New York is always evolving. And this year, Brooklyn saw a slew of conversion projects that are reshaping its neighborhoods — and topping its sellout list.

The borough’s top 10 condo priciest filings accepted by the New York State Attorney General’s office in 2018 totaled $2.43 billion. Most of the projects were in areas within close proximity to Manhattan — particularly, Williamsburg and Dumbo. And that’s caused friction with the respective communities, with two of the priciest developments on the list finding themselves the center of controversy.

There was also a marked gap between the most valuable condo filings. The most valuable sellout property at Tishman Speyer’s 11 Hoyt Street, was worth double the amount of the bottom six combined.

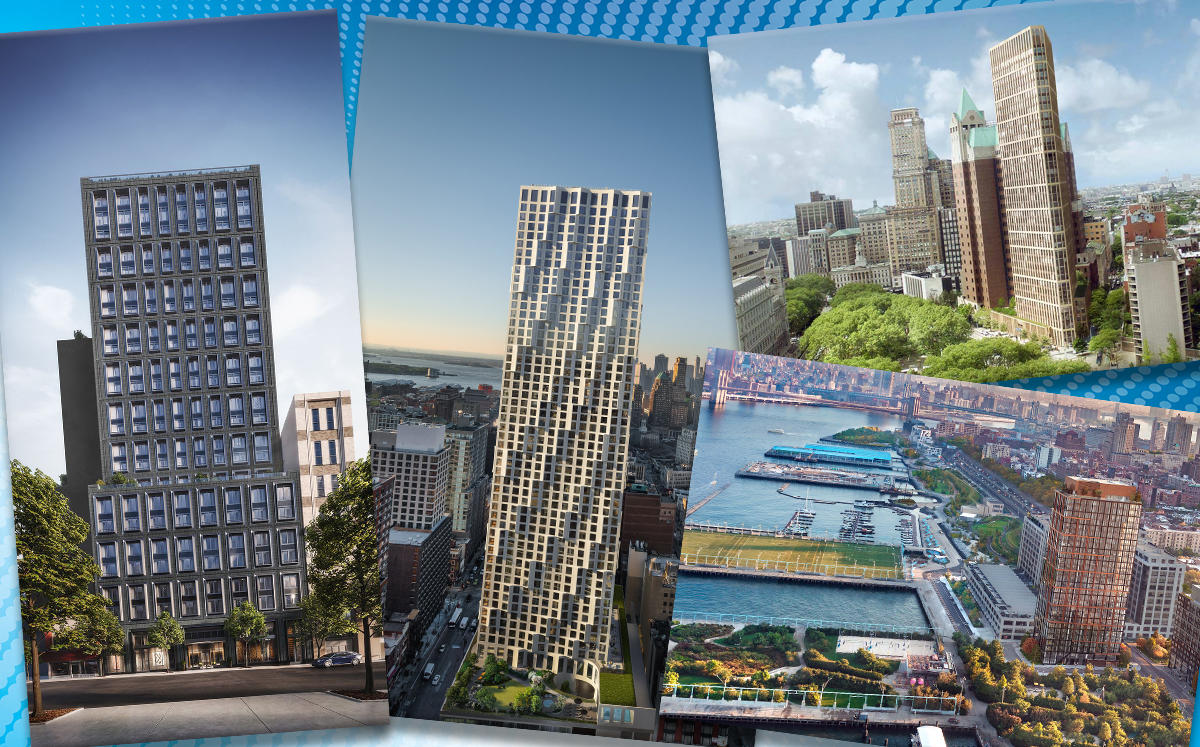

1. 11 Hoyt Street, Tishman Speyer | $837.9 million

Leading the rankings by more than $300 million is Tishman Speyer’s 481-unit project. The development, which is being built atop a Macy’s parking garage, will be finished in 2020. Apartments are being marketed by Corcoran Sunshine, with studios starting at $600,000 and four bedrooms up to $3.4 million.

It was designed by Jeanne Gang, of Chicago-based Studio Gang Architects, and has scalloped exterior made of cast concrete and glass. Residents will be able to access 27,000-square-foot private car park, and a health center with a squash court, sauna and a 75-foot saltwater pool.

2. Quay Tower at 50 Bridge Park Drive, RAL Development | $509.6 million

As one of RAL Development’s two towers rising above Brooklyn Bridge Park, and a sign of Dumbo’s transformation, the project issued the borough’s second highest sellout filing accepted this year. At 28 stories, the tower will have 126 units across 274,550 square feet, at an average of 2,178 square feet per unit.

Robert Levine’s RAL Development, in partnership with Oliver’s Realty Group, were tapped by the Brooklyn Bridge Park Corporation to develop the site, which includes 15 Bridge Park Drive, a 16-story building with 140 residential units. ODA Architecture designed the pair of buildings, which overlook Pier 6.

The project has attracted criticism from community groups, which protested the development in 2016. The same year, the state’s Empire State Development Corporation, pulled its support for the project after learning RAL made a $10,000 contribution to Campaign for One New York, Mayor Bill de Blasio’s fundraising arm.

RAL was also behind the conversion of the former Jehovah’s Witness warehouse at 360 Furman Street, which became a residential condominium known as One Brooklyn Bridge Park.

3. One Clinton at 280 Cadman Plaza West, Hudson Companies | $477.7 million

Above what was previously the Brooklyn Heights Library, Hudson Companies is building a 134-unit tower, rising 36 stories, which has drawn the ire of some community groups.

The City Council allowed the developer to buy the site for $52 million in 2015. It is funding the construction with a $280 million loan from Starwood Property Trust and Related Fund Management. While a price range for its units is not totally clear, they will sell for an average $3.6 million each. The project will include a new library and a lab for local public school students.

Community groups opposed the demolition of the library and protested the developer’s refusal to agree to use union-only workers.

4. The Brooklyn Grove at 10 Nevins Street; Adam America, Slate, China Vanke | $197 million

Downtown Brooklyn saw several towers with ambitious sellouts this year. And Adam America Real Estate, China Vanke’s U.S. arm and Slate Property Group, are building a 183-unit condo project to the neighborhood. The partners secured $104 million in construction financing for their 27-story tower at 10 Nevins Street in January from Bank of the Ozarks (now Bank OZK) and iStar Financial.

The trio purchased the property in 2015 for $48 million from Israel Neiman and a number of investors tied to Colibri Group, a movie-prop jeweler.

Two of the developers, Adam America and Vanke US previously teamed up on another ambitious project, a Long Island City tower with 182 units at 22-12 Jackson Avenue. With a projected sellout of $225 million, it was the most valuable Queens new condo filing of 2017. Adam America had also filed a condo offering plan in December for a 63-unit condo in Boerum Hill.

5. 5 River Park at 347 Henry Street, Fortis Property Group | $78.9 million

At the former Long Island College Hospital, developers Jonathan Landau and Joel Kestenbaum of Fortis Property Group, are redeveloping the Cobble Hill site into a residential condominium.

The firm initially put five of the project’s 25 units on sale to test the market in 2017, in a joint marketing effort with its other buildings at 91 Pacific Street and 350 Hicks Street.

Fortis purchased the buildings in 2015 and initially considered including affordable housing, if it could secure permits to increase the tower’s height. But it ultimately abandoned those plans and proceeded with an as-of-right market project.

6. The Cobble Hill House at 78 Amity Street, Vega Management | $75.3 million

Cobble Hill was a hotbed for sellouts in between $70 million and $80 million, and this new development is being built by locals, Vega Management.

There are 27 apartments, including five penthouses with private rooftop terraces. Three-bedroom units range from $2 million to $3 million, and the one-bedroom units start at $725,000. The site includes an underground parking, a rooftop terrace and a fitness center.

As of November, 22 percent of units were in contract for sale, according to filing documents.

7. 12-34 Crown Street, Pinnacle Group | $74.9 million

One of the city’s largest landlords, Joel Wiener’s Pinnacle Group, did what the firm does best: multifamily conversions. It acquired the Crown Heights rental building at 12-34 Crown Street in 2014 as part of a portfolio sale and plans to convert the 85-unit rent-stabilized units into condos.

At a $74.8 million sellout, the unit sale average is below $1 million — some are valued as low as $310,000, according to StreetEasy. The building, which spans 95,000 square feet, is a stone’s throw from Prospect Park and the Brooklyn Botanic Garden.

Rent-stabilized properties account for almost all — or 99 percent — of Pinnacle’s portfolio.

8. 67 Livingston Street, Silverback Development | $68.6 million

Sandwiched on a narrow block, the site is set to undergo a transformation from its humble origins as a home for student artists. Josh Schuster’s Silverback Development is converting the former Art Institute of New York City dorm to 23 units across 29 floors, consisting predominantly of two- to three-bedroom apartments priced between $2 million to $3 million.

In partnership with the family office of Helmsley Spear’s Mark Neuman, Silverback purchased the 50,000-square-foot property for $30 million from Glory Capital in 2016.

It’s the Great Neck-based firm’s first development in Brooklyn and second New York City project. The first is a 13-story condominium building on Second Avenue in Gramercy Park. Silverback told TRD last year that it had $1.5 billion of projects in the pipeline.

9. 856 Washington Avenue; Valyrian Capital, Daten Group | $58.4 million

At the site of the former Green Point Savings Bank in Prospect Heights, Valyrian Capital and the Daten Group are developing a 14-story condominium that will consist of 26 residential condos across 50,000 square feet.

Initially purchased by Slate Property Group in 2015 for for $6.5 million, the firm filed plans for a 28 story structure, but exited the project, which was overtaken by its current developers.

10. The Parlour at 243 4th Avenue, Brodmore Management | $54.6 million

Brodmore Management’s new development condo slipped into the top 10 sellouts this year with a bid to sell 19 apartments. Dubbed “Parlour,” the 12-story development shot up above a previous pair of auto body shops in Park Slope after it was announced in 2015.

Designed by INC Architecture & Design, apartments start at $1.6 million, and most units will take up half floors, coming in two- to five-bedroom suites.

Brodmore took over the development from Haysha Deitsch, a landlord known for his troubles at Prospect Park Residence, a retirement home where he reached a $3.35 million settlement with five residents at the building over an eviction dispute.