From the October issue:

“What the hell does Zillow mean?”

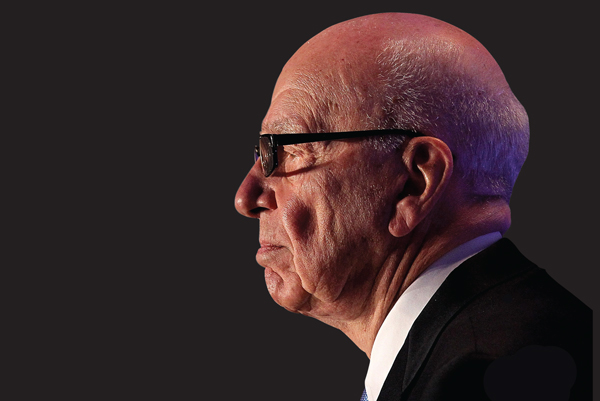

It was 2015, and the bull-headed media mogul Rupert Murdoch was speaking at a gathering of 4,000 real estate agents in Midtown Manhattan. “We know what ‘realtor’ means,” he said.

Murdoch had made a career out of big-game hunting, and this time his target was Zillow. Ever since buying StreetEasy in 2012, the $7.5 billion real estate giant had reigned over New York’s listings market.

A few months before lashing out at Zillow, Murdoch’s News Corp. shelled out nearly $1 billion to acquire Move Inc., the parent company of Zillow’s chief rival, Realtor.com. Murdoch applied his signature playbook, bringing in fresh blood to run the company and pouring millions of dollars into a flashy advertising campaign.

But it’s only in the past few months that Realtor.com has emerged as one of the most viable threats to StreetEasy.

Given how lucrative this corner of the business is — the market for agent advertising is pegged at $15 billion — it’s no wonder News Corp. has muscled its way in, not just in New York but around the globe. In the last year, Amazon and Facebook have both pounced on the real estate market, with Amazon teasing a potential agent-referral service and Facebook creating a real estate “marketplace” to post listings.

“The ad dollars that go into it are huge,” said Brad Inman, founder of real estate site Inman News. “It’s too big of an opportunity to pass up.”

“The ad dollars that go into it are huge,” said Brad Inman, founder of real estate site Inman News. “It’s too big of an opportunity to pass up.”

Murdoch has said as much himself: “We live in an age when more people than ever are going to portals like Realtor.com when they’re serious about property. There’s a lot of advertising to be had.”

Still, as national listings aggregators have rushed to launch in cities around the country, New York has proved to be relatively untouchable because it lacks a centralized Multiple Listings Service for aggregators to suck listings from.

Zillow broke into the Big Apple back in 2012 by shelling out $50 million for StreetEasy, which had launched six years earlier and cracked the New York code by scraping listings from the brokerages’ websites.

While the firms resisted StreetEasy at first, without an MLS the site was the only game in town. Firms soon saw how much traffic it drove to their websites and began feeding it listings directly.

But in the last year, as Zillow has rolled out a series of controversial programs to monetize StreetEasy, competitors, including Realtor.com, have smelled opportunity. With the brokerage community now fractured over how to deal with StreetEasy — boycott it or fork over cash to advertise on its site and pay for rental listings — the fight between aggregators to woo firms and land listings has intensified.

“If Realtor.com can gain an edge by gaining listings that StreetEasy and Zillow do not have, they’ll absolutely jump on that,” said Brian Boero, founder of 1000 Watt, a California-based direct marketing agency focused on real estate.

“Listings are the lifeblood of the real estate media business,” he added.

Though Realtor.com faces an uphill battle in New York, it’s already seeing some early traction.

During the first half of this year, it was New York’s fastest-growing online real estate site — with traffic up 12 percent year-over-year, compared to a 2 percent drop in StreetEasy traffic, according to data from media analytics company ComScore.

“They’re investing a lot of money to become New York-centric and work within our model,” said Bess Freedman, executive vice president and managing director of sales and business development at Brown Harris Stevens.

“Clearly, consumers and agents are familiar with StreetEasy — it’s become part of our language,” Freedman said. “So, I do think it’s going to be a bit of a battle. But you have to remember, agents are very upset with StreetEasy’s tactics. It could be a turning point.”

If history is any indication, Murdoch isn’t likely to back down. That’s something he made clear with his aggressive push into the cable television world with Fox News and his envelope-pushing tabloids like the New York Post.

“He invented the modern tabloid newspaper,” is how the Economist described him back in 2011.

That hard-boiled tabloid mentality is now being applied to the real estate listings game. “We’re going to make a better product,” Murdoch has said about Realtor.com. “Then when we’re satisfied we have a better product, we’ll get out and market it hard.”

It seems that time has now arrived.

Hitting the mother lode

StreetEasy’s ugly clash with New York brokers handed Realtor.com the opening it’s been waiting for.

In August, StreetEasy dealt a blow to the brokerage community when it announced that it would not accept the Real Estate Board of New York’s newly launched Residential Listings Service — a syndicated feed that all the city’s major residential firms funnel their exclusives into. Because the feed is not a true MLS, StreetEasy said accepting it could compromise the quality of listings.

But just a few days later, Realtor.com announced that it had struck a deal with REBNY to accept the feed, instantly giving it a mother lode of around 16,000 listings — a huge selling point it could tout to consumers.

“There’s no city like it, that has the same amount of influence,” News Corp. CEO Robert Thomson told The Real Deal, referring to New York during a recent phone interview.

To be the top site in the U.S., Realtor.com has to be a serious player in every major city, including New York, one of the largest advertising and real estate markets in the world.

“Having a significant profile in New York does enhance the brand building,” said Thomson, a close friend and confidante of Murdoch’s, who was managing editor of the Wall Street Journal before being tapped to head News Corp.

While the REBNY deal cemented Realtor.com’s bet on New York, rumors have been swirling for the last year that Murdoch’s company was looking to make a serious play here.

In June, it was featured on an episode of “Million Dollar Listing: New York,” when co-star Ryan Serhant hyped it to a client in a scene that took product placement to new heights.

And this summer, Realtor.com launched a flashy ad campaign featuring the wives of pro baseball players — including Yankees outfielder Matt Holliday — who’ve used the site for property searches when relocating around the country.

Realtor.com also has a larger marketing partnership with the Yankees. At a recent game against the Minnesota Twins, Realtor.com was the corporate sponsor and gave away 18,000 pairs of sunglasses. Company executives declined to say how much they’re spending on the overall sponsorship deal, but sources said that it was likely a couple hundred thousand dollars.

At another recent Yankees game, company executives sat in plush second-row seats on the third-base line and ate from a decadent buffet of prime rib and shellfish in the Legends Suite, where face-value tickets go for $800 a pop.

“New York is a really strategic market,” said Ryan O’Hara, CEO of Move. “We’ve been investing here, but it’s accelerated because of a lot of noise in the marketplace — for good reason,” he added in a thinly veiled reference to the StreetEasy fracas. “We’re trying to give agents and brokers a great alternative.”

O’Hara said Realtor.com has beefed up its presence in New York, where 20 employees now work out of News Corp.’s offices at 1211 Sixth Avenue. (That’s up from one or two local staffers pre-2014.)

The team is headed by Ninve James, a former Trulia executive and the company’s primary liaison to the brokerage community. For the last year and a half, James has met with nearly every brokerage executive in the city. The feedback from those players is what prompted Realtor.com to ink the REBNY deal, she said. In addition, the company is now also feverishly adding NYC-centric content to its site.

In August, Realtor.com launched an image-recognition Tool Called Street Peek, which lets users pan a street anywhere in the country, including in New York, with their cellphone camera and then pull up property details about the buildings.

In August, Realtor.com launched an image-recognition Tool Called Street Peek, which lets users pan a street anywhere in the country, including in New York, with their cellphone camera and then pull up property details about the buildings.

Meanwhile, the company has also hammered out deals with several New York firms — including Douglas Elliman and Halstead Property — to take their listings.

Elliman COO Scott Durkin said his firm has an “enhanced relationship” with Realtor.com that directs all buyer leads to the firm’s listing agent.

Many brokerages have already worked with Realtor.com in markets outside New York.

“The deals that we’ve closed, through leads from Realtor.com, are in the multi-million-dollar levels in Connecticut and New Jersey,” said Diane Ramirez, Halstead’s CEO and a member of Move’s broker advisory board, whose firm has been feeding listings to Realtor.com for 18 months.

Even before its RLS deal, O’Hara said Realtor.com’s investment in New York was starting to pay off. The site’s unique users grew 25 percent between January and July. The company declined to disclose the raw New York-specific numbers, but said nationally unique users have skyrocketed to 58 million from 28 million since 2014.

But Realtor.com has a long way to go — the average New Yorker looking for an apartment is still far more likely to log onto StreetEasy than Realtor.com.

“It’s a great site if you’re looking for a home in Kansas City or Cincinnati. But for Manhattan or Brooklyn, it’s not really designed for the market,” said CityRealty founder Dan Levy, who does not have ties to StreetEasy, Realtor.com or any other listings platform.

He said Realtor.com’s “one size fits all” approach — which is more geared to analyzing sales and prices in markets dominated by single-family homes — doesn’t work here because the mix of condos, co-ops and townhouses is unique.

“Your big national brands don’t really work that well in New York, that’s the practical reality,” Levy said.

Levy and others pointed out that Zillow had the same problem in New York before it bought StreetEasy, but purchasing a company that already had built-in name recognition changed that overnight.

“Realtor.com doesn’t have the brand cache, recognition, audience or usage that StreetEasy has accumulated over time,” said 1000 Watts’ Boero. “Just because Realtor.com has the listings, doesn’t mean they’ll completely dominate the NYC market.”

And while its new RLS partnership is a huge plus, it is not exclusive.

In fact, REBNY is trying to disseminate its feed as widely as possible. In August, it struck a deal with the New York Times, whose classifieds were once the go-to source for consumers looking for residential properties. With the RLS feed, the Times could now pose a serious threat to Realtor.com’s expansion ambitions. “The New York Times is a very strong brand in New York. Realtor.com is not,” said Donna Olshan, whose eponymous firm focuses on the Manhattan luxury market.

The company seems aware of the work that still lies ahead.

“It won’t happen overnight,” acknowledged O’Hara. “[But] the market is large enough.”

News Corp. is, indeed, trying to spread itself around the world widely, leveraging all of its other websites to promote its listings portal — mostly through widgets directing readers to the listing platform, but also via the Yankees partnership and the RLS deal.

“They’re trying very hard and doing their due diligence very thoughtfully,” said Elizabeth Ann Stribling-Kivlan, president of Stribling & Associates.

“There’s a lot of money behind them. They’re not just coming in here with no track record,” added Stribling-Kivlan, whose firm was one of the first to reject StreetEasy and announce that it would feed listings exclusively to the RLS. “They know what works nationally. And they have deep pockets.”

‘Immense’ potential

Murdoch — who is reportedly worth more than $13 billion — was born into the newspaper business.

The 86-year-old Australia native inherited two papers and a radio station at age 21 when his father died, and over the next several decades, he doggedly built an international media empire by buying up (and turning around) struggling assets.

News Corp.’s aggressive pursuit of the real estate space, however, came in 2000 when Lachlan Murdoch, Rupert’s eldest son and heir apparent, made a prescient bet on Australia-based REA Group, operator of realestate.com.au.

As the story goes, REA’s founder asked Lachlan to meet for a drink to discuss a company bailout and within a day, the younger Murdoch agreed to pay $10.8 million for a 44.2 percent stake in the business — $2.3 million in cash and $8.5 million in contra advertising, despite skeptics’ concern that the site would cannibalize classified ad revenue from News Corp.’s newspapers. (News Corp. later increased its stake.)

“If www.realestate.com.au doesn’t eat our lunch, then someone else will,” Lachlan reportedly said at the time.

Today, REA’s market cap is $6.9 billion.

Buoyed by strong returns, News Corp. has ramped up its real estate focus in recent years. The media giant, Thomson said, views real estate and news as “complementary media platforms.”

When News Corp. bought Move, he said, Realtor.com was “frankly struggling in third place.” Today, it’s the No. 2 real estate portal in the U.S., after Zillow.

“Part of that [growth] has been in using those platforms to do some of the marketing heavy lift that we’d have to spend even more on,” said Thomson, who is also Australian.

Last year, News Corp.’s digital real estate services division was the fastest-growing segment of the company’s $8.1 billion business and “powered” its profitability as print advertising plummeted. The segment generated $938 million in revenue in fiscal year 2017 — up 14 percent year-over -year, compared to a 2 percent dip in News Corp.’s overall revenue.

Thomson said on the company’s August earnings call that it firmly believes that the U.S. digital property market is “still in an early phase of its evolution.”

“Our goal is to grow as rapidly as possible; there’s no limit,” he told TRD. “In the long term, our goal is to be the leading site — not only in New York, but in the U.S.” And News Corp. is poised to spend heavily to do so, he noted. “There’s no specific limit, in part because we genuinely believe the potential is immense,” he said.

Another key part of that strategy is beefing up the Realtor.com portal to compete more effectively against Zillow — both in New York and nationally.

“There’s no question that the purchase by News Corp. has made it a better site,” said Steve Murray, founder of the Colorado-based residential brokerage consulting firm Real Trends. “They’re certainly adapting quicker and innovating faster.”

That momentum has made News Corp. one of the only — if not the only — rival to give Zillow a real run for its money.

That rivalry has been on plain display since September 30, 2014, the day News Corp.’s acquisition of Move was announced. Zillow CEO Spencer Rascoff’s response to the news was a two-word tweet that said: “Game on.”

In April 2015, Murdoch threw out the first real punch when Move subsidiary ListHub — which transmits listings from MLS systems to third-party sites — announced that it would stop feeding Zillow.

Since then, Realtor.com and Zillow have brawled — and not just over listings. Part of that fight played out in court, after Move accused two former executives who defected to Zillow of stealing trade secrets and then destroying evidence to cover up the theft. During a contentious day of testimony last year, Rascoff admitted that Zillow tried — unsuccessfully — to buy Move in 2013 in an attempt to neutralize it.

“We are focusing on innovating. News Corp. is focused on litigating,” Rascoff said during an appearance on CNBC.

In June 2016, Zillow agreed to pay $130 million to settle the case, but it did not admit to any wrongdoing.

Meanwhile, Zillow remains far ahead of Realtor.com when it comes to a key currency: web traffic.

Compared to Zillow’s 178 million unique monthly visitors, Realtor.com logged just 58 million during the quarter that ended June 30.

Realtor.com — which features 3 million properties nationwide — had only 7,498 for-sale listings in New York City in late September, almost 70 percent less than StreetEasy’s 12,724.

One area in which Realtor.com has maintained an edge, 1000 Watts’ Boero said, is the timeliness and quality of its data — an area where Zillow’s taken a beating thanks to its notoriously faulty Zestimates.

On top of the back-end changes it’s making, News Corp. is pouring millions of dollars into ad campaigns — including TV spots featuring actress Elizabeth Banks, the company’s brand ambassador.

Those ads don’t come cheap. Realtor.com spent $43.9 million on measured media — such as TV spots and print ads — in 2016, up 173 percent from 2014, according to Manhattan-based Kantar Media, which specializes in communication strategies.

For Realtor.com, the effort may be paying off.

Move was valued at $2.5 billion — more than double what News Corp. paid for it — by a Morgan Stanley analyst. Though that’s a far cry from Zillow’s $7.54 billion market cap, Move is gaining ground.

“Most major brokers around the country know full well they have to be on both,” said Real Trends’ Murray.

‘Not our model’

But StreetEasy is clearly not giving away the keys to New York City — to Realtor.com or anyone else.

Instead, it’s pushed to monetize the market here by introducing new advertising features and a $3-per-day fee to post rental listings.

The move put New York’s residential brokerage world in a bind, forcing it to pay for a service that had always been free. But StreetEasy scored a major coup in August when it announced a deal with Realogy — parent company to the Corcoran Group, Citi Habitats and Sotheby’s International Realty — which said it would pay for agents to post listings.

StreetEasy’s general manager, Susan Daimler, dismissed Realtor.com’s push into New York, saying her site’s value is rooted in being “laser focused on NYC only,” a clear dig at a rival with a national profile.

“[It] fuels the quality contacts, information and services real estate professionals receive from StreetEasy,” she said in a statement. “This can’t even be found on Zillow Group’s sister sites.”

Rani Nagpal, chief marketing officer at LG Fairmont, a startup lead-generation firm that bases its business off buying leads from Zillow, Realtor.com and other sites, said it has no allegiance to any one website.

“We’re opportunistic, so if Realtor.com generates stronger results for us, we’ll definitely shift our budget,” she said, noting that the firm is still testing Realtor.com’s system.

“We’re curious to see what will happen,” she said. “I definitely believe it can change the game.”

Thomson, meanwhile, stressed that Realtor.com is aiming to be a partner — not a competitor — to the brokerage industry.

“What is clearer to brokers and real estate agents now is that Zillow is not a particularly good partner,” he said. “That’s not our business model. It never will be our business model.”