WeWork’s valuation has dropped to $2.9 billion — a far cry from $47 billion at its peak.

The office-space provider was most recently valued at $7.8 billion in the fall, after it agreed to a takeover by SoftBank following a failed attempt to go public. SoftBank, WeWork’s biggest backer, disclosed the valuation in its earnings on Monday, Bloomberg reported.

WeWork’s business model has been under pressure because of the coronavirus pandemic, as stay-at-home orders across the country keep non-essential workers from offices. The company has paid rent at 80 percent of its locations, while collecting rent from 70 percent of its members, CEO Sandeep Mathrani said on CNBC’s Squawk Box last week.

Read more

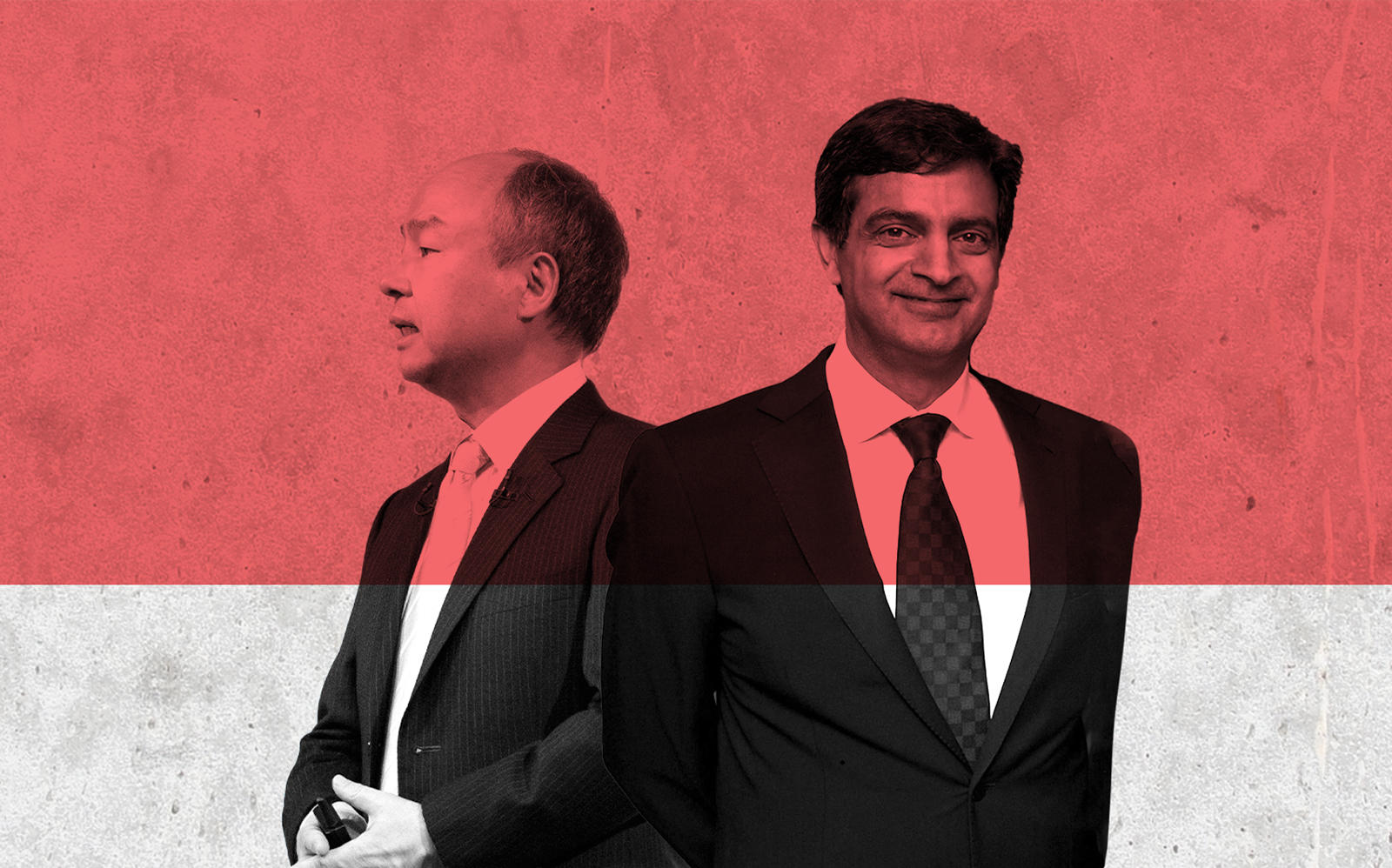

SoftBank took control of WeWork and pushed out co-founder and former CEO Adam Neumann last year. Neumann is now suing SoftBank after the company abandoned a $3 billion deal to buy stock from him and others as part of the bailout, claiming the firm relied on faulty pretexts to back out of the deal.

The Japanese conglomerate’s Vision Fund lost $17.7 billion last year after writing down the value of investments such as WeWork and Uber. Its overall operating loss was 1.36 trillion yen, and its net loss was 961.6 billion yen — the worst ever in the company’s history.

“The situation is exceedingly difficult,” SoftBank founder Masayoshi Son said. “Our unicorns have fallen into this sudden coronavirus ravine. But some of them will use this crisis to grow wings.” [Bloomberg 1, 2] — Eddie Small