The developers of the seven-building Bedford-Stuyvesant condominium complex known as Cascade secured $88 million in construction financing last week from Madison Realty Capital [TRDataCustom], sources told The Real Deal.

The funds allow the development team of Isaac Deutsch’s Empire State Management, Abraham Brach and Nachman Leibowitz to proceed with construction of the 400,000-square-foot project on the old Cascade Linen factory site. The first phase is slated for completion next year.

Madison acquired an old $50 million loan from Canadian lender Romspen in May, and then modified and expanded it to complete financing for the project’s first phase, sources said. The first mortgage construction loan, provided by Madison, closed last week.

The developers filed offering plans with the New York State Attorney General’s office in May for the first three buildings, with a combined projected sellout of $114.8 million for 97 apartments. At an average $1.2 million per unit, the apartments will be among the priciest in the neighborhood. The Samuel Wieder Associates-designed complex would also hold 142 parking spaces and 36,000 square feet of retail, including a 20,000-square-foot supermarket. The two phases will have a combined 222 apartments, sources said.

The developers, who bought the cluster of factory buildings on the site from Mike Kohn’s Alliance Capital Group for $70 million in 2015, aimed to market the apartments to families and other members of the Orthodox Jewish community.

The developers mostly followed through with plans devised by Kohn, who paid only $27 million for the site in 2013.

Deutsch, Brach and Leibowitz, who are members of Williamsburg’s Hasidic Satmar community, are developing luxury condos, in an area of northern of Bed-Stuy where a $1 million-plus price point is scarce. They have been self-funding the project in the interim, sources said.

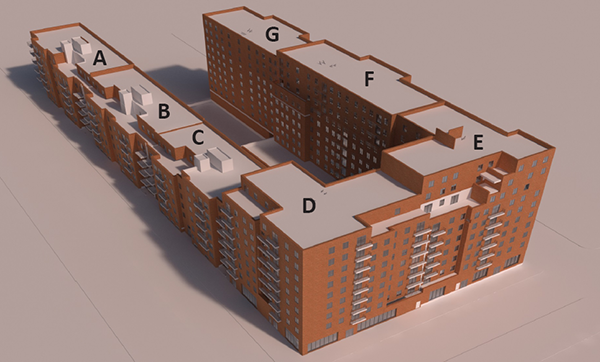

Plans call for two 10-story buildings, one nine-story building, one eight-story building and three six-story buildings.

The condo plans have the addresses of 104, 114 and 134 Stockton Street. The site’s other addresses are 553-569 Marcy Avenue, 833-869 Myrtle Avenue and 90-134 Stockton Street.

Madison, an investor-lender led by Josh Zegen and Brian Shatz, has provided construction financing for a handful of Brooklyn projects such as Yoel Goldman’s 1 million-square-foot Rheingold Brewery development in Bushwick and Bruman Realty’s new two-building complex in Bushwick. Madison’s interest rates, which average between 9 and 12 percent, are often on par with other hard-money lenders, sources said.