Non-developers rarely find themselves on the buy side of an air rights deal – and when they do, it appears that the prices are sky-high.

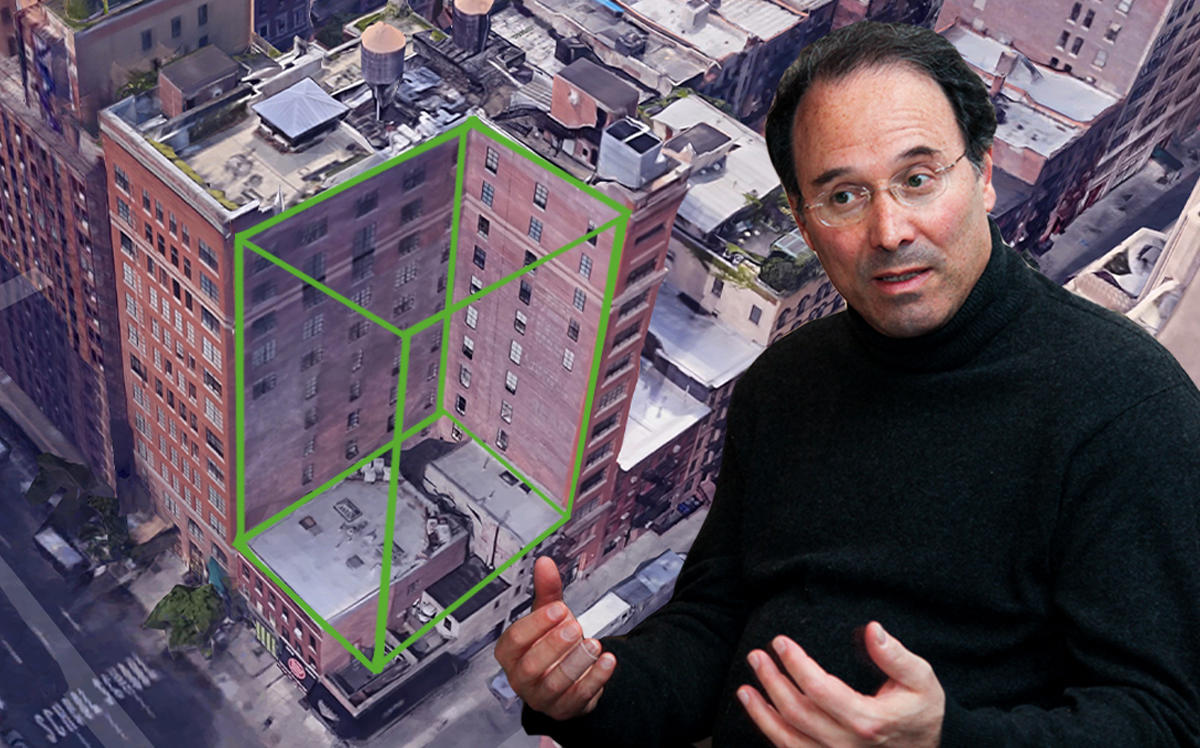

As reported by the New York Times on Monday, residents of the 11-unit loft building at 206 West 17 Street, also known as City Prairie, shelled out a hefty $11 million back in 2016 to buy development rights from Gary Barnett’s Extell Development, simply to preserve their Empire State Building views.

An analysis by The Real Deal found that the condo unit owners paid a significantly higher price per square foot than what most developers were paying on comparable deals at the time. The residents at City Prairie don’t seem to regret the decision, either.

“It was a big number, and I would say it was well worth it because the apartment has views on the corner, and if a building had gone up there I would have never gotten the price that I got.” Douglas Elliman agent Doreen Courtright, who sold the eighth-floor unit of the building for $9.75 million last month, said. The sale of that full-floor apartment was the first (and so far only) sale at the building since the air rights deal.

“I work with a lot of buyers, and with every buyer the first thing they do is look out the window and go, ‘Oh, could a building go up over there?’,” Courtright said. “And even if they did get an accepted offer, the lawyer who would be representing them would do their due diligence and find out that there was a potential for development on the corner and then the deal could fall apart, and that happens all the time. So the fact they did buy the air rights was huge for us getting our price.”

Barnett could not immediately be reached for comment.

Under existing zoning, the maximum floor-area ratio the two merged lots could have allowed was 7.52, yielding a roughly 31,500-square-foot residential or mixed-use development. After selling its development rights, Extell ended up just building a three-story, 12,000-square-foot retail-and-office project instead.

Paying $11 million to take about 19,500 square feet off Extell’s hands means that the loft residents paid over $560 per square foot of development rights, which makes it one of the pricier air rights deals by square footage in recent memory.

A 2015 study from the Department of City Planning found that for deals in the Special West Chelsea District, a few blocks west of the Extell site, “prices have ranged between $200 and $400 psf.” A 2013 study from NYU’s Furman Center found that air rights deals in Clinton and Chelsea averaged $219 per square foot, based on 45 deals examined between 2003 and 2011.

Of course, prices for air rights have risen since then — and have started to slide in the past 18 months or so, according to sources — but an air rights deal in the high $500s a foot is still rather uncommon, especially outside of a high-demand area such as West Chelsea along the High Line.

In early 2018, the owners of Grand Central terminal were in talks to sell nearly 700,000 square feet in air rights to JPMorgan Chase for about $240 million. Public records show that the $208 million deal closed in December at $312 a foot. This February in Hudson Yards, Rockrose Development picked up over 139,000 square feet of air rights from the Metropolitan Transportation Authority at just $147 per square foot.

“Regardless of the methodology used to justify the $11 million, it’s really about what was it worth to the condo unit owners at the end of the day,” said City Center Real Estate’s Brian Strout, a real estate broker specializing in air rights and land assemblages for development, noting the unique considerations at play in the City Prairie deal.

Strout added that various “extras” that often come with air rights deals, such as light-and-air easements, underpinnings, cantilevers, and construction license agreements can push prices higher when a developer is buying development rights, and these factors did not come into play here. (Alternatively, the loft residents were more or less only buying a light-and-air easement, since they had no intention to develop.)

That’s not to say that the loft residents didn’t get any “extras,” though. According to the terms of the easement agreement recorded in property records, Extell is not allowed to use the roof of its new building for more than 12 events a year, and cannot put cell towers or commercial signs on it. Additionally, the residents of the fourth floor (the lowest floor with a view) have the right to ask Extell to “place shrubbery or other decorative screening on the roof.”

Though defensive buys to protect a view from new development are uncommon, Strout pointed to a few other examples that New York City has seen over the years. In 2000, the co-op at 623 Park Avenue bought air rights from two neighboring buildings to prevent development next door. And back in the 1980s, the co-op at 844 Lexington Avenue bought an entire building across the street in order to block an assemblage. The prices for these deals could not be determined from public records.

New on The Real Deal: Read our new daily digest for a roundup of all the news and deals, big or small, in New York City. Updated three times a day.