New development condos were the weakest player in this year’s condo market, showing a 13 percent drop in sales volume relative to 2016 while the rest of the market remained mostly flat, according to a new report.

The average price for a Manhattan condo stood at $3.1 million in 2017, the same as the previous year, when it set a record, according to the report from CityRealty, which is based on projected numbers through the end of 2017. On the new development side, the average price came in at an average $4.7 million, down from the record $5 million in 2016.

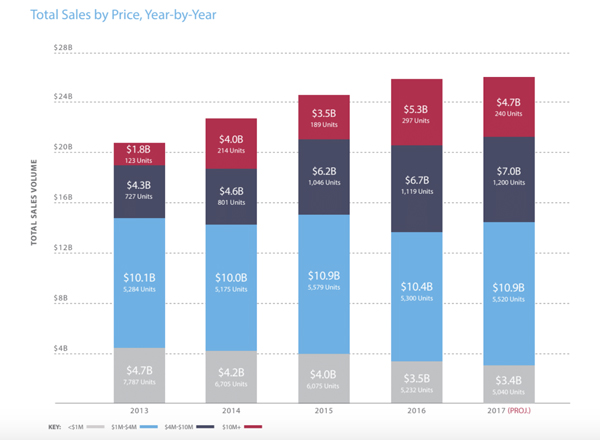

Sales volume for the residential market, including co-ops and condos, was $25.9 billion in 2017, compared with $25.8 billion in 2016. CityRealty projections peg new development sales at roughly $8.1 billion through the end of 2017, down 13 percent from the $9.3 billion in new condo sales recorded last year.

The high end of he market overall contracted, resulting in fewer sales but at higher prices. In 2017, 240 units above $10 million were responsible for $4.7 billion in sales, at an average price of $20 million. In 2016, 297 units sold for a total of $5.3 billion, at an average price of $18 million.

On the opposite end, apartments under $1 million remained relatively flat, but comprised a slightly lower share of the market than in previous years. Sales volume decreased from $3.5 billion to $3.4 billion—for 5,232 and 5,040 units respectively—but remained at 13 percent of the market, compared with 13.5 percent in 2016.

Though the residential market hasn’t seen much drama this year, taking a step back to the previous decade provides some context. The average condo price has in Manhattan has increased 90 percent since 2007 while the average new development condo nearly quadrupled in price, rising 193 percent over the decade.

Per CityRealty, 47 percent of the condo sales volume was Downtown, with 24 percent in Midtown, 14 percent on the Upper East Side, 10 percent on the Upper West Side and 5 percent in FiDi. Condo prices rose 27 percent on the Lower East Side in 2017, the highest of any neighborhood.

The year’s big winner in terms of sales volume was 56 Leonard Street, where 65 units sold for a total of $636 million, at an average of $9.8 million per unit. The most expensive condo building last year was 15 Central Park West, with six sales averaging $7,350 a square foot. The Runner Up Was 432 Park Avenue, where 15 units sold at an average of $5,626 a square foot. It had the highest average sales price of any condo building at $25.7 million.

The top closed sale as of Nov. 30, 2017 was a $65 million pad at 432 Park Avenue, according to the report.

One of the losers this year was the Trump empire, according to the report, where average prices at 11 Trump properties fell below Manhattan’s average for the first time. The biggest sufferer was Trump International, where prices fell 27 percent to $5.2 million per unit.

While the condo market was largely flat, the co-op market had a good year in 2017. The average sales price rose to $1.4 million from $1.3 million in 2016, and the median sales price increased to $838,304 from $818,250. About 6,400 co-ops are expected to close before the calendar flips to 2018, up from 6,212 in 2016.

CityRealty predicts that in 2018, the average price of a Manhattan apartment will dip slightly for the first time since the recession.