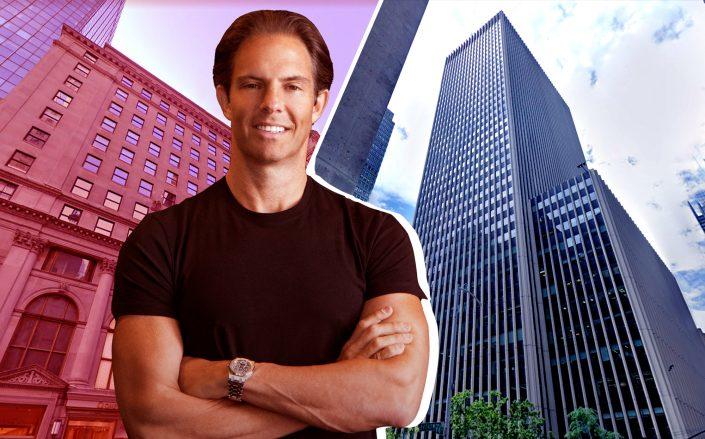

The Coca-Cola building at 711 Fifth Avenue with Michael Shvo and 1411 Broadway (Credit: Google Maps)

UPDATED, April 13, 4:01 p.m.: The 10 largest Manhattan loans recorded in March totaled $2.7 billion, more than 50 percent above February’s total. Developer Michael Shvo closed on two loans that made the list, including the largest one — a refinancing for the Coca Cola building.

1) Shvoca Cola – $545 million

A partnership led by Michael Shvo secured a $545 million loan from Goldman Sachs and Bank of America to refinance the Coca-Cola building. Shvo’s group — which includes Turkish developer Bilgili Holding, private equity firm Deutsche Finance America and German pension fund Bayerische Versorgungskammer (BVK) — acquired the property in September for $937 million from Nightingale Properties and Wafra Capital Partners, just weeks after they had bought it from Coca Cola.

2) RefiDi – $510 million

Silverstein Properties and UBS Realty Investors secured a $510 million refinancing, including $410 million of fixed-rate and $100 million in floating-rate debt, led by Wells Fargo and including Bank of New York and U.S. Bank as lenders. The new debt replaced a $310 million CMBS loan provided by Wells Fargo in 2013. Silverstein recently completed a $50 million renovation at the landmarked office tower that included opening a rooftop restaurant and bar, Banker’s Club.

3) Ivanhoe: A Finance – $450 million

Canadian pension fund Ivanhoé Cambridge, Callahan Capital Properties and Swig Company secured a $450 million loan from Bank of China for 1411 Broadway, a 40-story, 1.2 million-square-foot Midtown office tower. The refinancing replaced prior debt provided by HSBC in 2012, when Ivanhoé Cambridge acquired a 49.9-percent stake in the building from Blackstone Group.

4) Mendelian refinance – $324 million

Mendel and Eugene Mendelowitz’s Acuity Capital Partners landed a $324 million CMBS refinancing for a large multifamily portfolio, including 27 properties in Manhattan and one in Brooklyn. Cantor Commercial Real Estate and KeyBank co-originated the loan, which was set to be included in a new single-asset, single-borrower CMBS issuance. As a result of the coronavirus crisis, the market for new CMBS issuances is currently frozen.

5) Buildingsworth – $240 million

Blackstone Group provided a $240 million refinancing to Vanbarton Group for 980 Sixth Avenue, a mixed-use building also known as the Hollingsworth (and formerly as the Vogue). Vanbarton bought the 400,000-square-foot building in 2018 for $316 million and secured a $205 million mortgage from Brookfield’s debt fund. The 24-story building features ground-floor retail space, office space leased by WeWork since January, and 320 residential units.

6) Shvoho – $210 million

In Shvo and partners’ other big deal of the month, the group secured a $210 million loan from LoanCore Capital to finance the $386 million acquisition of 530 Broadway in Soho. Jeff Sutton’s Wharton Properties and Joe Sitt’s Thor Equities were the sellers. The 11-story mixed-use building, built in 1898, is fully leased with tenants including Anomaly, JKR, Knotel, Skechers, and Club Monaco.

7) Madisoho – $168 million

In another Soho acquisition deal, JPMorgan provided a $168 million loan to a group of investors led by Madison Capital for the purchase of 130 Prince Street. Invesco Real Estate sold the five-story, 88,000-square-foot building for $206 million. Madison will manage the investment for a group of owners that includes a wealthy individual from the tech industry, sources said.

8) Land loan – $135 million

iStar-managed ground lease REIT Safehold secured a $134.8 million mortgage from John Hancock Life Insurance Company for the ground under 685 Third Avenue, which it had acquired from Japan’s Unizo Holdings in late December in a deal that saw BentallGreenOak acquire a leasehold interest in the building. The financing also included an undisclosed amount of mezzanine debt.

9) George & Gaedeke – $133 million

Dallas-based Gaedeke Group landed a $133 million acquisition loan from Athene Annuity and Life Company for its $200 million purchase of Blackstone’s 44 Wall Street. George Comfort & Sons will operate the building on Gaedeke’s behalf, and the firm also advised Gaedeke on the deal. The 24-story, 354,000-square-foot office building is 84 percent occupied.

10) JPMortgage – $130 million

Prudential Insurance Company provided a $130 million refinancing to JPMorgan Asset Management for the Capitol, a 39-story, 387-unit rental tower at 776 Sixth Avenue. The new debt replaces $130 million in financing provided by HSBC in 2012. JPMorgan has owned the property since 2002, after buying it from developer the Witkoff Group.

11) Going Solow – $125 million

Sheldon Solow’s Solow Building Company refinanced the 14-story office building at 4 West 58th Street with a $125 million loan from JPMorgan Chase. The property was home to the historic Paris Theater, which closed in August. Solow bought the building in 1994, keeping the movie theater in place, and is currently developing a 19-story condo tower at 7 West 57th Street.

This article was updated to include the refinancing of 120 Broadway, loan no. 2, which was incorrectly excluded from the ranking.