Concessions remain high and rents on residential apartments keep sliding in Manhattan, leading to the largest year-over-year decline in net effective rent in the last six-and-a-half years.

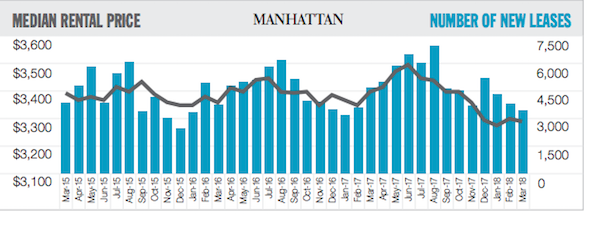

Median net effective rent dropped 3.8 percent to $3,168 in March, according to Douglas Elliman’s latest rental report. Though lower than February, the share of new rental transactions with concessions hit 41.7 percent — the third highest level seen in seven-and-a-half years, the report states.

“On one hand, it’s more of the same but weaker,” said Jonathan Miller, CEO of appraisal firm Miller Samuel and the author of the Elliman report. “I suspect that we’re going to be having this conversation for a very long time.”

Miller noted that median face rent — calculated without accounting for concessions — fell 3.2 percent year-over-year to $3,290. That metric is particularly telling, given the fact that concessions remain so high. While concessions are keeping the vacancy rate — which fell to 2.05 percent from February’s 2.29 percent — at bay, they aren’t keeping rents from sliding, he said.

A separate report by Citi Habitats notes that the low vacancy rate might have been caused by a change in season (the market usually picks up pace in spring) or by buyers who are opting to rent while awaiting the impact of the new federal tax law.

“Signing a lease means less commitment,” Gary Malin, president of Citi Habitats, said in a statement. “Whatever their motivation for renting, tenants remain price-sensitive, so landlord incentives remain in play — especially in the luxury segment — to create a sense of value in the marketplace.”