Prologis, one of the largest owners of industrial real estate, granted rent deferrals to just 7 percent of its tenants who asked for help because of the coronavirus.

“This relief is targeted at our smaller customers with legitimate needs stemming from Covid and not for opportunistic requests,” said Chief Investment Officer Gene Reilly, speaking at Tuesday’s first-quarter earnings call in which the company reported higher net profit and revenue. Of the deferral requests that were granted — which totaled $18 million — customers received on average 33 days of deferral. The deferrals were structured to be repaid over the remainder of the year.

Reilly said another 23 percent of requests are still under review, but those requests have slowed. The company has already denied 70 percent of total deferral requests, representing 4.3 percent of its gross annual rent.

Prologis reported higher earnings from the January through March period, encompassing the escalation of the Covid-19 pandemic across the globe. Net earnings rose by nearly 41 percent, to $489 billion. Total revenue was up sharply from the previous quarter: $978 billion compared to $772 billion in the last three months of 2019.

Read more

The company’s executives noted that leasing demand has been high from e-commerce companies and those that stock essential products. They projected the pandemic will accelerate the shift to online shopping and will lead some companies to keep more inventory on hand than they had in the past.

For instance, 40 percent of the new leasing Prologis has undertaken recently has been to e-commerce firms, compared to just 23 percent pre-pandemic, Reilly said.

Still, the firm, in a bid to remain conservative because of the uncertain nature of the pandemic, said it was projecting reduced demand for the remainder of the year. Prologis lowered its guidance for the rest of 2020, anticipating no rent growth and lowering the net earnings per diluted share range to $1.81 to $1.88, from $1.98 to $2.13.

The firm also anticipates occupancy for the year to come in between 94.5 and 96 percent, down from 96 and 97 percent. Sixty percent of Prologis’ customers are growing, with the rest shrinking, Reilly said.

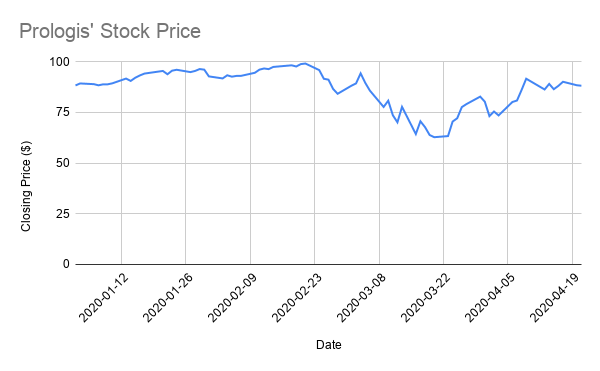

Prologis’ stock was down 0.34 percent, trading at $88.24, shortly after 2 p.m. Tuesday.

Write to Mary Diduch at md@therealdeal.com