Shareholder litigation against WeWork’s major players has begun.

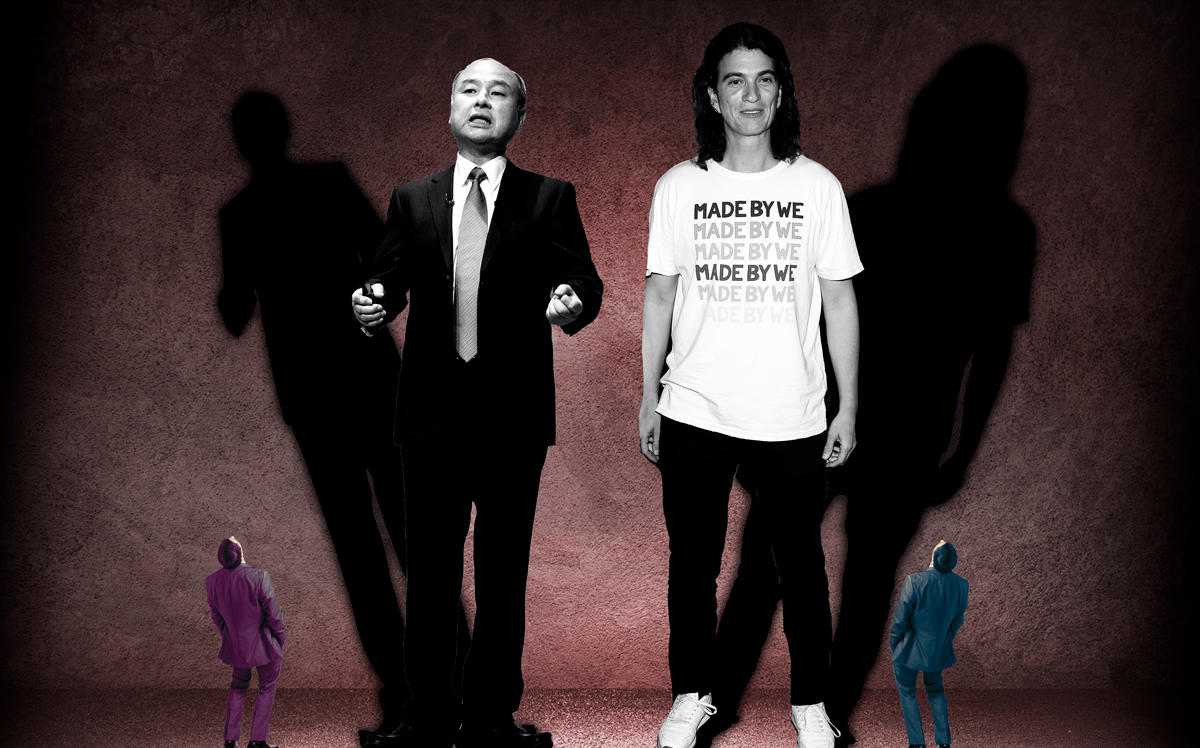

Co-founder Adam Neumann, SoftBank head Masayoshi Son and board members of the embattled office-space company were sued this week by a minority shareholder who accuses them of self-dealing and unjustly enriching themselves.

The complaint, by former WeWork employee Natalie Sojka, targets SoftBank’s $9 billion takeover of the company, and says the Tokyo-based conglomerate increased its stake in the company to 80 percent from 29 percent through a “fire sale.” It also skewers a $1.7 billion package SoftBank provided to Neumann.

A spokesperson for WeWork called the suit “meritless.” A spokesperson for SoftBank did not respond to a request for comment, nor did a representative for Neumann.

WeWork’s valuation plummeted to $8 billion from $47 billion as its plans to go public during the fall fell apart. SoftBank, its largest investor, agreed to provide $9 billion to buy out shareholders and provide WeWork with enough capital to stave off bankruptcy.

As part of SoftBank’s bailout, founder Adam Neumann was paid almost $1 billion for his stake in the company and received a $185 million consulting fee. SoftBank also settled his $500 million debt with JPMorgan and other banks.

Since Neumann’s departure the office-space company has installed a new chairman, Marcelo Claure, a SoftBank executive and the former CEO of Sprint. Artie Minson and Sebastian Gunningham, two WeWork executives who worked under Neumann, are running the company as co-CEOs.

Most board members who have faced scrutiny for perceived corporate governance abuses also remain at the company. Some were named as defendants in the shareholder lawsuit, including Steve Langman, John Zhao, Ronald Fisher, Lewis Frankfort, Mark Schwartz and Bruce Dunlevie.

The plaintiff worked as an executive assistant and team lead at the company in San Francisco, leaving in September. She now works as an executive assistant to the CEO of financial firm SoFi, according to her LinkedIn page. Sojka’s attorney did not respond to a request for comment.

Sojka’s complaint, which is seeking class-action status and was filed in California Superior Court in San Francisco County, claims that WeWork attracted talented employees by offering them stock options that they were led to believe would spike in value once WeWork went public.

Instead, the suit alleges, WeWork’s major shareholders breached their fiduciary duty and forced the company to pull its IPO plans. While minority shareholders lost the value of their stock options, the majority investors engaged in self-dealing to protect their own interests, the complaint alleges. Reuters first reported on the lawsuit.

The lawsuit caps a tumultuous week for Softbank. After posting operating losses of $6.5 billion for the third quarter Wednesday, the firm’s stock dropped almost 4 percent. Son, SoftBank’s CEO, told news reporters in Tokyo that his “own investment judgement was really bad,” and that “I regret it in many ways.”

In the meantime, WeWork employees await to hear news of layoffs, which could hit as much as a third of the company’s 12,000 employees. This week 150 signed a letter to management that called for workers to be treated “humanely.”

“We don’t want to be defined by the scandals, the corruption, and the greed exhibited by the company’s leadership,” wrote the employees, who call themselves the WeWorkers Coalition, according to the New York Times.

Other legal offensives have been launched against those with ties to the company. Last month a former executive assistant to Neumann sued him and other WeWork executives for gender discrimination last month, alleging that she was targeted and harassed for being pregnant.