SoftBank Group CEO Masayoshi Son has recently admitted that he made several big mistakes when investing in U.S. tech companies, especially with (surprise!) WeSomehowStillExistWork. It turns out that telling the eccentric leader of a new company he is not being crazy enough can occasionally end up not being the best advice.

As Son looks to restore the reputation of himself and his company, The Real Deal is here to help with some recommendations for investments that should prove to be much safer and more prosperous than his recent flops.

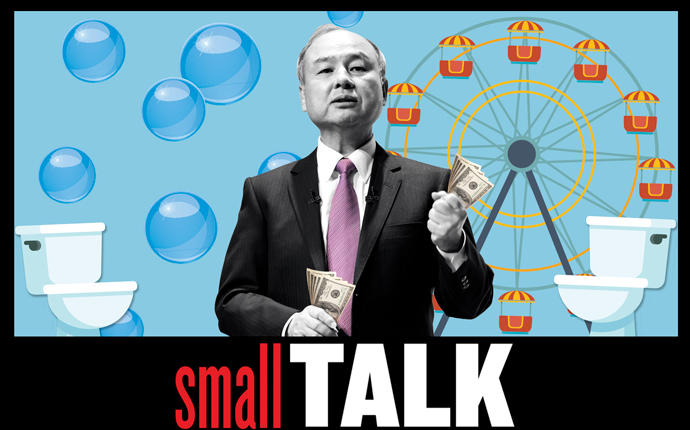

A giant Ferris wheel on Staten Island: The only thing that has kept New York from breaking into the top tier of global cities like London and Disneyland is its lack of a giant Ferris wheel, and Staten Island would obviously be the best place to build one. And since giant Ferris wheels are famously easy to build and find investors for, this would be the perfect type of low-risk project to help Softbank get its groove back.

Home Depot: Home Depot is profitable. That sums up just about everything I know about the company, but that should still be enough to make it a better investment for SoftBank than pretty much anything else it has put money into lately.

Beanie Babies: Every time my parents tried to tell me I didn’t need more Beanie Babies growing up, I would always tell them that they were very wrong because, even if I somehow got tired of Beanie Babies (which would never happen), I would just be able to sell them later on for extremely high prices. Since I usually won these arguments, I assume I was right about this and that Beanie Babies are now one of the most valuable commodities on the planet, making them a perfect place for SoftBank to store its money.

Whatever Billy McFarland is up to these days: Sure, he’s currently serving time on fraud charges in a federal prison near Elkton, Ohio, and, sure, that whole Fyre Festival thing didn’t work out quite the way he said it would, but as the old saying goes: fool me once, shame on you; fool me twice, please accept this $700 million investment and a complimentary Ja Rule album.

A restaurant that is pretending to be a technology company: This is basically just a normal restaurant, in the sense that customers show up and spend money to buy food, but its founder has the unique ability to talk for at least two consecutive hours about how it’s actually more of a technology company, in the sense that it uses all sorts of technology to technologize the restaurant industry, which is long overdue for some tech-based disruption. Please do not ask him any specific questions about the type of technology it uses. It’s a secret.

Bubbles: No, not financial bubbles like housing in the 2000s or dot-coms in the 1990s. Even I know those are bad. I’m talking about literal soap bubbles—the kind you see children joyously playing with as they run through beautiful parks on picturesque spring days. How could anyone possibly lose money investing in something as pure and gorgeous as that?

KrOwew: This new startup company, fearlessly led by its charismatic and somewhat controversial founder Mada Nnamuen, focuses on buying office space and then subleasing it to smaller companies. Well, that’s what it focuses on for now, at least. Its eventual plan is to take over the world, provided it can get a large amount of money from SoftBank first.

Toilets: People are always going to need toilets.

Me: Do I have any grand, visionary plans to revolutionize the automobile industry or the office leasing industry or any other type of industry? No. But given that investing with those types of people hasn’t been working out too well for SoftBank lately, maybe it’s time they changed things up a bit.