Temple Court, a Queen Anne-style high-rise from Manhattan’s gilded age, sat empty for years while developers quietly eyed it for luxury conversion. GFI Capital Resources, which acquired the property from Joseph Chetrit in 2012, was the one to finally get it done, outfitting the red-brick Building On Nassau Street with 67 apartments in a new, 51-story tower.

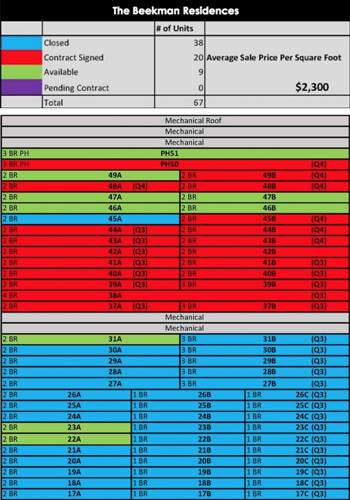

Now, three years after launching sales, The Project Known As 5 Beekman Street is 87 percent sold, according to documents filed with the Tel Aviv Stock Exchange this week. The closed sales have an average price of $2,300 per square foot.

38 units have closed and 20 are in contract, according to the filings, meaning only nine apartments remain up for grabs.

That includes the building’s penthouse, which is mysteriously not on the market, according to what’s available on listings website StreetEasy.

GFI did not immediately return requests for comment on the sales figures at 5 Beekman and its unlisted penthouse.

The project also includes a hotel, where GFI’s Allen Gross told The Real Deal last year he plans to charge $10,000 for the top-floor suite.

Last year, Douglas Elliman agent Fredrik Eklund sold the penultimate-floor penthouse for nearly $12 million, a record for the Financial District.