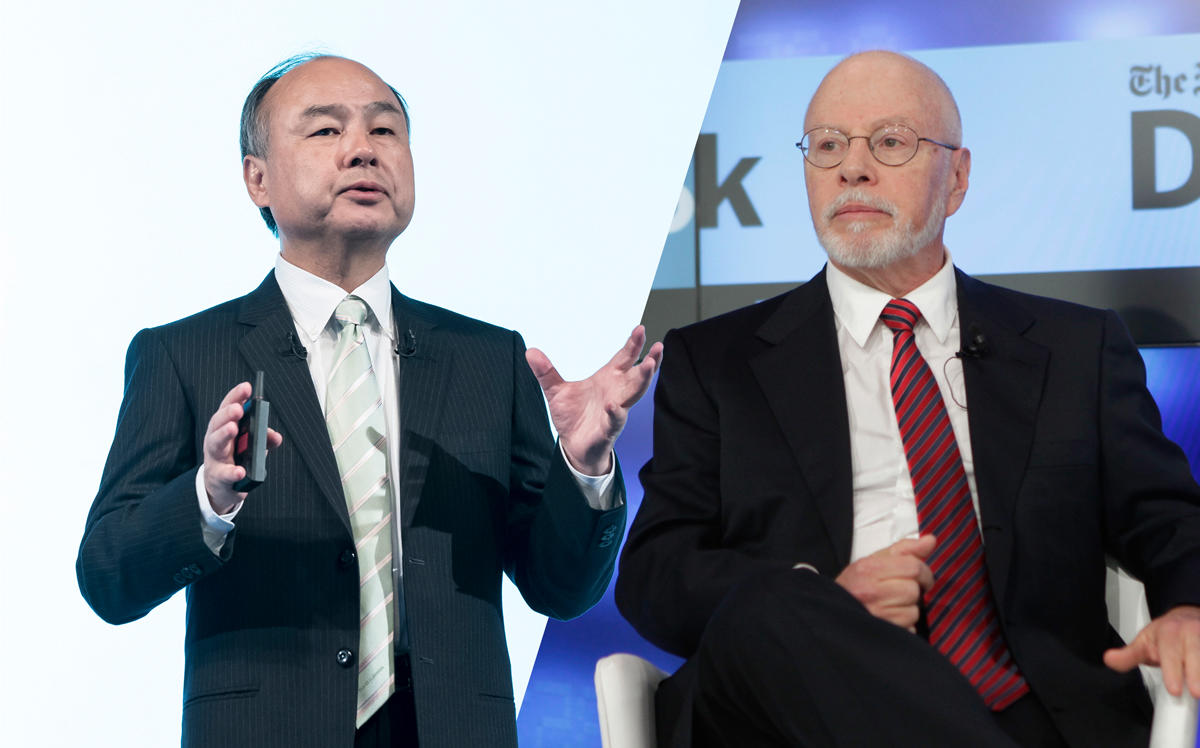

SoftBank CEO Masayoshi Son will map out the company’s strategy at a New York investor meeting for the first time since WeWork’s implosion led to another huge investment in the co-working firm.

Elliott Management Corp., among others, will be waiting. The activist investor called for a buyback of as much as $20 billion of the Japanese technology conglomerate’s shares, Bloomberg reported. But Son said there was “no rush,” and that he would like to sell as little as possible.

The March 2 investor meeting is being facilitated by Goldman Sachs, and Elliott will be a topic of discussion, sources told Bloomberg.

SoftBank is still smarting from WeWork’s botched offering last year, and the $9.5 billion rescue package it coughed up for the co-working giant, with help from Goldman. Earlier this month, SoftBank said it would abandon plans to raise $108 billion for its second Vision Fund.

But the company can point to several recent developments as signs of progress for its shareholders and potential investors. After regulators approved the T-Mobile-Sprint merger, shares of Softbank rose 3.3% in Tokyo. Shares also rose after Elliott revealed a $3 billion stake in SoftBank earlier this month. Elliott has expressed reservations toward SoftBank’s overall strategy.

Elliott and Son seem to agree that Softbank is undervalued, but see eye to eye on little else, according to reports. Elliott has a track record of getting its way with companies it targets — Barnes & Noble included — but that is unlikely to happen with SoftBank, because of the outsize power Son wields. The CEO holds more than a quarter of the total shares, and any board proposal must be approved by two thirds. [Bloomberg] — Georgia Kromrei