Toll Brothers saw its best quarter ever for contract value — but the luxury homebuilder’s profits missed expectations, in part due to higher labor and material costs.

Net income for the quarter was $111.8 million, or 72 cents a share, the company said in a statement Tuesday. That’s down from $124.6 million a year ago.

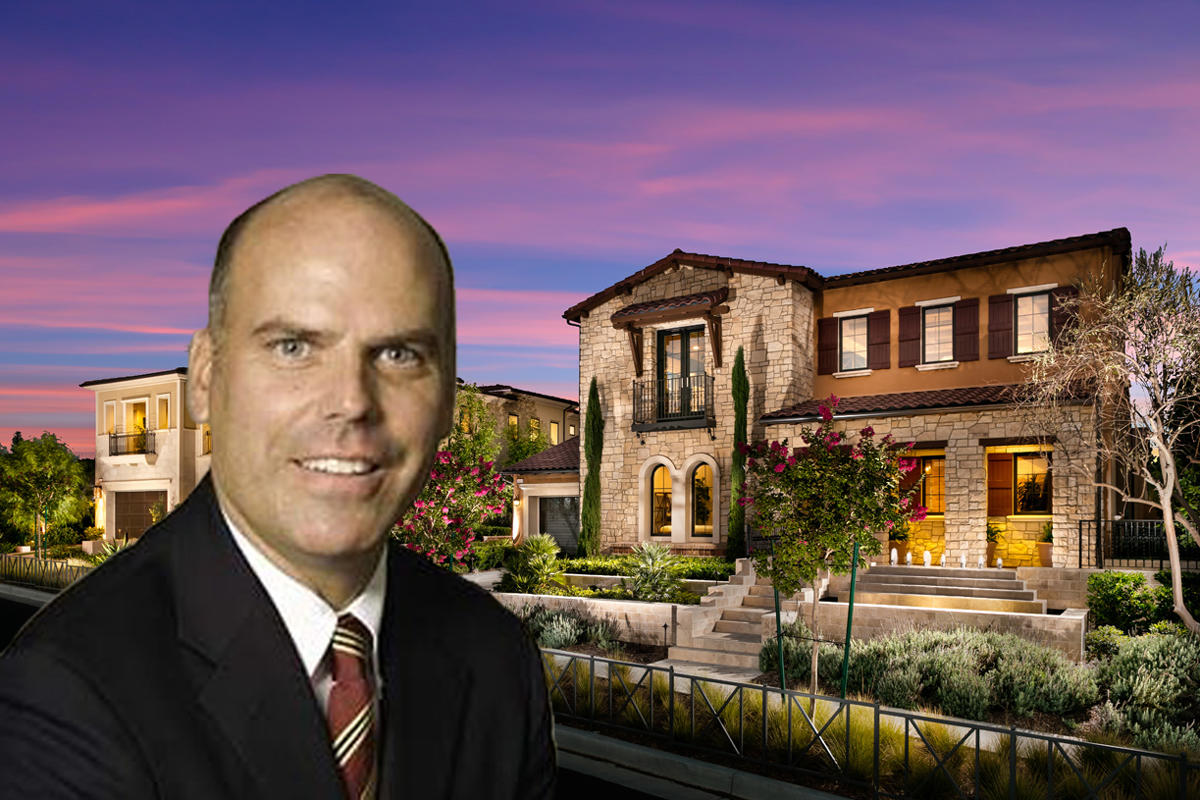

“All product types and regions are expected to show margin growth” in the next two quarters, CFO Martin Connor said in an earnings call Tuesday. Adjusted gross margin fell below guidance in part because of cost pressure with labor and material costs, he said. Costs rose 20.5 percent to $1.29 billion in the quarter.

Toll Brothers’ City Living division, which primarily focuses on the New York City metro area, sold 29 units for a total of $89.6 million during the quarter ($3 million a unit).

Meanwhile, net contract value rose 18 percent to $2.38 billion, the highest quarter ever. Contract value for the City Living division rose 19 percent, and California in particular saw a 52 percent jump.

The City Living division inked 65 contracts valued at $97.1 million in the second quarter of FY 2018, compared with 43 contracts signed in the second quarter of 2017, with a value of $81.8 million. The average contract price was $1.49 million, down from $1.9 million a year earlier.

As California becomes a larger portion of Toll Brothers’ business, the overall region saw 564 contracts in the quarter, up from 388 in the second quarter of 2017. Contract value grew to $901.2 million from $594.1 million.

California and the Western region also produced nearly 50 percent of total revenues in the second quarter, the homebuilder said. Overall revenues were $1.6 billion, the highest second quarter ever. Toll Brothers is expecting its $6.36 billion backlog to boost revenue growth this year.

“It does not appear that the rise in mortgage rates has had a negative impact on our business,” CEO Douglas Yearley said on the earnings call.

For the full year, Toll Brothers expects to deliver 8,000 to 8,500 units with an average price between $830,000 and $860,000. The company said it has been “shifting a bit to fill in the lower price point” over the past couple years. The strategy is a reflection of more millennials buying homes as well as the company’s geographic diversity, executives said on the call. The shifts are not driven by rising mortgage rates, the company said.

Toll Brothers’ City Living is aiming to sell $323.5 million worth of apartments at 77 Charlton Street, its condo project in Manhattan’s Hudson Square. The average price per unit is just over $2 million, in line with the company’s shift away from ultra-luxury in favor of mere luxury in recent years.