We know it is a bad time to own malls, but retail landlord Macerich’s Tuesday earnings call highlighted how dire matters are.

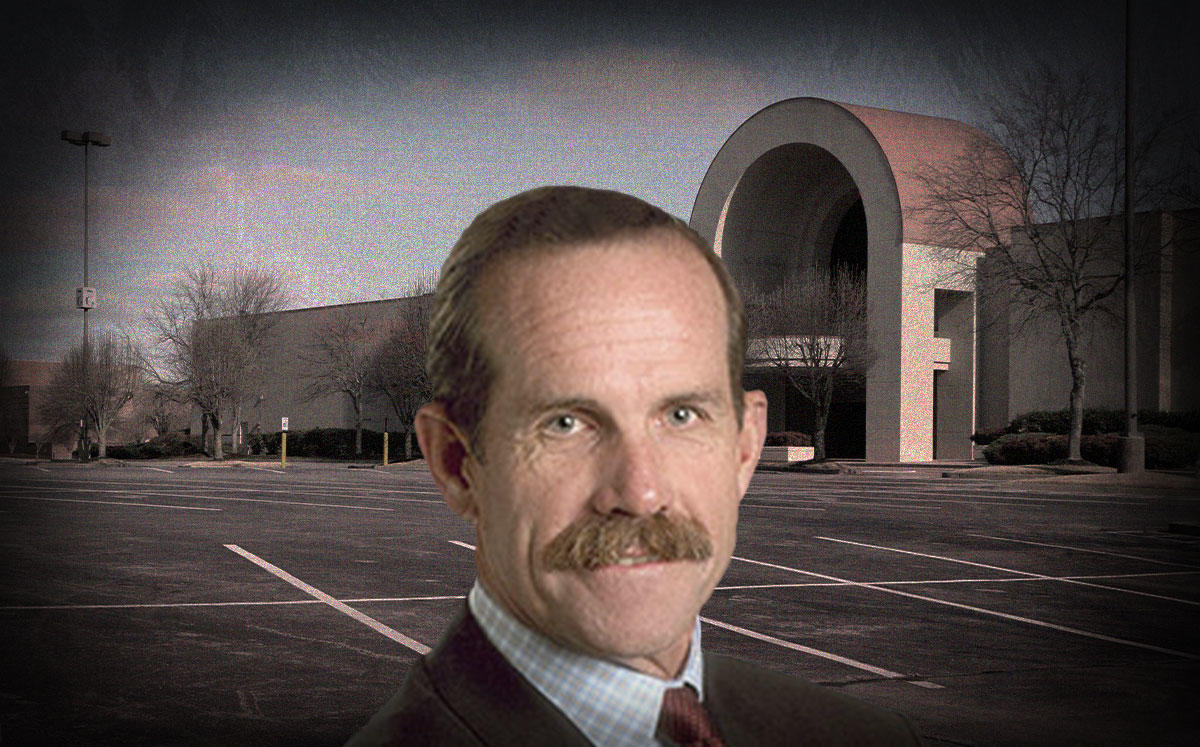

Tom O’Hern, CEO of the Santa Monica retail real estate investment trust, reported that the company “collected about 26 percent of rent” from tenants at the 47 shopping centers Macerich owns throughout the country, malls replete with brands like H&M and Pottery Barn that have been shut down throughout the coronavirus pandemic.

This is a problem: More than 90 percent of the company’s revenue comes from leases. In the first three months of 2020, Macerich generated $226 million in revenue, with $211 million coming from lease payments, and posted a net income $8.7 million.

But O’Hern admitted at the call’s start that the Q1 earnings, “seem, frankly, not that relevant.”

Market analysts’ questions about the lease payments dominated the earnings call.

“We are having literally hundreds of discussions with our retailers that are underway,” O’Hern told one analyst who asked about the paltry 26 percent collection rate. “Many of them are asking for rent deferral. It’s a long process. There’s a lot of uncertainty.”

Much of the uncertainty, O’Hern said, centers upon when malls will reopen. Macerich’s portfolio is largely in California, New York City, and Chicago, locales that imposed coronavirus-induced mall shutdowns in mid-March, which are only beginning to be reassessed.

Macerich does own 13 total malls in Texas, Colorado, Missouri, Iowa, Indiana and Arizona that have recently reopened. And company executives expressed hope that all shopping centers would reopen by mid-June, gameplanning on the call about hand-sanitizers, “social distancing markers for fitting rooms,” and curbside pickup.

How Macerich expects to deal with tens of millions in unpaid rent is not totally clear, though a couple of partial solutions were discussed.

O’Hern said the company “continues to have conversations with lenders” to “defer payments so the outflows match the inflows.”

“Those conversations continue today,” the CEO said, declining to specify the state of negotiations or potential lenders willing to make a deal.

The biggest cost cut laid out was property redevelopment. The company said it would slash renovation spending to $60 million from the budgeted $150 million.

That cut does not include the mammoth redo of One Westside Pavilion in Los Angeles, which Macerich is doing in conjunction with Hudson Pacific Properties. The site is being converted into office space for Google.