In a May interview with the New York Times, Housing and Urban Development Secretary Ben Carson warned against policies that provide “a comfortable setting that would make somebody want to say: ‘I’ll just stay here. They will take care of me.’”

Carson further said he believes in “incentivizing those who help themselves.” If that means aiding the already well-off, a comparison of two key housing subsidies by listings website Apartment List would indicate that the federal government is already doing that.

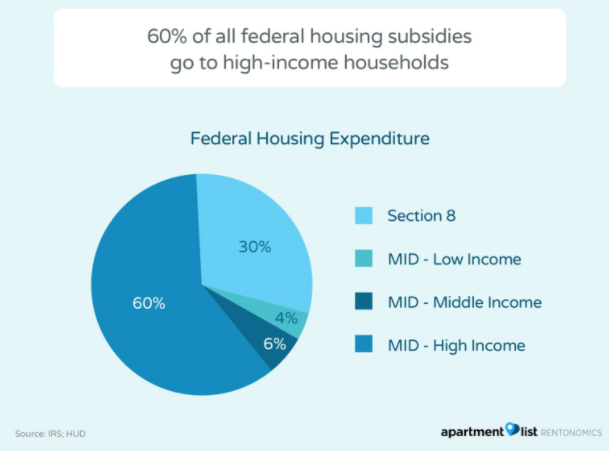

The study shows that in 2015, the government forwent $71 billion in tax revenue from the mortgage interest deduction, which allows homeowners to write down mortgage interest on their federal income taxes.That figure is more than double than the $29.9 billion spent on the Section 8 rental assistance program, which mostly benefits poor and working families.

Furthermore, wealthier homeowners are more likely to benefit from the MID than lower-income homeowners, defined as those making less than 80 percent of the area media income, the report found. The larger one’s mortgage interest, the higher the value of the deduction, so those who can itemize deductions greater than the current standard deduction of $12,600 for a married couple are most likely to benefit from MID.

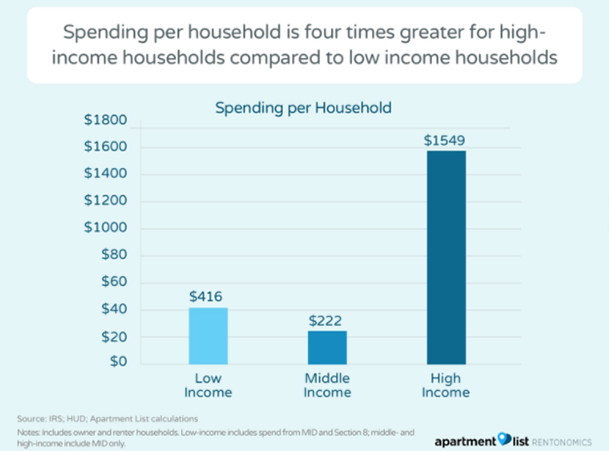

And even with Section 8 taken into account for lower income families, the total expenditure between the two programs is greater for wealthier families, the report shows. The annual housing subsidy for a high-income family amounts to $1,549, according to the report, but just $222 for a middle-income family and $416 for a low-income family.

The Section 8 program, created by Congress in 1974, is a key revenue component in many of New York City’s largest affordable housing complexes, including Starrett City, which is under contract with Rockpoint Group and Brooksville Company, where the federal government subsidizes more than 3,000 apartment rents.

President Trump’s tax plan proposes doubling the standard deduction, which would ultimately mean fewer filers claiming the MID on their annual tax returns. This has attracted the ire of the homeownership lobby, who will push congress to preserve the incentive.

Meanwhile, the White House has proposed a $6 billion cut to HUD, which manages the Section 8 program. The direct cut to Section 8 under the proposal would amount to at least $300 million, although the real drop in spending would be much more according to many analysts due to the increased demand from population growth. Other similar subsidies, such as those for the disabled and for Native Americans, would also see cuts at a time when rents paid as a share of GDP is at an all time high.