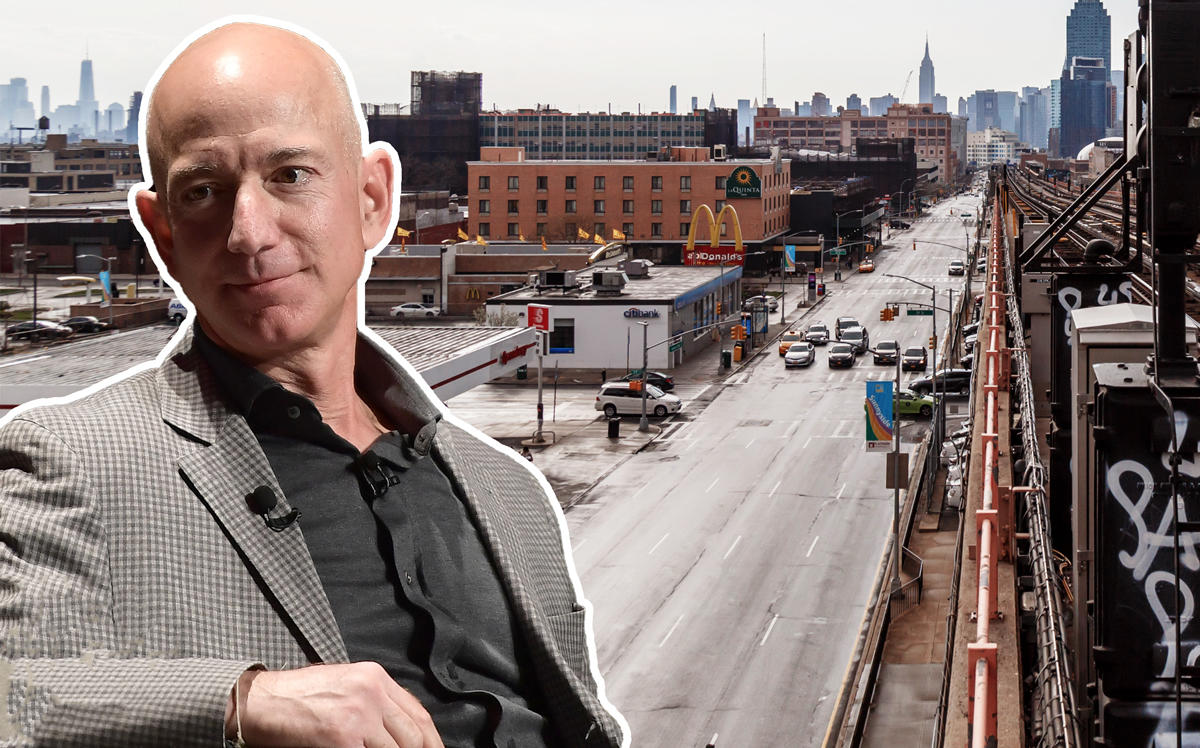

Amazon won’t be taking advantage of the Opportunity Zone tax break in Long Island City.

The tech giant confirmed it won’t pursue the incentives for its planned campus in the Queens neighborhood, Bloomberg reported.

“We will not be using the Opportunity Zone on this project,” Holly Sullivan, head of economic development at Amazon, told the City Council in a Wednesday hearing.

The area in LIC where Amazon is planning its offices was designated as an Opportunity Zone last year. Under the program, investors can defer federal taxes on capital gains until Dec. 31, 2026, reduce that tax payment by as much as 15 percent and pay no taxes on possible profits from an opportunity fund if they hold onto the investment for 10 years. The initiative is part of the 2017 tax overhaul.

Amazon didn’t comment on whether others attached to the project, such as outside investors or future development partners, would seek to use the tax incentive, the report said.

As part of the bidding process the state’s Empire State Development and the city’s Economic Development Corporation offered up to $3 billion in tax breaks and a dozen sites in the state, including several in the city, according to previous reports.

Amazon has said it’s in no rush to add workers in LIC. The company expects to have 700 employees in the area next year and hit 25,000 by 2028. The firm said it will remodel its temporary offices before workers can move in, and it could take two years to break ground on the New York campus. [Bloomberg] — Meenal Vamburkar