For now, selling an apartment in Manhattan remains an out-of-sync dance between buyers and sellers.

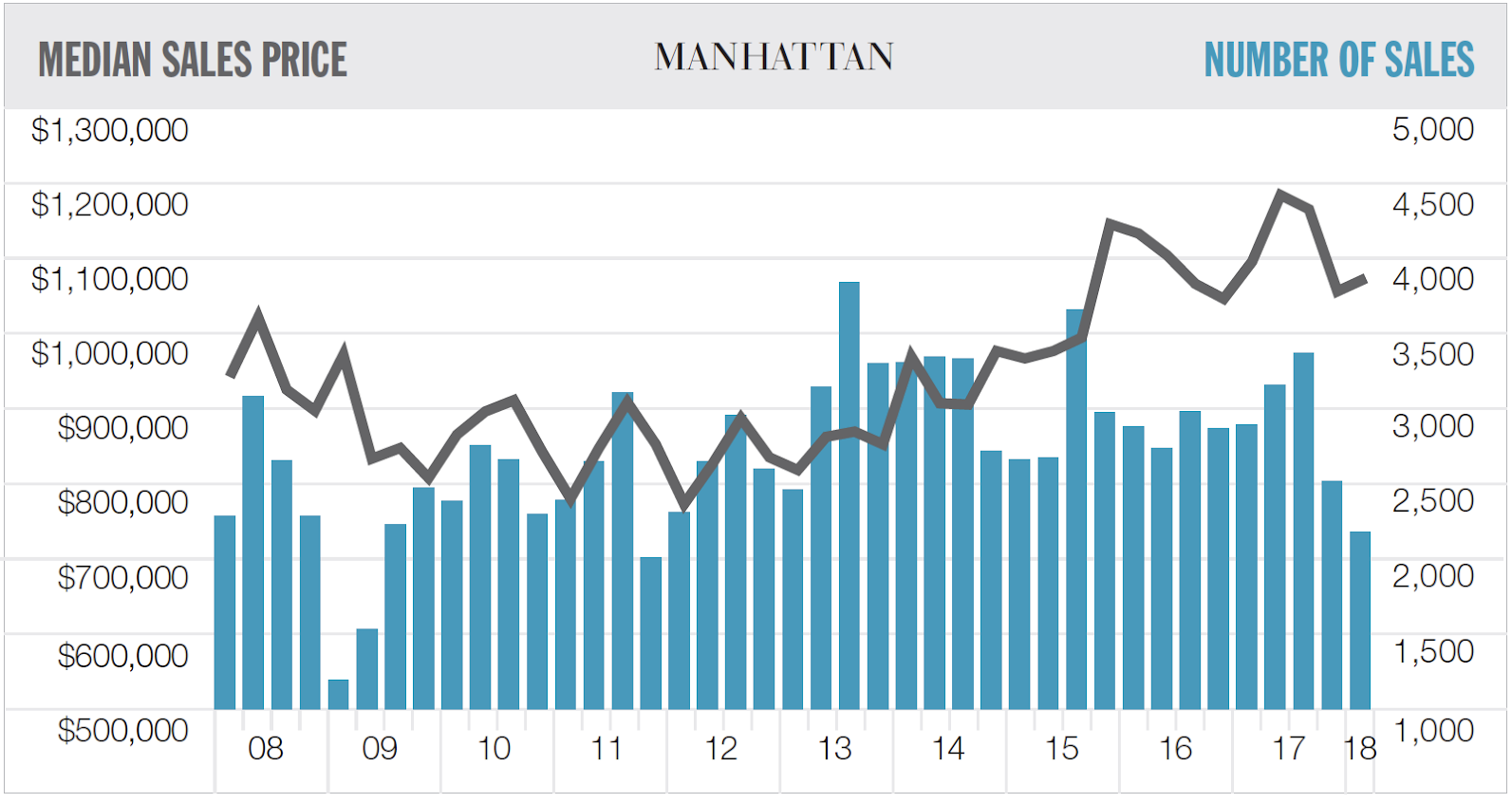

The number of closed sales in the first quarter of 2018 fell to 2,180, a 24.6 percent decrease from the same time last year, according to a new report from Douglas Elliman. The total is the lowest seen in six years and the largest annual decline in nine years, said Jonathan Miller, CEO of appraisal firm Miller Samuel and author of the report.

Part of the reason for the decline is the exhaustion of so-called “legacy contracts” — those inked based on floor plans back in 2014. Another reason is a lack of urgency among buyers and high prices. The median apartment sale price in the first quarter was $1.08 million, a 2 percent decrease year-over-year and a 1.7 percent increase from last quarter.

Steven James, CEO of Douglas Elliman’s New York brokerage and director of sales for its East Side office, noted that there’s “unease” among buyers about the new federal tax law and the rise in interest rates. He expects that as the impact of both becomes more clear and as sellers become more realistic in pricing, there will be an uptick in sales.

“We all saw that this was coming,” he said. “Buyers wanted to catch their breath, and they wanted a little more give in prices than what they were getting from sellers.”

A separate report by the Corcoran Group notes that resale co-ops saw a 2 percent increase from last year, due in large part to a 14 percent increase in inventory and a drop in price. The median sales price for these units was $820,000 — 25 percent below the median price for all sales in Manhattan.

Miller noted that only 9.4 percent of sales were the result of a bidding war, down from the 31 percent seen in the third quarter of 2015. The absorption rate rose to 8.4 months, up from last year’s 6.1 months, the report showed.

“I see 2018 as a period of price discovery between buyers and sellers, as uncertainty is a big part of the equation,” Miller said. “It’s going to take them a while to get to some equilibrium on what the value is for their properties.”