could leave some borrowers in a black hole — with high debt installments and additional fees that could take months and, in some cases, years to pay off — before they are able to regain control of their properties.

39 months

Length of time the federal government has given Opportunity Zone investors and developers to deploy capital and begin construction on projects, citing the pandemic as the main reason. The government had previously given OZ investors and developers 30 months to make improvements to their properties in order to qualify for the tax benefits.

25,000

Number of stores that could close this year due to coronavirus, dwarfing the record 9,800 retail closures set in 2019, according to a report from retail data firm Coresight Research. Pier 1 recently said it plans to permanently shut all of its 541 stores, after filing for Chapter 11 bankruptcy protection in February. J.C. Penney plans to close 242 stores as part of its restructuring — the 118-year-old department store chain has about $500 million in cash on hand.

Number of stores that could close this year due to coronavirus, dwarfing the record 9,800 retail closures set in 2019, according to a report from retail data firm Coresight Research. Pier 1 recently said it plans to permanently shut all of its 541 stores, after filing for Chapter 11 bankruptcy protection in February. J.C. Penney plans to close 242 stores as part of its restructuring — the 118-year-old department store chain has about $500 million in cash on hand.

$66M

Unpaid rent and other charges that Simon Property Group is suing Gap to collect. The retailer is among the tenants that stopped paying rent after stay-at-home orders and government-ordered store closures hit the U.S. retail market. Gap leases more than 400 spaces from Simon, the country’s largest mall operator.

Unpaid rent and other charges that Simon Property Group is suing Gap to collect. The retailer is among the tenants that stopped paying rent after stay-at-home orders and government-ordered store closures hit the U.S. retail market. Gap leases more than 400 spaces from Simon, the country’s largest mall operator.

37%

U.S. hotel occupancy in the last week of May — up from less than 30 percent throughout April, according to hotel data firm STR. Hotel fundamentals climbed for the seventh week in a row as states began reopening. Revenue per available room, a key performance metric, was up to an average $30.34. But those numbers don’t account for the hotels that have shut their doors due to Covid-19 and the hotel market still has ways to go.

$2.9B

WeWork’s latest valuation — down from more than $45 billion just last year, Bloomberg reported in May. The co-working company had $47.2 billion worth of lease obligations on its books at the end of 2019 and is reportedly looking to reduce those rent liabilities by 30 percent. WeWork’s critics have long speculated that it could end up in bankruptcy, particularly during an economic downturn.

WeWork’s latest valuation — down from more than $45 billion just last year, Bloomberg reported in May. The co-working company had $47.2 billion worth of lease obligations on its books at the end of 2019 and is reportedly looking to reduce those rent liabilities by 30 percent. WeWork’s critics have long speculated that it could end up in bankruptcy, particularly during an economic downturn.