Clipper Equity and the Chetrit Group landed a $98.9 million loan for the Parkside Brooklyn residential complex in Prospect Park South.

The new debt replaces a $38 million TD Bank mortgage issued last March. The lender for the new loan is Virginia firm Greystone Servicing Corporation, which provided a $21.4 million gap mortgage.

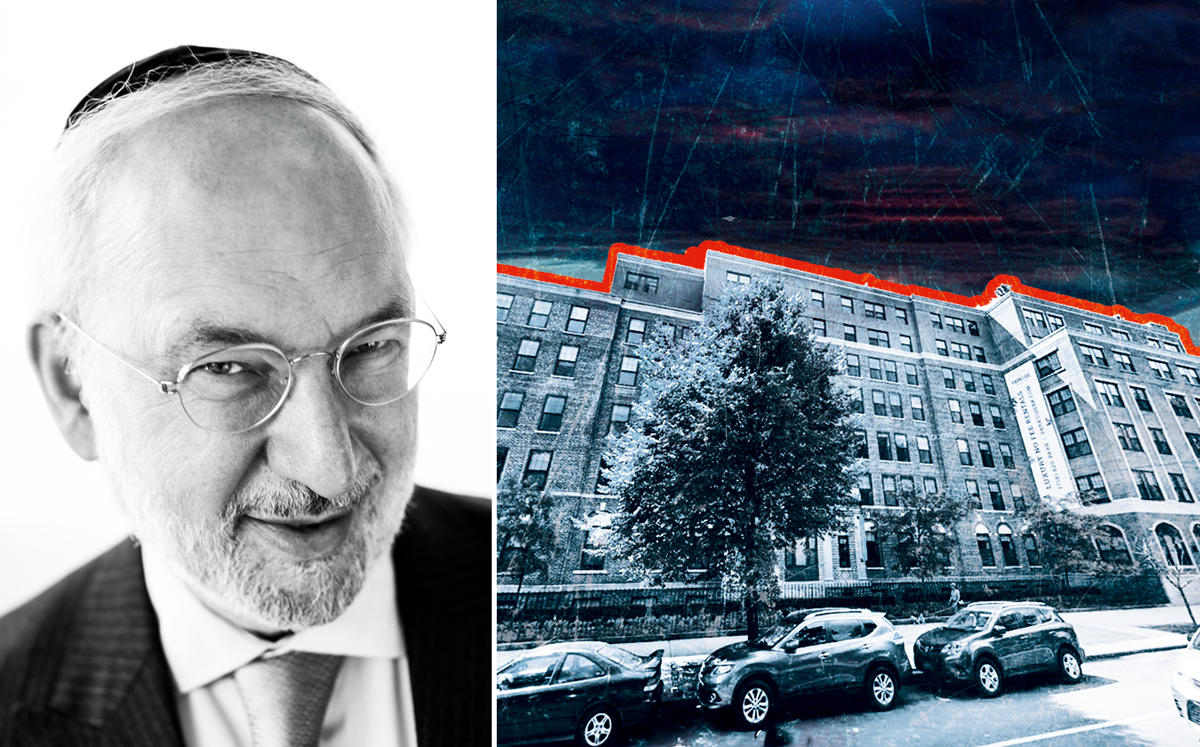

The property, which features two buildings at 123 and 125 Parkside Avenue, sits mid-block between Parade and St. Paul Place across from Prospect Park. The building at 123 Parkside spans 166,600 square feet. Previously known as 123 on the Park, it stands seven stories tall and contains 131 apartments, according to city data. Meanwhile, the 125 Park building, which has an alternate address of 45 Woodruff Avenue, is an eight-story building that spans 169,400 square feet. it contains 131 residential units, records show.

The luxury rental complex was built on the former location of the Caledonian Hospital. Since opening in 2014, the 123 Parkside property has been a rich source of ghost stories in the area. A 2015 New Yorker article outlined accounts of motion sensor lights turning on in unoccupied hallways and doors opening and closing at random. According to a report from the New York Post, the turnover for doormen was high on account of the building “being a messed up place to work.” Tenants previously considered pushing for a rent break on account of the ghosts.

Clipper Equity, a publicly traded REIT that specializes in New York rental properties, and the Chetrit Group, also jointly own Gramercy Square, a luxury residential property built at the former site of the Cabrini Medical Center. Clipper did not immediately respond to requests for comment. Earlier this month, The Real Deal broke down its deregulation strategy at its various holdings in Manhattan and Brooklyn.