Zillow made over $600 million off Premier Agent advertising last year. And with the launch of the initiative in New York through StreetEasy, it could make up to $86 million more over the next two years, a new Deutsche Bank report estimates.

“We see StreetEasy monetization ramping up as new agents come into New York Premier Agent ad auctions and existing agents increase spend to defend share,” Deutsche Bank analyst Lloyd Walmsley wrote in the Aug. 7 report, titled “Livin’ is Easy on StreetEasy.”

Zillow estimates that its Premier Agent revenue for 2017 would be between $760 million and $765 million, up 26 percent from last year. For discussion’s sake, let’s assume that Deutsche Bank’s estimate is accurate, and that the Premier Agent revenue from StreetEasy stays constant between 2017 and 2018. That would mean that StreetEasy’s Premier Agent would account for nearly 6 percent of Zillow’s entire Premier Agent revenue in those years.

During the second quarter, Premier Agent earnings jumped 29 percent to $189.7 million, Zillow reported on Aug. 8. The company didn’t break out figures for New York, but said Premier Agent revenue here doubled between March and June, as agents saw a “flood of leads” come their way.

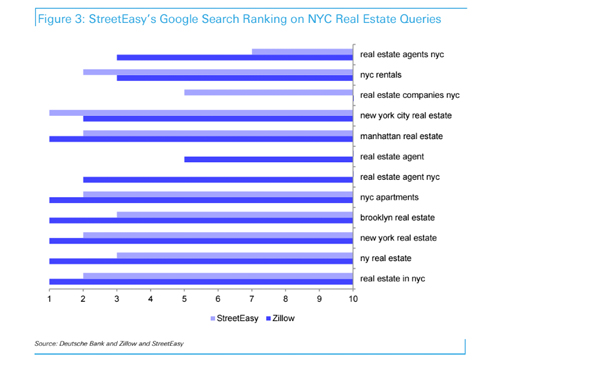

“We’re more excited than ever about our potential in New York, given the collection of brands we have,” Zillow CEO Spencer Rascoff said. “Our audience size really dwarfs the competition.”

Like all else, Premier Agent is more expensive in New York. Agents must buy a minimum of 30 leads in certain zip codes, according to the Deutsche Bank report. (Premier Agent uses auction-based pricing, so there’s no set price per lead.) In New Jersey, by comparison, agents only have to purchase a minimum of 10 leads. New York’s premium pricing could actually work out well for StreetEasy, Deutsche Bank estimates, as “the minimum will weed out the more casual agents who are not willing to up their budge if the marketplace pricing trends higher.”

Firms like LG Fairmont are preparing for that scenario.

“We’ve definitely seen an increase in Premier Agent pricing,” said Aaron Graf, CEO of the brokerage. “If history is a guide, we will continue to see rising prices until the point where many buyers drop out.”

The controversial program has divided the city’s residential brokers since it debuted on March 1. Firms like LG Fairmont, as well as TripleMint and Elegran Real Estate, have built their business around online lead generation. But the heads of the city’s largest firms, including Corcoran Group’s Pam Liebman and Brown Harris Stevens’ Hall Willkie and Bess Freedman, have called Premier Agent “pay to play” and say it does consumers a disservice. Still, Corcoran — along with Douglas Elliman, Nest Seekers International and BOND New York — have opted in to “Premier Broker,” which lets firms buy bundles of buyer leads.

In recent weeks, brokers have been focused on StreetEasy’s daily fee to post rental listings. The company has also said it won’t accept the syndicated listing feed from the Real Estate Board of New York, prompting 10 residential brokerages to say they will stop feeding their listings to the site in an attempt to control their own listings.

But the Deutsche Bank analysts said it may be too late. “StreetEasy is in too powerful a position as being the de facto place to look for real estate in New York City,” they wrote. “The traffic advantage is so large that it is too late for agents to abandon the platform, particularly without a great alternative in New York with traffic scale.”