One block away from the Related Companies’ luxury condominium project 70 Vestry, home to the likes of Tom Brady and Lewis Hamilton, sits an empty lot that was supposed to be home to a luxury hotel from France’s Groupe Lucien Barrière. Related has nothing to do with that project… or do they?

The partners behind the development at 456 Greenwich Street, which filed for bankruptcy last month, have requested a legal examination of Ponte Equities and Related’s communications in order to determine whether the landlord and developer colluded to take over their project.

Subpoenas addressed to individual members of the Ponte family, their companies and Related, request production of “all documents and communications” concerning the hotel project and its allegedly problematic lease.

Whether or not these suspicions are confirmed, there’s more to Tribeca’s long-delayed Hotel Barrière Le Fouquet than meets the eye – more developers, more investors, and more lawsuits.

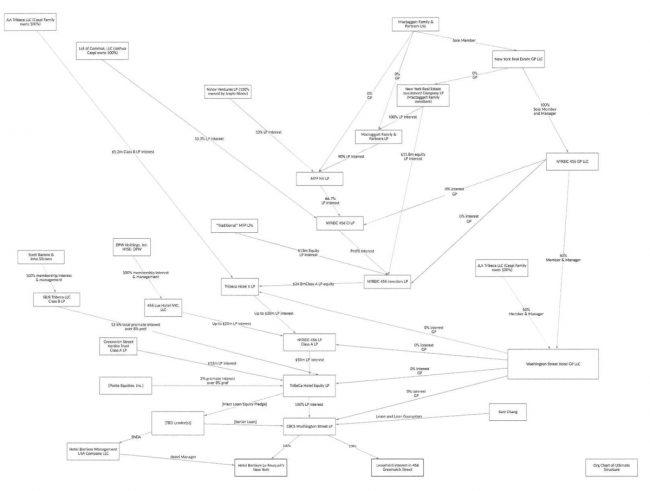

An organizational chart of the 456 Greenwich hotel project

“A lengthy relationship”

In the initial bankruptcy filing last month, the partnership between Mactaggart Family & Partners and Caspi Development Corp. claimed that the Pontes’ rigorous lease terms had prevented them from securing a construction loan for several years, putting them at risk of defaulting on the lease and losing their entire investment.

Now the developers have proposed an explanation for the landlord’s alleged behavior. “The Debtor believes that the reason for the Landlord’s actions may be that they are seeking to develop the property with a third party,” according to the motion filed in bankruptcy court two weeks ago.

“This would be consistent with Ponte Equities having a lengthy relationship with Related, having also partnered with them in building a 13-story condominium building in Tribeca and developing 261 Hudson Street, along with 460 Washington Avenue,” a footnote in the filing adds.

The filing includes a link to a The Real Deal article from February, which reported that Ponte had bought 15 condos at Related’s 70 Vestry Street, a block away from the hotel site.

Representatives for the partnership between Mactaggart and Caspi declined to comment on the bankruptcy or other aspects of the project. Related and Group Lucien Barrière did not respond to requests for comment.

Lease and sell

456 Greenwich wouldn’t be the first hotel to be built on land leased from the Ponte family, one of Tribeca’s biggest landlords.

Sam Chang

The 575-key Arlo hotel at 231 Hudson Street, which opened in 2016, sits on a 99-year ground lease owned by the Pontes. The lease was first arranged by Sam Chang and Barone Development, who then sold the leasehold to Eagle Point Hotel Partners in 2013. Barone stayed on as the site’s general contractor.

Scott Barone, the company’s founder, would later credit the 231 Hudson Street project for launching his development career. “Sam Chang took a shot on me when no one else would have or should have,” he told Real Estate Weekly last year. “I owe him everything.”

The ground lease at 456 Greenwich Street was also first inked by Chang and Barone, during the post-rezoning feeding frenzy in Hudson Square. Much like the Arlo site, the partners eventually handed off the project to other developers. This time, the buyers were Mactaggart Family & Partners, the co-investment platform of a family of Scottish aristocrats, and Westchester-based Caspi Development Corp.

Barone stayed on as the project’s general contractor at first, but fully divested from the project in December 2017, a Barone spokesperson said. Barone nonetheless took part in the project’s groundbreaking that month, according to news reports.

“We divested from the project as part of our overall strategic shift to only own majority interests in any project we develop,” Barone said in a statement. “As this project had us in a minority partner role, without control, it no longer fit our long term goals.”

Scott Barone

Meanwhile, Chang has remained as an equity investor in the project, and is named as a co-debtor in the Chapter 11 filing. Documents filed by the Pontes in bankruptcy court show that the hotel magnate is a guarantor for the project as well, with an obligation to complete a hotel on the site if the lessees do not. Chang did not respond to a request for comment.

“Just trying to be practical”

Although Mactaggart and Caspi claim that Ponte’s terms prevented them from ever securing a loan for the project, one lender says they were ready and willing to finance the hotel years ago.

In a 2017 lawsuit that’s still making its way through appeals court, Soho-based Churchill Real Estate Holdings alleges that the developers signed a letter of intent for a $60 million senior loan, only to back out when they believed they could secure better funding elsewhere.

Churchill first connected with the developers in March 2017, when a prior mezzanine lender backed out over insufficient funds, court documents show. Negotiations began promisingly, and it turned out Joshua Caspi and Churchill partner Justin Ehrlich were old college friends who’d known each other for years.

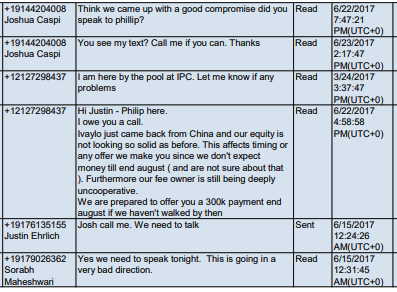

“Monsieur Erlich want to get into the French hotel biz with us?” Caspi asked Erlich via text message soon after the first meeting, according to court exhibits. Churchill and the developers signed a preliminary term sheet the following month, and proceeded to prepare loan documents. That’s when things started to go sideways.

Joshua Caspi’s texts

In May, Caspi informed Ehrlich that a “billionaire from California,” identified as James R. Parks, had agreed to make an equity investment in the project, much of which was to be backed by EB-5 funding. According to Churchill, this violated provisions in the initial agreement. The lender and the developer met again to resolve their differences, but failed to do so.

Philip Mactaggart, CEO of Mactaggart Family & Partners, then informed Churchill that they did not plan to close the loan for at least 18 months, “if at all,” court documents show.

“We did not ask you to call that capital then and it would certainly not make any sense for you to continue sitting on it,” Mactaggart said in an email submitted to the court by Churchill. “Just trying to be practical.”

Churchill now claims that Mactaggart and Caspi never intended to follow through with the loan deal in the first place, and used their term sheet to secure funding from Parks instead. Meanwhile, Mactaggart says that Churchill was the one who backed out of the agreement first.

“In retrospect, Churchill may have gotten cold feet since it seems (as noted above) that lending on a hotel development project is not something with which they are familiar,” Mactaggart CFO Ivaylo Ninov said in an affidavit.

Interestingly, the affidavit also states that the developers had secured $60 million in funding from G4 Capital Partners. That evidently fell through as well, as no loan appears in either property records or the bankruptcy filing.

Ivaylo Nino and Justin Ehrlich

The bankruptcy filing indicates that Jim Parks’ EB-5 funding never materialized either, though the developers did make an effort to court Chinese investors in 2017, with Ninov personally traveling to China to promote the project.

One prospectus circulated online touts the Mactaggarts’ “royal background,” while other promotional material called Parks “one of the most capable real estate developers in Los Angeles,” and claimed that the project had already secured $60 million in debt financing. Parks did not respond to a request for comment.

Promotional material featuring an old design of the hotel that was rejected by the landmarks commission)

Though a lower court dismissed the lawsuit, an appeals court overturned that decision earlier this month, noting that although the parties were not obligated to enter into a loan, the preliminary agreement still included some binding terms, including a “break-up-fee” of $600,000.

Churchill declined to comment for this story.

“Maneuverings and incompetence”

In their objection to the developers’ request to investigate their relationship with Related, the Pontes’ attorneys point to the Churchill case as proof of the landlord’s innocence.

“Debtor is also wrong when it suggests that the Landlord – rather than the Debtor’s own maneuverings and incompetence – has discouraged potential sources of financing,” the objection notes. “In fact, one potential lender has actually sued the Debtor in New York State Court, asserting that it had reached agreement with the Debtor to finance this very project.”

The Pontes also note that they have amended the ground lease several times, and that Mactaggart and Caspi have offered no proof of a scheme involving Related.

Related’s attorneys agree with the Pontes, and emphasize that the company “is a non-party and which has no business or other relationship with the Debtor.”

A hearing on the matter is scheduled for May 3.