A bill that would require anonymous LLCs to disclose their beneficial owners is back on the table.

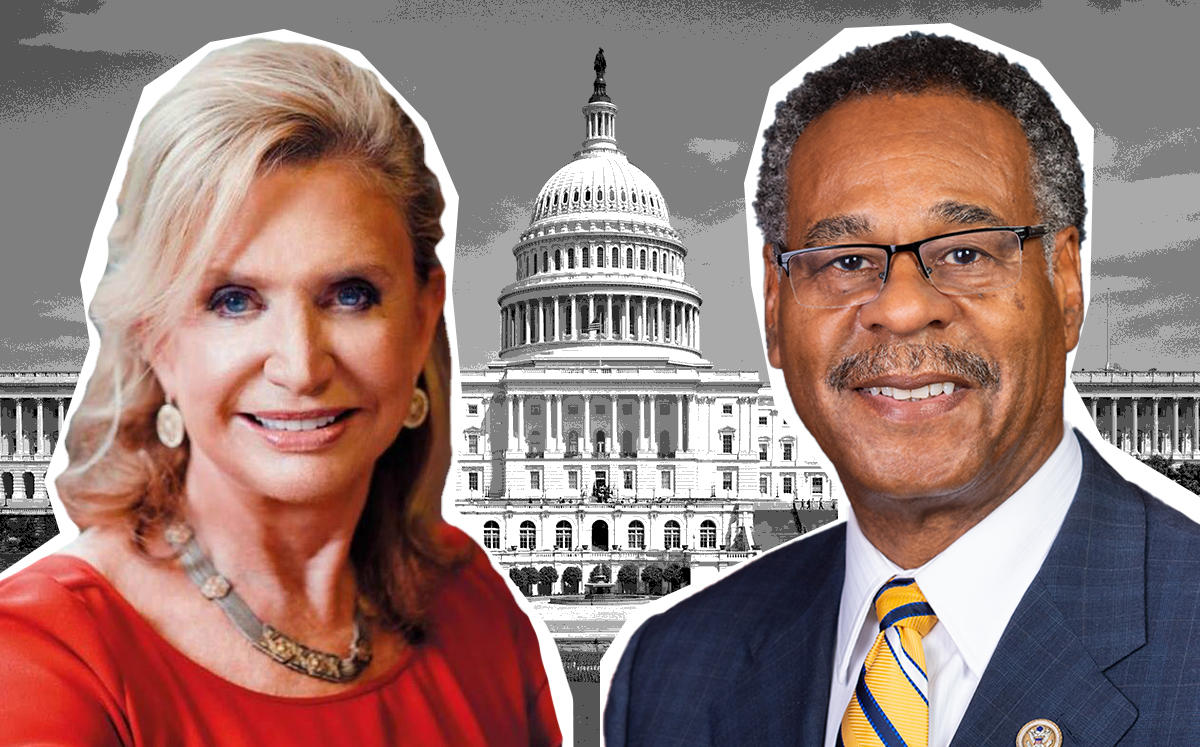

Congresswoman Carolyn Maloney, of New York’s 12th congressional district, presented a draft of the Corporate Transparency Act of 2019 during a congressional hearing on Wednesday. Under the bill, corporations and LLCs would be required to disclose their beneficial owners to the Financial Crimes Enforcement Network, or FinCEN, which would then share that information with law enforcement and financial institutions.

“The problem that we’re trying to solve here is very simple,” said Maloney, who noted that she had been working on this bill for 10 years. “Criminals and terrorists have always used anonymous shell companies to finance their operations, because they never have to disclose who actually owns these shell companies.”

“Law enforcement tells me that whenever they’re following the money in an investigation, they always hit a dead end at an anonymous shell company,” she added.

The bill is a reintroduction of the Corporate Transparency Act of 2017, which garnered bipartisan support during the prior congressional year, but not enough to pass.

“There is a lot of contention on the need to collect this info to combat money laundering,” said Mark Hays, head of the anti-money laundering division at anti-corruption watchdog Global Witness, who attended the hearing. “I think that the amount of support we had last year persists.”

Another bone of contention was whether FinCEN was the proper agency to collect this information. Congressman French Hill of Arkansas, who also attended the hearing, has proposed a bill that would designate the Internal Revenue Service be the point of collection instead. While Hill argues that this would be a more efficient way of collecting that information, Maloney countered that IRS information would be difficult for law enforcement to access.

“As an FBI agent, I wouldn’t have access to that information,” said financial crimes expert Dennis Lormel, a witness at the hearing. “I would have to have a court order to get that information, especially tax information.”

Most obviously non-shell companies would be exempt from these additional disclosure requirements. Exempt corporations include banks, publicly traded companies, insurance companies and non-profits, as well as any company that employs more than 20 full-time employees in the U.S., has a physical office in the U.S., and generates more than $5 million in gross receipts annually.

Congresswoman Maloney noted that this legislation is of particular importance to New York City, both as a prime target of terrorist attacks on the one hand, and a favored place to stash dirty money on the other.

“You can just ride through my district at night, the East Side of Manhattan, and you’ll pass complete buildings where there are no lights on,” Maloney said. “They’re bank accounts, and they [law enforcement] simply want to know who owns that bank account for national security.”

Two other bills were considered during the hearing. One would authorize the Secretary of the Treasury to pay monetary rewards to people who assisted in investigations of foreign government corruption, and the other included a laundry list of proposals to modernize and close loopholes in existing anti-money laundering legislation.’

There have been other efforts to combat the use of LLCs. In November, the Treasury Department sharpened its disclosure rules, requiring that title companies provide the identity of LLC buyers who spend $300,000 or more on a real estate purchase in 12 major metro areas including New York City, Miami, Los Angeles, Chicago, San Francisco and Boston. It was a dramatic expansion of the previous Geographic Targeting Order, which had lower thresholds for cash deals in New York City, Los Angeles, San Francisco, San Diego, Miami-Dade, Broward and Palm Beach Counties, among other cities