The stadium’s prospects are not looking good for this season and beyond, and, by extension, perhaps not for the New York Mets either.

S&P Global predicts the stadium will make very little revenue while operating costs rise, according to Forbes. The report also forecasts costs will increase by 2 percent annually until 2035.

Unaudited documents obtained by Forbes, however, show revenues have been rising since 2015 when The Mets made it to the World Series: Citi Field’s overall revenue in 2016 was more than $167 million, 10 percent more than the year before.

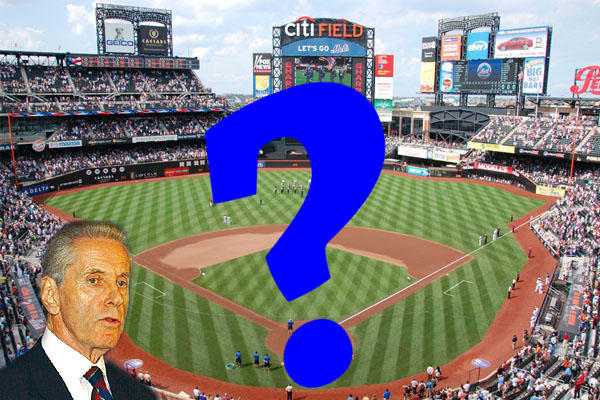

The stadium is operated by a company owned by Fred Wilpon and Saul Katz, who also own the team and founded Sterling Equities.

The S&P report comes as shares for the team are being sold for the first time since 2012, when Wilpon and Katz were in the midst of a lawsuit issued by the representative of Bernie Madoff’s victims. Cash from the 2012 sale was used to pay operating expenses, loans and lower debt, according to Bloomberg. [Forbes] — Erin Hudson