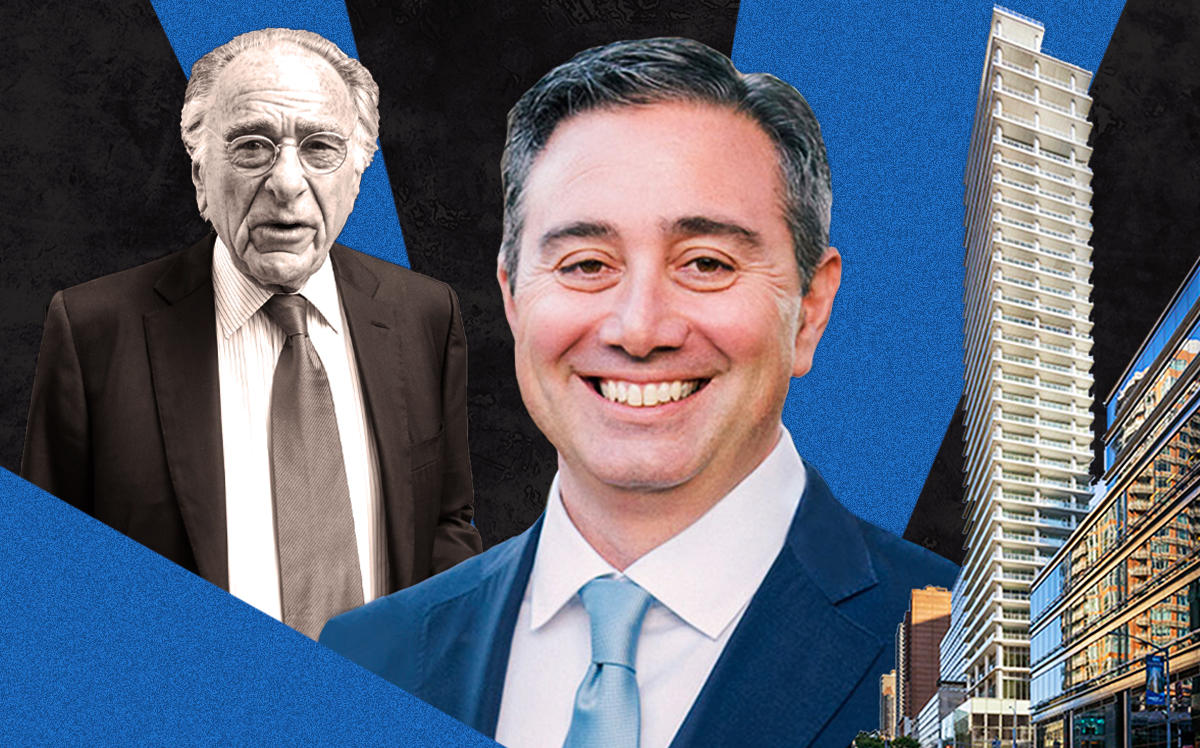

Price cuts are in and developer Harry Macklowe is out at 200 East 59th Street, a troubled condo project making a fresh start.

Closings at the completed, CetraRuddy-designed Midtown tower started in late January, a month after Macklowe, 83, sold his stake to his capital partner, Singapore-based Alpha Investment Partners, for an undisclosed amount. Centurion Real Estate Partners, a development firm with a history of taking over challenged projects, was then brought in as the replacement sponsor.

The transition from Macklowe, an audacious visionary, to Centurion managing partner John Tashjian, a data-driven numbers guy, seems fitting in an overstocked market where developers are reckoning with re-pricing as the condo boom fades into memory.

“This building hasn’t had its opportunity yet,” said Tashjian, who sat down for an interview with The Real Deal to discuss his plan for the property. “It hasn’t had its moment in the sun.”

But selling a condo in today’s climate is a daunting task, even for the steadiest of hands. Stocks are tumbling and the coronavirus outbreak and presidential election have ramped up uncertainty as the market was already contending with huge amounts of unsold inventory.

Still, Tashjian said he sees his task as more of “repositioning” rather than overhauling 200 East 59th Street. He is reluctant to criticize his predecessor’s sales strategy — Tashjian remains in regular contact with Macklowe and describes him as a “modern master” — but acknowledged that Centurion has brought back CetraRuddy to make the common areas more welcoming, and has done away with the “whimsical” original marketing campaign that featured elephants and balloons on the building’s signature wrap-around terraces.

Most significantly, the firm is bringing down prices.

An updated price list for 14 of the building’s 67 units, filed last Friday with the attorney general’s office, shows an 18 percent overall drop from the original, 2017 asking prices.

At 15A, the initial asking price of $4.74 million has been slashed to $3.75 million. (Per square foot, the decrease was from $3,347 to $2,648.) Further up, a two-bedroom on the 26th floor has been marked down 20 percent, to $5.7 million from $7.1 million.

“I think it might have been priced realistically when they underwrote it and priced it,” Tashjian said of the building. “But markets change.”

Swapping sponsors

It’s not common for a new sponsor to be brought in midway through a project, but it does happen, particularly when the market weakens.

In one notable case, two inexperienced developers planned a 600-foot tower at 21 East 22nd Street in 2006. Demand was high then, but as the housing bubble popped the developers struggled to secure financing to complete the tower — known as One Madison. Before long they were buried in debt and legal disputes. In 2012 the project was taken over by Related Companies and HFZ, who had been competing for the site before they joined forces.

Macklowe bought the East 59th Street site, at the southeast corner of Third Avenue, from SL Green in 2014 for $100 million, and paid $2.1 million to buy out a tenant at 989 3rd Avenue. He financed the project with a $64 million acquisition loan from Singapore’s United Overseas Bank.

By the time sales launched in 2017 — led by Douglas Elliman Marketing Development — the luxury market was a very different place, posing a conundrum now facing condo developers across the city: How to sell a building designed and priced in the boom?

For many, the answer is to drop prices. But Macklowe was reluctant to discount units at his 35-story condo, according to several people familiar with the project, and was often slow to respond to offers. That delayed the all-important step of getting the building declared “effective,” meaning at least 15 percent of units are sold and the offering plan is activated. (That has since been achieved.)

Given what was going on with all the product on the market, it was just kind of set up for a perfect storm of not being able to sell — Andrew Gerringer, managing director of new business development, The Marketing Directors

The issue created some tension with his capital partners, according to people with knowledge of the situation, and the parties agreed to part ways, negotiating Macklowe’s exit over several months. Both Macklowe and Alpha Investment Partners declined to comment.

Andrew Gerringer, managing director of new business development at the Marketing Directors, looks out at the site from his office at 59th and Lexington. Over the years, he said, he often wondered what would happen to the project, whose progress appeared slow.

“Given the high price of the land, the non-prime location of the real estate, the unit prices [Macklowe] was looking to achieve — and given what was going on with all the product on the market, it was just kind of set up for a perfect storm of not being able to sell,” Gerringer said.

Tashjian rejected that characterization of the location. “If 59th and 3rd is a non-prime location then I suggest he pull out a map,” he said, noting the building’s proximity to Bloomingdales, Bloomberg’s headquarters and Vornado Realty Trust’s luxury condo tower, One Beacon Court.

Troubled condos

Founded in 2003, Centurion operates both as a traditional development firm and as a fixer of sorts. Its takeovers of struggling projects include One Beekman (33 Park Row), 347 Bowery and the Riverhouse condo at One Rockefeller Park — where original developer Sheldrake Organization was removed by its capital partner, Lehman Brothers, and some if its executives were later convicted of fraud.

In today’s pressure-cooker environment — where developers are coming up with creative concessions and price cuts to move inventory — Tashjian said his firm has been getting a lot of calls about projects having difficulty.

The market shift has led many developers to push back sales launches until their condos are almost complete, recognizing that buyers increasingly want to see actual units, not just designs, and get a feel for them before they commit.

“New developments that are faring best are those that are completed [and] move-in ready,” said Mickey Conlon, a Douglas Elliman broker handling sales at 200 East 59th.

Unlike other projects Centurion has taken over, Tashjian said Macklowe’s building needed little change in structure or design. The firm’s relaunch plan is centered on marketing and price.

You’ve got two kinds of buyers out there… The bottom feeders will come in and they’ll try to cut you for sport, and we’re just nonresponsive to that. — John Tashjian, managing partner, Centurion Real Estate Partners

The project’s bumpy start created perception issues that Tashjian has to contend with as he tries to woo brokers and buyers, but he said interest — both domestic and international — has been strong. So far, at least five units have sold and another 11 are in contract, according to data provided by Nancy Packes Data Services. (Tashjian said the numbers are much higher, but declined to disclose them.)

A key change, of course, is price. But Tashjian rejects the idea that price cuts are the answer to all the luxury market’s problems, and said Centurion won’t compromise on some parts of the building.

“You’ve got two kinds of buyers out there,” he said, “people who are need-based, who are looking, and then you’ve got bottom-feeder investors. The bottom feeders will come in and they’ll try to cut you for sport, and we’re just non responsive to that because we believe we have a product of value that’s important, and we’ll wait for the people that recognize that.”

“That being said,” he conceded, “you can’t just price yourself; you’re not looking for a needle in the haystack. We have to meet the bulk of people that recognize value.”

Write to Sylvia Varnham O’Regan at so@therealdeal.com