Every day, The Real Deal rounds up New York’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 2:50 p.m.

Video produced by Sabrina He

3 World Trade Center (Credit: Wikipedia)

Uber is reportedly taking seven floors at Silverstein Properties’ 3 World Trade Center. Uber, after going public in May in a disappointing $82 billion stock offering, will combine several offices it has in the area. The space it’s in talks for at 3 WTC spans 308,000 square feet, and the deal would give the option to expand onto an eighth floor, bringing its total square footage to roughly 350,000. [Crain’s]

Rating agencies have had doubts about WeWork for years. In an analysis of two dozen CMBS ratings reports for properties across the country, TRD found that those rating agencies have increasingly viewed WeWork, and co-working tenants in general, as a negative in their risk assessments. Meanwhile, landlords largely continued to focus on the company’s positives in public statements. [TRD]

CBRE group subsidiary Hana has opened three co-working locations in London. The locations will host 500 CBRE employees. Hana will partner with Nuveen Real Estate at one flexible working location, LGIM Real Assets at another and Oxford Properties at their third location. [Press release]

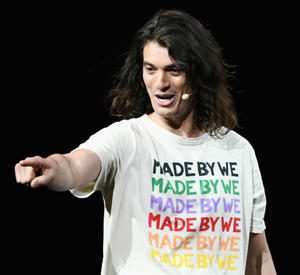

WeWork CEO Adam Neumann (Credit: Getty Images)

WeWork forges ahead with its IPO after making significant governance changes. In a revised S-1 filing, CEO Adam Neumann reduced his high-stock vote from 20 to 10 votes and agreed to relinquish his profit on any real estate deals he enters into with the company. The updated prospectus also assures investors that any subsequent CEO will be chosen by the board; previously, Adam Neumann’s wife Rebekah Neumann played a key role in the decision. The We Company plans to go public the week of Sept. 23. [WSJ, Bloomberg]

One in four condos in New York City are sitting vacant, according to a new report. The study found that of the 16,200 units completed in New York City since 2013, around 4,100 are still on the market. It’s pushed developers to lower prices and offer concessions. And practices from previous real estate cycles are resurfacing, like the bulk sale of unsold units to investors, converting condos into rentals and more. [NYT]

Natixis’ head of real estate finance Greg Murphy is leaving the bank. Murphy oversaw an increase in originations from $3.5 billion in 2016 to about $7.5 billion in 2017 and 2018, but will return to his native Texas to retire. As to who will replace him: Murphy said the “deep bench” of senior people includes Jerry Tang, Michael Magner, Andy Taylor and Arvind Pai. [CO]

The City Council expanded the Minority and Women-Owned Business Enterprise Program but left LGBTQ persons out. The program now includes Native Americans, but an LGBTQ chamber of commerce accused openly-gay City Council speaker Corey Johnson of blocking the expansion of queer rights. Johnson, who is running for mayor in 2021, denied the accusations. [Crain’s]

Sales slowed to a crawl at Saks Fifth Avenue this quarter. Sales were the lowest they’ve been in eight quarters for the flagship brand of Canada-based Hudson’s Bay, and the company blamed a precipitous drop in the gross profit margin on a “hyper-promotional environment.” [Bloomberg]

The market may not be what it was in 2016, but a few condo towers are seeing traction. According to a report from Property Shark, 11 of the 15 developments with the most sales in the first six months of the year were in Manhattan. With 121 units sold, Extell Development’s One Manhattan Square on the Lower East Side had the most sales, followed by Related Companies’ 15 Hudson Yards with 98. A Brooklyn project, the Greenpoint, took third place with 59 sales. [NYT]

A “class action” lawsuit alleges that a condo owner failed to provide a specialty wine cooler. While the class action only includes one plaintiff, the suit could include all the jilted purchasers of the luxe wine coolers. 565 Broome Street, designed by architect Renzo Piano, is also home to Uber’s CEO Travis Kalanick, who purchased the $36 million penthouse, and tennis star Novak Djokovic who purchased two units in 2017. [TRD]

“Hipster dorm” owner Carnegie Management has racked up $278,000 in fines, according to a city lawsuit. The suit claims the owner of the McKibbin Lofts in East Williamsburg converted the space to illegal hotel rentals, accruing six violations in 2016, and hasn’t paid any of them yet. [CO]

Hector Figueroa (Credit: Getty Images)

REBNY honored 32BJ’s late president Héctor Figueroa with a Humanitarian Award. While Figueroa did not always see eye to eye with real estate, he recently supported the city’s bid to bring Amazon to Long Island City and the real estate industry’s efforts to counteract the expansion of the rent law. [TRD]

Compiled by Georgia Kromrei

FROM THE CITY’S RECORDS:

Financings:

Madison Capital secured a $69.15 million refinancing for 140 Crosby Street in Soho, a WeWork location. Societe Generale was the lender. [ACRIS]

Empire Management secured $77 million in building and project loans from Santander Bank for 250 Fifth Avenue, which will be the site of a 181-key hotel. [ACRIS 1, 2]

Herald Square Properties secured a $53 million refinancing for 251 West 30th Street, an office building in Chelsea. Ladder Capital was the lender. [ACRIS]

Compiled by Mary Diduch