New York Community Bank has a message for the industry: Lending on rent-regulated buildings is still its bread and butter.

Officials from New York Community Bank on its fourth quarter earnings call this morning fired back at analysts scrutinizing the bank’s multifamily portfolio in light of the new rent law.

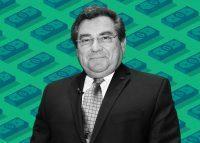

“We have been six months under new rent regulations, to date we are not seeing any negative asset-quality trends,” Joseph Ficalora, CEO of New York Community Bank, said on the Wednesday call. “50 percent or $18.7 billion of our total multifamily portfolio is subject to the Housing Stability and Tenant Protection Act. The average loan to value ratio is 53 percent.”

Read more

NYCB officials also said that despite headlines, property values are not plummeting.

Any changes to the values of multifamily properties have proven difficult to determine, as few large deals have been transacted in the six months following the upheaval. The largest rent-regulated portfolio to trade since the changes to the rent law were passed was purchased at a significant discount, sparking a discussion over valuations in the industry.

“We’re seeing cap rates of low five to mid five, even high four,” said Ficalora. “Each market is different.”

Some alternative lenders financed deals expecting future increases in rent rolls — a practice that the bank insists it has not engaged in. Future drops in value of rent-regulated assets “do not impact one iota our ability to loan,” Ficalora said.

The bank has also repurchased $771 million in multifamily mortgages that it previously originated and sold to other institutions. Now, according to Ficalora, some institutions are looking to divest from New York City’s rent-regulated market.

“We are multifamily, rent-regulated — this is our core business model,” Ficalora said. “We are far more comfortable with it than people who have never originated those loans.”

Officials from NYCB also noted that some landlords in New York City’s multifamily market are keeping units vacant in the hope of combining units to set a new first rent, a trend that has been widely reported , although data on the practice is unavailable.

“We’re seeing owners leave apartments vacant to join units together,” said Ficalora. “That’s something wealthier players can do, we’re seeing a lot of that.”