Lone Star Funds sells 7-property portfolio for nearly $500M

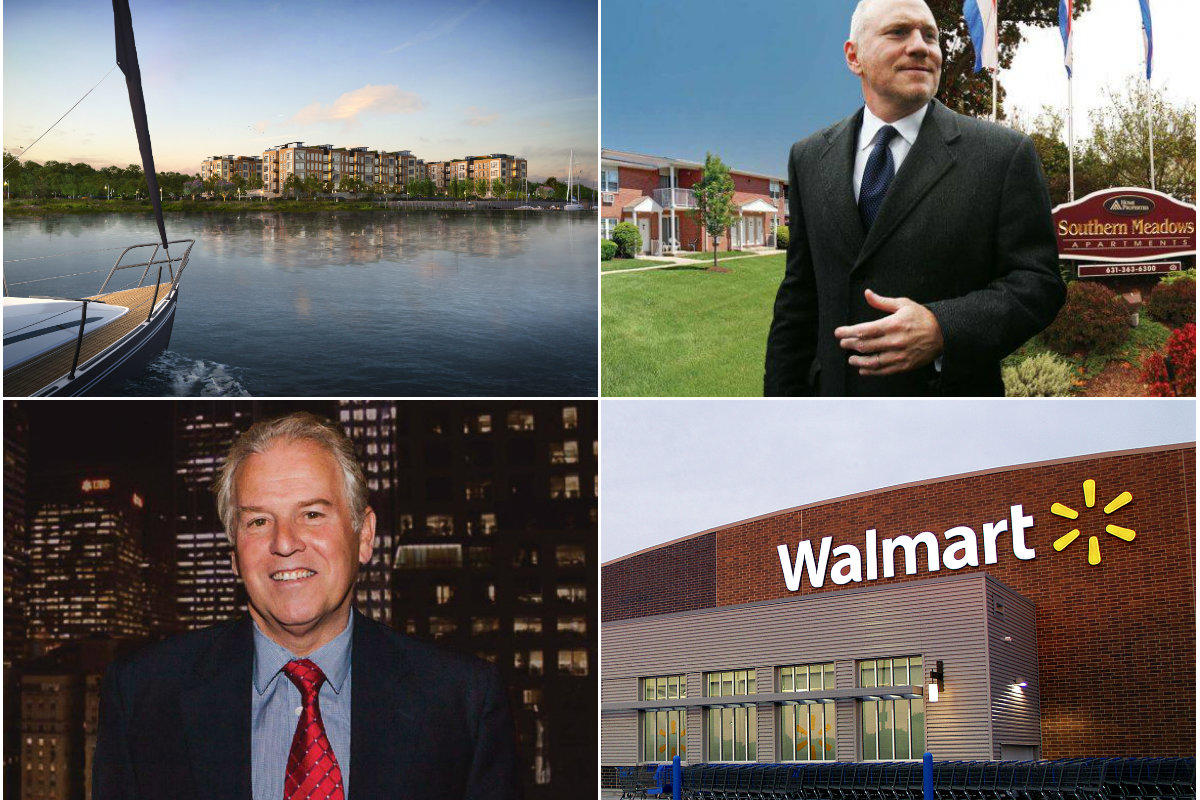

Dallas-based private equity firm Lone Star Funds sold a seven-property portfolio with 1,496 units on Long Island to Melville-based Fairfield Properties and Chevy Chase, Maryland-based real estate investor FCP for $472.5 million, The Real Deal reported. The deal came a little more than a week after Lone Star sold a $1.1 billion portfolio of garden apartments in Maryland and Virginia to the Kushner Companies, a firm founded by Charles Kushner, the father of President Donald Trump’s son-in-law, Jared Kushner. Fairfield’s managing partners Gary and Michael Broxmeyer plan to refurbish common areas and upgrade apartments throughout the portfolio, whose properties were built between the 1950s and 1970s. Its assets in Nassau County include 242 units in Westbury’s Westwood Village, 122 units between Cambridge and Yorkshire villages in Levittown and 80 units in East Meadow’s Heritage Square. In Suffolk County, the portfolio has 542 units in Bayport’s Southern Meadows, 368 units at the Lake Grove Apartments in Lake Grove and 232 units in Bay Shore’s Mid-Island Apartments. FCP, formerly known as Federal Capital Partners, contributed a $100 million preferred equity investment to the deal, which is the company’s first Long Island investment. Lone Star got the portfolio via its $7.6 billion acquisition of real estate investment trust Home Properties in 2015. CBRE Group’s Jeffrey Dune, Gene Pride, Eric Apfel and Alexander Virtue marketed the Long Island properties on behalf of Lone Star. [TRD]

Long Island developer, attorney John Damianos dies at 67

John Damianos, an attorney and principal at Smithtown-based Damianos Realty Group, died suddenly on Feb. 25 at his home in Old Field, Long Island Business News reported. He was 67. Damianos served as a manager of property management and legal counsel for his third-generation, family-run firm, which Newsday noted was founded by his father, the late Dr. Xenophon Damianos, in 1968. John Damianos was raised in Stony Brook and joined the family business in the 1980s, directing acquisitions, leasing, operations and real estate transactions. His obituary said Damianos was also a board member of the Long Island Building Owners-Managers Association and the Real Estate Institute and was a recipient of the ABLI Developer of the Year Award. “John Damianos was a wonderful friendly man,” friend Marie Zere, a principal at Ronkonkoma-based Zere Real Estate Services, told LIBN. “He was always the bright light in the room. His love of gardening made all of the Damianos Realty properties outstanding and during the holiday season he would decorate all of their buildings inside and out, making the Town of Smithtown a landmark to drive through.” Erwin Staller, another longtime Long Island developer, died in early February at 97. [LIBN]

RXR Realty’s The Beacon tops out in Glen Cove

The Beacon at Garvies Point, a $1 billion waterfront development from RXR Realty in Glen Cove, is one step closer to opening its doors, having recently topped out, said a spokesperson for the Uniondale-based developer. When completed by the end of this year, the Beacon will have 167 units ranging from between 900 and 2,850 square feet. The condo complex has already garnered much anticipation, with 65 apartments in contract totaling more than $72 million in sales, according to Multi-Housing News. The Beacon held a topping out ceremony on Feb. 22 with executives from RXR, Glen Cove city officials and representatives from construction manager Hunter Roberts touting the completion of its first phase. Nearly half of all Beacon units have already been sold, prompting RXR to raise prices five times to meet demand. The development will also have rooftop and courtyard terraces, balconies on nearly every unit, fitness facilities, a lounge, a game room, a movie theater and pool. The broader Garvies Point development in Glen Cove, a suburb at one time part of the so-called Gold Coast on Long Island’s North Shore, will have 75,000 square feet of commercial and retail space with amenities sprawling across 28 waterfront acres. [MHN]

Engel Burman to replace Deer Park school with senior housing

The school district in the hamlet of Deer Park voted four years ago to sell the onetime home of the defunct George Washington School to a developer, and now a deal finally looks like it may take place within the next few months, according to Newsday. The school closed more than 28 years ago. It subsequently hosted a day care center and a community center, both of which moved out by June 2015 as Deer Park prepared to sell the facility to Garden City-based developer Engel Burman. The latter plans to erect Seasons at Deer Park, a roughly $30 million housing development that will have 14 residential buildings and 200 apartments for people 55 and older. The project will also include a recreational building with a swimming pool and another building to hold school district offices. Engel Burman will build a single-family house on the same plot. The developer has secured all of the necessary approvals from the Town of Babylon, of which Deer Park is a part, to move ahead with its plans, but is still awaiting a final go-ahead from the Suffolk County Department of Health Services to remove the agency’s wastewater on the site, Engel Burman’s attorney Christopher Kent of Long Island’s Farrell Fritz told Newsday. After that final sign-off is obtained, construction should take about 18 months, the outlet reported. [Newsday]

Senior living soars on Long Island, greater NYC metro area

The Engel Burman Group is among the most active developers in the realm of senior living, as noted in a recent story from The Real Deal as part of its inaugural Tri-State issue. David Burman, a partner at the Garden City-based builder, told TRD that Engel Burman has 20 assisted living communities in New York and New Jersey and has plans for five more in the Tri-State area by 2021. Land costs could start at $60,000 to $65,000 per unit of active adult community housing, said Burman, noting that such figures are on the low end for areas like Long Island. Tariffs and construction labor costs have been adding to Engel Burman’s bottom line as the the company competes for quality construction workers and the price of materials continues to rise, Burman said. TRD reported last month on an Engel Burman senior living project in Mount Sinai, near Brookhaven in Suffolk County, which secured a $57 million construction loan from M&T Bank. [TRD]

Yaphank’s Boulevard development to get Walmart ‘SuperCenter’

Retail giant Walmart plans to open a “SuperCenter” — a large store containing a supermarket — on a 322-acre development on the onetime Parr Meadows horse racing track in Yaphank, Newsday reported. Dubbed the Boulevard, the development spearheaded by Yonkers-based AVR Realty will also have luxury homes, an assisted-living facility and a hotel. Rose-Breslin Associates, the property’s owner, has already secured economic incentives for the project and now plans to submit a site plan for the 292,568-square-foot retail component to the development for which Walmart will be the anchor tenant. The 197,000-square-foot Walmart would be open 24 hours a day and have online grocery pickup, a pharmacy and an auto care center. Walmart only has 4.94 percent of the grocery market share on Long Island, according to Newsday, lagging behind local leader Stop & Shop, which has 51 stores and 21.02 percent of the market. (Newsday noted those numbers were even before Stop & Shop bought Bethpage-based King Kullen in January.) Walmart, however, is in the process of increasing the size of its Farmingdale location by 40 percent, to 219,450 square feet. That project will begin in the spring. As for the Boulevard, which has its roots in a decades-old project nicknamed “Willy World” proposed by Garden City-based developer Wilbur Breslin, it began construction in 2015. When finished, the development will have 935 apartments, condos and townhouses; a 118-bed assisted living facility called Chelsea Senior Living; and a 146-room Home2 Suites by Hilton. [Newsday]