Manhattan’s median rents took a hit as the market share of leases with concessions continued its rising streak. And the state of the market — rampant with incentives and listing discounts — is unlikely to change anytime soon.

“I don’t see how you could say otherwise,” said Jonathan Miller, CEO of appraisal firm Miller Samuel and author of Douglas Elliman’s rental report. “It’s more of the same.”

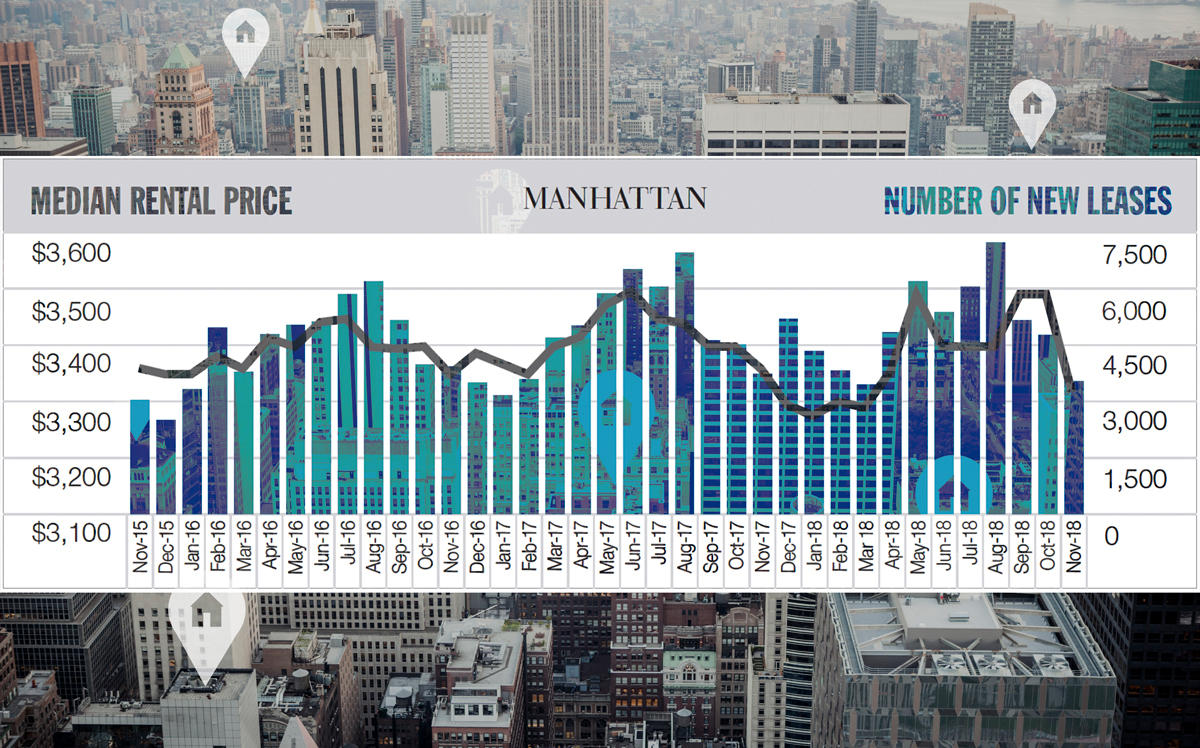

Median net effective rent fell 1.9 percent year over year to $3,221. At the same time, the share of new leases with concessions swelled to 42.2 percent from 29.6 percent a year earlier. November marked the 42nd consecutive month of year-over-year increases in incentives.

Concessions have been even more prevalent in new development. The share of 67.4 percent indicates the market is absorbing the higher-end inventory more slowly, Miller said. Because the price points of new development projects skew toward the higher end, “the product being built doesn’t quite match the demand.”

In a separate report, Citi Habitats noted that the vacancy rate, which was 1.55 percent in November, increased for the third straight month. The market had the most available inventory in the month since March. Gary Malin, the brokerage’s president, pointed to the issue of affordability. While rents have declined, prices remain high relative to most tenants’ ability to pay, he said.

“People are pressed financially in so many different ways,” he said. “ It’s really difficult to push rents above where they are now.”