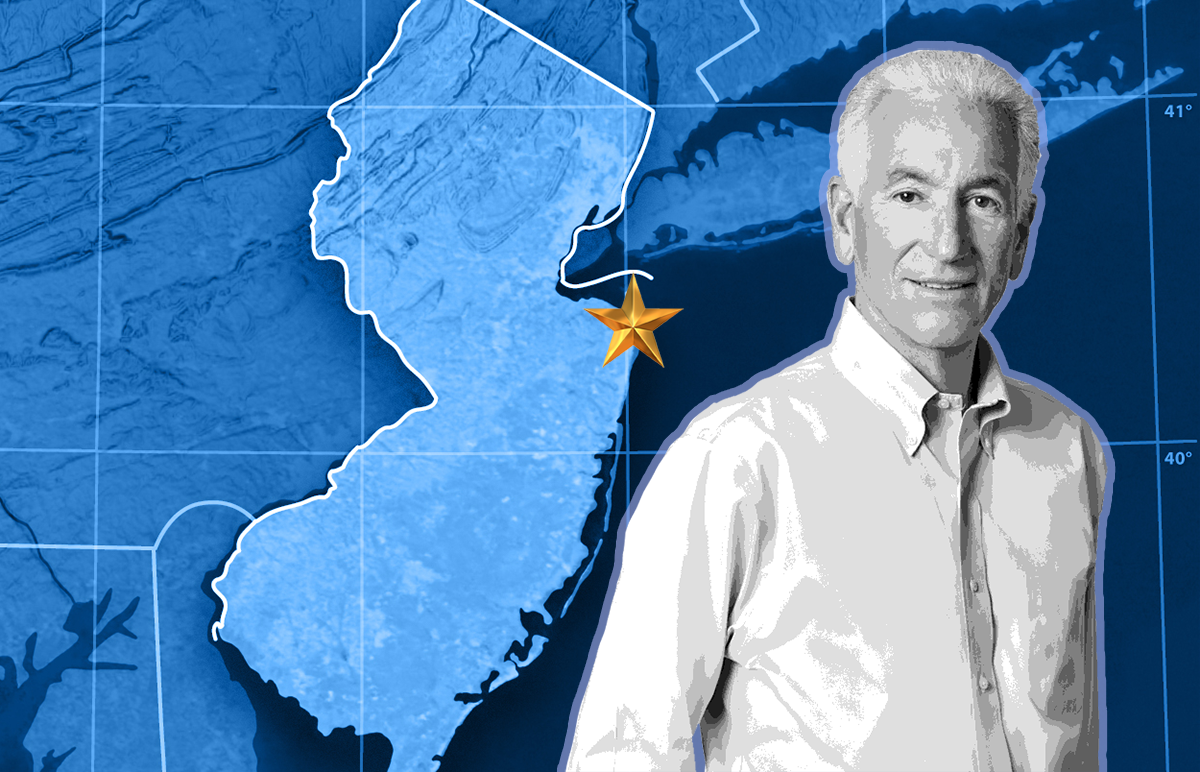

Kushner Companies will stand to gain significant tax benefits if it chooses to develop a piece of New Jersey beachfront located in an Opportunity Zone, a key feature of the Trump administration’s tax overhaul last year.

The company has spent $13 million buying properties in Long Branch, New Jersey, since the Opportunity Zones legislation was enacted, according to Bloomberg. The company reportedly bought the Bungalow Hotel for $9 million in May and purchased two single-family homes for $4 million in August. Each site qualifies for the Opportunity Zone benefits, as they were purchased after the program was implemented.

The Opportunity Zone program has sent the real estate industry scrambling for projects and increased capital raising efforts since it was enacted. Since September, a handful of major firms have announced plans for funds at $100 million or more, including Skybridge Capital, RXR Realty, Normandy Real Estate Partners, Youngwoo & Associates, Toby Moskovits and Somerset Partners.

Under the scheme, developers are eligible to benefit from tax deferments and tax breaks for investing in projects located in designated low-income neighborhoods in the U.S. Treasury Secretary Steven Mnuchin has said the program will generate $100 billion in capital investment across the country.

It has been previously reported that Kushner-owned properties are also located in at least 10 Opportunity Zones. The company did not respond to a request for comment before deadline. It has repeatedly said the Jared Kushner has held no role in the company since becoming White House advisor.

Meanwhile, Cadre, the real estate crowdfunding platform partially owned by Jared and Josh Kushner, announced last week that it will target investors seeking to deploy funds into “under-served markets throughout the U.S,” according to a tweet by the company’s CEO Ryan Williams. [Bloomberg] —David Jeans