When state legislators set out to change New York’s rent law, Two Trees Management was not concerned about its portfolio. The developer does not invest heavily in rent-stabilized properties.

“We didn’t think that the changes initially would impact us,” said David Lombino, managing director of external affairs at Two Trees. “And I don’t think it was the intention of legislators to do so.”

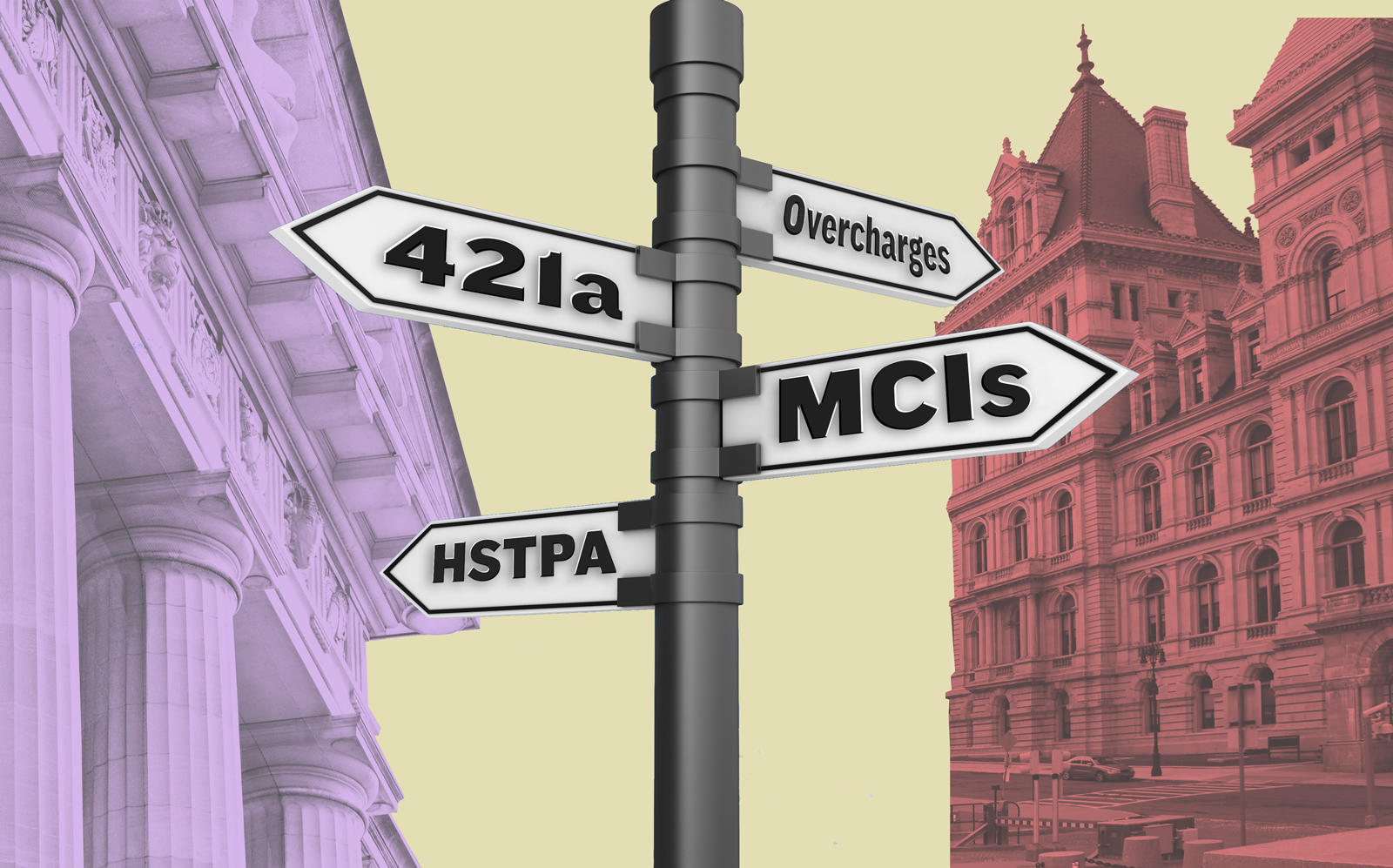

But when lawmakers eliminated high-rent decontrol in the Housing Stability and Tenant Protection Act of 2019, they inadvertently changed a key aspect of the popular tax break formerly known as 421a.

They quickly amended the law so buildings using the break, renamed Affordable New York, could still remove non-affordable units from regulation when the rent exceeded a given threshold, most recently $2,816.

The fix, however, didn’t apply to properties receiving the old 421a. That trapped market-rate units in Two Trees’ Domino Sugar mega-development, Brookfield Properties’ Greenpoint Landing, the Durst Organization’s Hallets Point and others in rent regulation for the duration of the abatement.

That result is just one of several unresolved issues from the rent law’s passage one year ago. The state’s housing regulator, the Division of Homes and Community Renewal, is still finalizing rules for the law’s application, including guidelines for landlords to increase rents on stabilized apartments that they fix up.

Some aspects of the law, including how to calculate past rent overcharges, are being hashed out in court, while real estate executives are seeking legislative fixes for others.

Teaching an old 421a new tricks

If the legislature doesn’t change the rules for buildings receiving the old 421a to allow for high-rent deregulation, Lombino said the Domino development will likely have to opt into Affordable New York. This would increase the 25-year tax break to at least 35 years and make some apartments less affordable: Instead of being set aside for households earning up to 80 percent of the area median income, the AMI threshold would be 130 percent.

The switch would appeal to many developers. Although Affordable New York projects must include more income-restricted apartments, landlords can charge higher rents and enjoy a longer property-tax break.

“We think raising the rents and AMIs on the affordable units would be a mistake and represent an abandonment of the commitments that everybody made when Domino was approved,” Lombino said.

But Two Trees also has reason to be sensitive to the restrictions around deregulating market-rate apartments under the old 421a. Years ago the developer faced a flurry of lawsuits alleging it overcharged tenants at 125 Court Street by ignoring rent-stabilization rules. The firm told ProPublica in 2016 that it had discovered overcharges in a 2013 audit and reimbursed tenants more than $300,000. At the time, owners could apply vacancy bonuses and raise preferential rates upon renewal in stabilized apartments, two rent-hike options eliminated by last year’s law. Under the old 421a, units must remain under rent stabilization for the duration of the tax break

Two Trees is now seeking a change to the law that would only apply to developments in Greenpoint and Williamsburg, not retroactively to all properties receiving the old 421a, Lombino noted.

“There’s no one arguing that you should regulate high-rent, market-rate units at the cost of less affordability on affordable units,” he said. “That’s why the legislature already fixed it on Affordable New York.”

Lawmakers seem willing to address the rent law’s interaction with old 421a. Assembly member Joseph Lentol said he is working with nonprofit developers to figure out a solution.

“They are in agreement that amendments are needed to deliver a very important target of affordable housing,” he said in a statement. “I will certainly work to make that happen.”

Sen. Brian Kavanagh, who chairs the Senate’s housing committee, said he is open to discussing the issue.

Looking to the courts

State courts have also shaped how the rent law is applied. In April, the state’s highest court ruled in favor of landlords in a Regina Metropolitan Company lawsuit, finding that

the rent law couldn’t be applied retroactively to rent-overcharge cases.

The Regina ruling specified that overcharge cases pending when the rent law passed would rely on a four-year lookback, rather than the six years permitted by the new law. But the case also opened the door to using a different formula to calculate overcharges if “the owner engaged in a fraudulent scheme to deregulate the apartment.”

“Fraud is a pretty wide open concept,” said tenant attorney William Gribben, a partner at Himmelstein, McConnell, Gribben, Donoghue & Joseph. “As a tenant attorney, my focus is going to be on if the apartment has been deregulated, it’s fair game to see why.”

Read more

The industry is also waiting on the courts to determine whether the rent law barred tenants from being charged broker fees for agents hired by landlords. A hearing is slated for September.

Landlords have also filed legal claims asserting major capital improvements completed with the expectation of rent increases under the old rent law should be grandfathered. The new law lowered the cap on annual rent increases through the program to 2 percent from 6 percent, and made them temporary.

“I’ll concede that they have an argument,” Gribben said. “I don’t think they should win it.”

Homes and Community Renewal is preparing a schedule of reasonable costs for MCIs, which will provide guidelines for acceptable prices for certain types of renovations.

Landlords can expect some clarity on at least one issue this week. The state’s rent law eliminated the Rent Guidelines Board’s ability to apply vacancy bonuses to stabilized leases, but the board must still decide whether to allow increases on vacancy leases all together. Based on the four proposals the board is poised to consider Wednesday, and the likelihood of a rent freeze, members don’t seem likely to allow such increases.

“Even if they did, it’s still a political issue every year,” said Alvin Schein, attorney at Seiden & Schein. “Owners have to hope and pray vacant apartments are included.”

Write to Kathryn Brenzel at kathryn@therealdeal.com