UPDATED, 3:25 p.m., Feb. 22: Clipper Realty has received a 10-year, $246 million loan from New York Community Bank for its debt on Flatbush Gardens, along with a 10-year, $360 million loan from Deutsche Bank for its debt on Tribeca House.

The company paid off mortgage loans on Flatbush Gardens worth about $168 million and loans on Tribeca House, a pair of rental buildings on Murray and Park Place, totaling $410 million, according to a press release from the company. The refinancing lowers Clipper Realty’s interest rates on both loans, provides extra liquidity, solves most of its variable rate debt and reduces its annual debt service.

Larry Kreider, CFO of Clipper Realty, said in a statement that the transactions will initially reduce Clipper’s annual debt payments by about $6.6 million.

The Flatbush Gardens loan has a 3.5 percent annual fixed interest rate, while the Tribeca House loan has a roughly 4.5 percent fixed interest rate. An Iron Hound team led by Robert Verrone and Robert Vernicek brokered the Tribeca House loan.

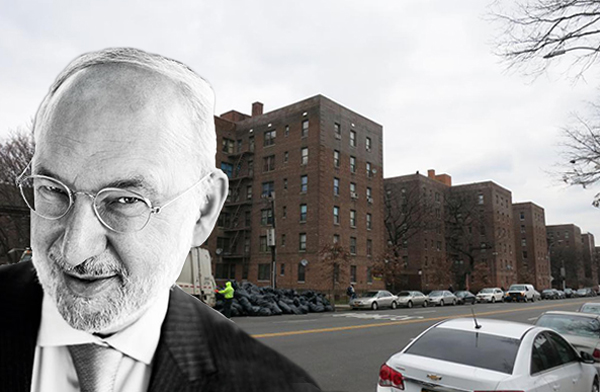

The David Bistricer-led firm, now a real estate investment trust, purchased Flatbush Gardens, a 59-building residential complex with 2,500 largely rent-stabilized apartments in central Brooklyn, in 2005 for $138.2 million through Renaissance Equity Holdings.

This story was updated to include more information on the Tribeca House loan.