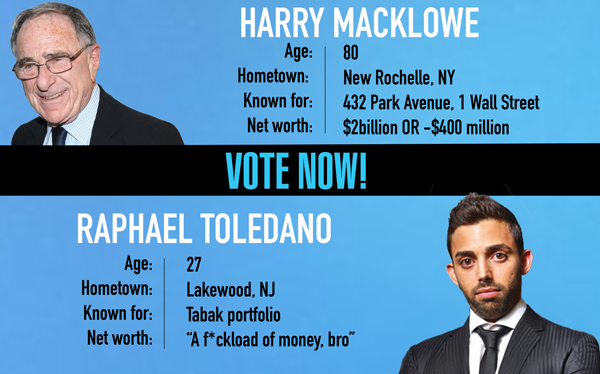

One, an octogenarian emblem of the highest-stakes Manhattan Monopoly, a man who had the balls to buy a $7 billion portfolio at the top of the market and the stomach to resurrect his empire after that deal took it down. A Page Six fixture with a billion-dollar art collection.

The other, a frenetic 20-something with a penchant for patent-leather shoes and blingy suits, a Lakewood kid who could have pulled off one of the most profitable multifamily flips in years but fancied himself as a multigenerational landlord dynasty instead and, as a result, became a cautionary tale.

Let’s start with Harry Macklowe. In April, while regaling reporters with jokes of the “take my wife – please!” variety, Macklowe said he had offered his wife, Linda, $1 billion to divorce him, a move that would allow him to wed his French lover, Patricia Landeau. But when the divorce trial actually commenced this month, Macklowe’s lawyers tried their damnedest to position him as a broke businessman, dealing with looming debt and a pile of precarious projects. They claimed, citing his deferred capital-gains taxes, that he was actually worth negative $400 million.

But deferring capital-gains taxes through 1031 exchanges is a forever game that all developers play. Linda’s lawyer described the tactic as “a case study in divorce accounting 101.”

Macklowe is also trying to portray his property portfolio less as an empire and more as a humble and dicey enterprise.

Assets such as 200 East 59th Street and even the retail at 432 Park Avenue are struggling with sluggish demand, his lawyers said. (That’s despite 432 Park’s projected $3 billion residential condo sellout and over $1.5 billion in closed deals as of December.) New ventures, Such As 1 Wall Street, face their own issues, his lawyers said. But Linda’s well-compensated quants, who’ve laid bare what they claim are Macklowe’s actual stakes in these projects, project the developer’s portfolio will generate $275 million over the next five years for him.

Our second contestant is Rafi Toledano, who has managed to cram in more controversy in two years than most investors do in a lifetime: He’s been hit with and settled claims of harassing rent-stabilized tenants, shown to potentially have connections to a fake law firm, fought to hold on to a major East Village multifamily portfolio, struck a short-lived deal to sell that portfolio, and is in the process of losing that portfolio to his lender.

Now, Toledano has been hit with an eviction order at his Upper West Side pad. His response to that eviction order? Filing a housing court petition in which he claims to be a rent-stabilized tenant.

The rental contract at the Simon Baron-owned property at 393 West End Avenue, Toledano claims, included a 421a rider detailing the apartment’s rent-stabilization requirements.

On hearing of the maneuver, SaMi Chester, who has helped organize tenants in Toledano-owned buildings to take legal action against the landlord, said: “This has got to be a joke, right? Here’s a guy who’s built his career on screwing over rent-stabilized tenants. Now he’s doing that?”

Chaser: Speaking of stunts, my colleagues Mark Maurer and Konrad Putzier have chronicled some of the more audacious ones retail investors use in attempts to make their portfolios more valuable. These include payout offers that allow them to charge tenants higher rents, kick-out clauses, and more. It’s a story every retail investor, lender and tenant should read.

(Paydirt is a weekly column that riffs on the biggest NYC real estate news of the moment, providing analysis and historical context on the deals and players that make this town tick. Read more from Paydirt here.)