WeWork has found its knight in shining armor.

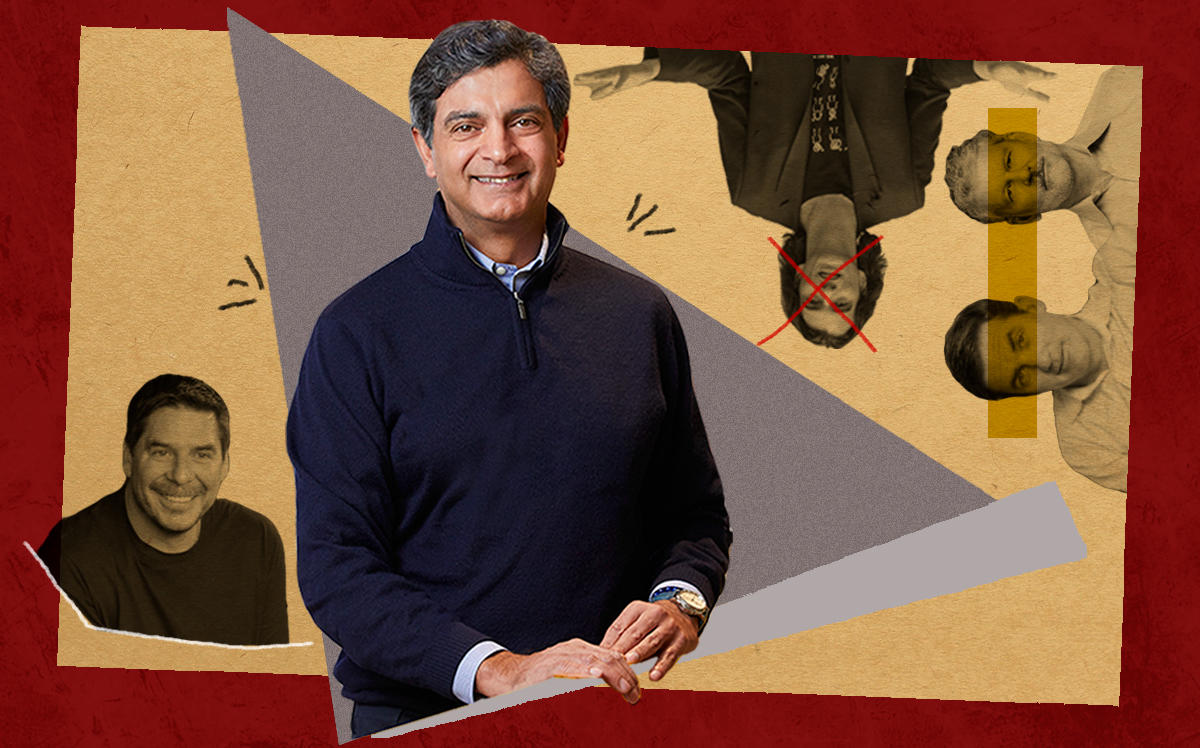

After a months-long search, the office-space company will replace its two incumbent CEOs this month with Sandeep Mathrani, a real estate veteran who once led a company back from bankruptcy.

Mathrani left his position as the CEO of Brookfield Properties’ retail group in January, a departure now seen as precipitated by his landing the WeWork job. He is joining the company after it endured one of the most spectacular corporate downfalls in recent memory, and his appointment is a major step in the effort to transform WeWork’s image as a cowboy-led tech startup.

One former senior WeWork staffer said “all of us were laughing about the fact that WeWork has accepted the fact it’s a real estate company.”

Another goal that Marcelo Claure, the chairman of its parent, the We Company, has for Mathrani might be even harder to achieve: profitability.

“He is a proven leader with turnaround expertise in the real estate industry,” Claure said in a statement.

WeWork has a long path ahead to prove its core business model of subleasing office space is viable. Since its launch in 2010, it rapidly signed leases across the globe, while attracting huge investments to fuel its growth, ultimately earning a valuation of $47 billion.

But after years of touting its office-space platform as a revolutionary tech startup under the leadership of former CEO and co-founder Adam Neumann, the company was forced to pull plans for a public offering last year after investors balked at its astronomical valuation.

What followed was nothing short of an implosion. Its valuation dropped to $8 billion and SoftBank, its largest investor, led a push to oust Neumann. SoftBank then committed to a $9.5 billion rescue package and installed Claure, one of its executives, as chairman. WeWork has since laid off thousands of workers and drastically cut back on new leasing.

“It’s someone who has come out of the retail apocalypse and now could navigate out of the Adam apocalypse,” said Dror Poleg, a former adviser to WeWork rival Breather, and the co-chair of the Urban Land Institute’s Technology and Innovation Council in New York.

People who have worked closely with Mathrani describe him as disciplined and a tough boss. One who worked alongside Mathrani for several years called his appointment a “coup” for WeWork. “He’s very smart, very hardworking,” the person said. “He’s a bit ruthless too.”

Mathrani, 57, will arrive at WeWork with a track record that includes bringing the country’s second-largest retail landlord, General Growth Properties, back from bankruptcy.

Born in India, Mathrani was schooled in the U.K. and the U.S. before joining Forest City Ratner, where he became an executive vice president, before joining Vornado Realty Trust in 2002 as the head of the company’s retail division.

In 2010 he was named CEO of Chicago-based General Growth. GGP was undergoing the largest real estate bankruptcy in U.S. history after its portfolio was decimated by the Great Recession.

In New York, Mathrani diverted GGP from its typical mall acquisitions and led some major deals on Fifth Avenue retail real estate. It partnered with Thor Equities in 2014 to acquire 685 Fifth Avenue from Gucci for nearly $500 million.

The same year GGP joined Wharton Properties to acquire the Crown Building for $1.8 billion — a record for an office-building acquisition at the time. They later offloaded a major portion of the building to a group led by developer Michael Shvo.

Mathrani’s role at GGP made him among the best-paid real estate CEOs in the country. In 2015 he raked in $39 million; the following year he spent $3.8 million for a two-bedroom co-op at the white-glove building 860 Fifth Avenue.

In 2018 he guided the company through its $15 billion sale to Brookfield Properties, where he assumed the role of global head of retail. As part of that transaction, Mathrani was reported to have received a $189 million windfall.

But he was soon looking to be the face of a company again.

“He was used to being front and center in a public role,” one person familiar with his work at Brookfield previously told TRD of his tenure at GGP. The person added that his role at Brookfield was “not really the same role that it was” when he led GGP.

A person familiar with Mathrani’s hiring by WeWork said he was first approached by Claure to join the board, but those talks evolved. The person said Claure will remain “very much engaged” in the day-to-day management of the company.

At the end of 2019 WeWork had 740 locations in 140 cities across 37 countries, and more than 650,000 memberships, according to the company. It now has a five-year plan that includes achieving “positive free cash flow in 2022.”

In addition to laying off thousands of employees, WeWork has offloaded its non-core business lines to cut costs. Most recently, it divested its stake in women-focused co-working startup the Wing and sold software company Teem.

Mathrani has ties to the flexible office industry and led Brookfield’s negotiations to invest in Industrious, a WeWork rival. Jamie Hodari, Industrious’ CEO, said Mathrani is “definitely not your typical real estate person” and has “a lot of personality.” He added that the “idea of WeWork being run by a known quantity to us” is a benefit.

“As someone with a stake in the industry, WeWork behaving rationally is important to us,” said Hodari. “This represents a move in that direction. That’s a good thing.”

As for the co-CEOs being replaced, Minson and Gunningham will stay at the company during a “transitional period” but then leave, a person familiar with the situation said. The pair were previously singled out by departing executives for being part of a cohort of “yes men” that allowed Neumann to run WeWork to the edge of a cliff.

Before joining WeWork, Minson had built an esteemed reputation after negotiating the spinoff of AOL from Time Warner as deputy CFO of Time Warner. Gunningham had been an executive at Amazon, overseeing its online marketplace, before arriving at WeWork.

Mathrani, who will start Feb. 18, said in a statement that WeWork has “significant potential if we stick to our shared values.”

Eddie Small contributed reporting