French bank Natixis securitized its $600 million mortgage for Maefield Development’s hotel and retail project at 20 Times Square, according to records filed with the Securities and Exchange Commission on Tuesday.

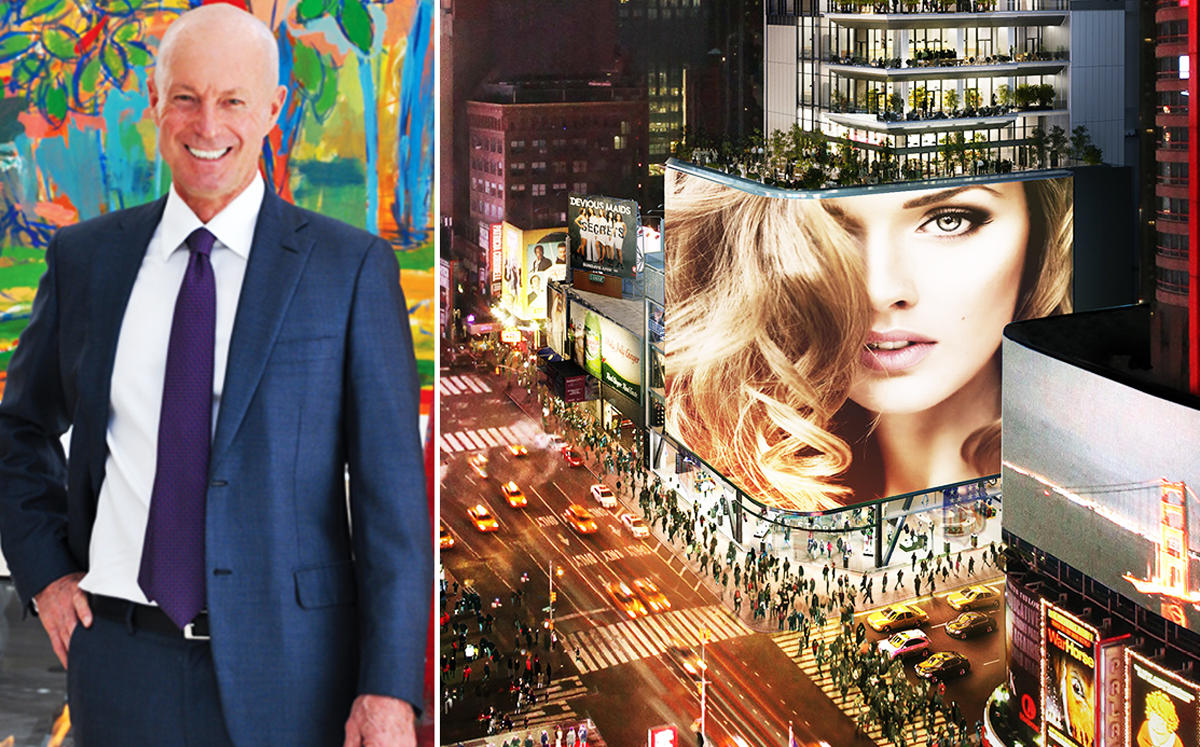

Natixis and its partners originated a $2 billion loan to finance Maefield’s acquisition of the property, which is expected to be the future site of 39-story building with a 452-key Marriott Edition hotel. Last February, Mark Siffin-led Maefield bought out its partners, a consortium composed of Steve Witkoff, Winthrop Realty Trust, New Valley and Carlton Group, in a deal that valued the property at $1.53 billion.

The debt, which was securitized into UBS Commercial Mortgage Trust 2018-C12, consists of 11 notes. The loan was folded into a pool of 65 fixed-rate mortgages against 75 assets. The total loan is $750 million.

The Witkoff-led investor group bought the site for $430 million in 2012. Siffin’s involvement in the project dates back to 2010, when he raised funds to buy the 11-story building at the site.

The 20 Times Square property, which has the address of 701 Seventh Avenue, will also contain 76,000 square feet of retail space. The National Football League and Hershey’s have already opened stores at the location. The property’s façade also features a 17,000-square-foot LED screen, which is the largest in Times Square. The hotel is expected to open later in the spring.