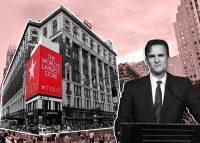

Czech billionaire Daniel Kretinsky has acquired a 5-percent stake in Macy’s, with plans to work with management to turn around the struggling retailer as it prepares to reopen its stores.

Kretinsky, who has a net worth of about $3.4 billion and recovered from a coronavirus infection in March, is known as “Czech sphinx” for his inscrutable demeanor. He first built his fortune in the energy business, and his Energetický a průmyslový holding is now one of central Europe’s largest power companies.

The billionaire’s holdings also include the Sparta Prague soccer team and a stake in French newspaper Le Monde. His Vesa Equity Investment, which acquired the Macy’s stake, is now one of the company’s top five shareholders Bloomberg reported.

Macy’s, which had been closing stores and cutting jobs prior to the pandemic, has furloughed a majority of its workers due to the coronavirus. The company’s shares have fallen nearly 70 percent this year, and dipped by 3.9 percent on Monday.

Read more

In April, following his recovery from coronavirus, Kretinsky said that his firm was “already investing” in the new economic climate, in the belief that “the current market is undervaluing certain very interesting and important companies.”

Kretinsky, who has a history in investing in struggling firms, said, “Those who will not react enough will lose all or a lot, but those who will overreact will lose as well, potentially a lot.” [NYP, Bloomberg] — Kevin Sun