When the city’s major firms came together this month to syndicate their listings exclusively through the Real Estate Board of New York, they hoped to put a check on StreetEasy’s increasing clout over the residential industry. But they better brace for the counterpunch.

In an unusually direct statement for a company fluent in corporatespeak, StreetEasy’s general manager Susan Daimler said Thursday that the listings aggregator would refuse to work with REBNY’s Residential Listings Service.

“We will not be taking a feed from the RLS,” Daimler said, ‘because we would characterize this as a clear move to restrict our efforts to provide consumers with the most robust real estate marketplace in New York City.”

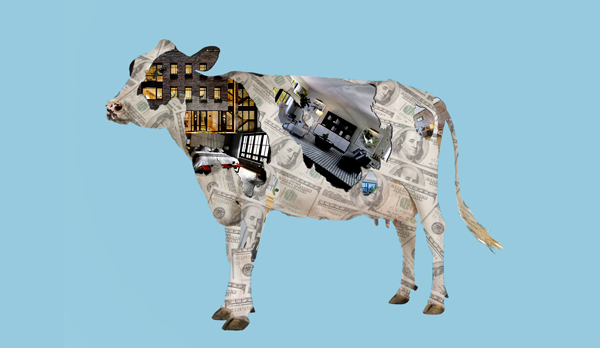

StreetEasy announced earlier this week that it would begin charging brokers a daily fee to display their rental listings on the platform. Crunch the numbers on that initiative, and you begin to get a sense of what’s at stake for the New York-based company and its parent Zillow, the $6 billion behemoth that has aggressively monetized the platform since acquiring it in 2013.

Here’s some back of the napkin math. (Note that it makes the highly optimistic assumption that brokers don’t pull a good chunk of their listings when the service is no longer free.)

The median time on the market for a New York rental listing is 25 days, according to StreetEasy data from 2016. StreetEasy will be charging brokers $3 a day for the service, so that’s $75 per listing. The platform currently has over 30,000 live listings – so that’s $2.25 million in additional revenue.

That money is coming directly out of agents’ pockets.

The median asking rent for a rental listing on StreetEasy’s platform is $2,795, according to data provided by StreetEasy. (Note that the company’s data isn’t necessarily representative of the market as a whole, as thousands of listings in outer-borough neighborhoods may not appear on its platform).

| Region | Median days on market | Median asking rent in 2016n | StreetEasy fee |

|---|---|---|---|

| Manhattan | 27 | $3,191 | $81 |

| Brooklyn | 25 | $2,550 | $75 |

| Queens | 21 | $2,200 | $63 |

| Bronx | 28 | $1,600 | $84 |

| Staten Island | 30.5 | $1,853 | $92 |

| NYC | 25 | $2,795 | $75 |

Assuming agents collect a 12.5-percent broker fee, StreetEasy’s data show that an agent representing one side of a rental deal may take home $1,258 after their firm takes a cut — meaning an agent would end up paying the site around 6 percent of their earnings. On a deal where an agent represents both sides, StreetEasy estimates a commission of $2,515, meaning the fee is closer to 3 percent of the agent’s earnings.

“If you have a lot of listings, it can add up quickly,” said Karla Saladino, managing partner of Mirador Real Estate.

Mdrn. Residential’s Zach Ehrlich noted that if agents have a rental exclusive that sits on the market for longer — say three or four months — StreetEasy’s fees could add up to far more.

“That’s an enormous amount of money if they’re making a few thousand dollars in commission,” he said. And there’s potential for serious growth, too: There are about 70,000 rental deals done every year just in Manhattan, according to data from appraisal firm Miller Samuel.

But turning rental listings into a paid product could slash the number of agents who use StreetEasy as a marketing tool.

“I think what StreetEasy needs to be smarter about is understanding that without firms like myself that are putting up a large amount of rental listings, we’ll start taking those off StreetEasy and diminish the experience for the user,” said Jordan Sachs of Bold New York, a brokerage with large rental projects like the Moinian Group’s Sky.

“It’s a chicken and egg thing,” Sachs added. “Sure, we can afford this but it’s going to motivate us and other brokerages to put money outside of StreetEasy.”

Brokers hawking $20,000- and $30,000-a-month rentals may not bat an eye, but those at small firms, especially those that focus on lower-priced markets in the boroughs, said they will be hardest hit by StreetEasy’s new rental program. On Thursday, Romy Chiarotti, an agent at Williamsburg-based brokerage Brick & Mortar, launched a petition against the fees that garnered several hundred signatures by mid-afternoon.

“I have 20 listings on StreetEasy so I’m looking at $60 a day,” said Peta Couzens of Upper Manhattan-based Bohemia Realty. Her listings range from a one-bedroom in Washington Heights asking $1,850 to a four-bedroom on the Upper West Side that’s listed for $11,000.

Dan Levy founder of CityRealty, noted that the bulk of the city’s rental listings are between $2,000 and $4,000 a month, so agents’ margins are far thinner than they would be on the pricier product.

We would characterize this as a clear move to restrict our efforts to provide consumers with the most robust real estate marketplace

And with a cost attached to uploading each listing, agents may list just one or two properties, then redirect leads to other listings in the type of “bait and switch” schemes that StreetEasy had hoped to weed out in the first place.

“If we have five units in a building, we’re only going to advertise one,” Couzens said. “We’ll just select a feeder unit, put those up, use it to draw in consumers and take them to other units.”

Ehrlich said his firm may be very selective about what it puts on StreetEasy when marketing 25 Bruckner Boulevard, a rental building in the South Bronx. “It’s definitely going to put affect how we release that,” he said. “We may actually cut that down and focus on inventory we can move.”

Daimler said StreetEasy also hoped to incentivize agents “to stop advertising stale listings and to more closely examine a marketing tactic or asking price that might need adjustment if an apartment isn’t getting rented.”

Some in the industry are with her on that. “I think we’ll get a more transparent rental market,” said Daniel Shamooil, CEO of Great Neck-based VORO Real Estate. With a fee attached, agents are more likely to only put up accurate and available apartments, since they won’t want to waste money. “The daily rate is worth it,” he added. “Even if it stays up there for 30 day, it’s only $90, and if you have to do that for a year, and you do one rental, it’s paid for.”

Brian Meier of the Corcoran Group predicted the fee would cut down on agents who list the same unit multiple times. “Some small firms I see are posting 500 ads at one time. Most are fake or outdated,” he said. “This will now cost them about $500,000 a year and it will clear them from the market.”

Some believe this will ultimately hurt StreetEasy. “It hurts their brand in terms of being the catch-all for everything,” said Kathy Braddock, managing director of William Raveis NYC. “It’s not so much the $3, it’s what does it mean going forward. Is this a prelude to them charging for sales, as well?”

StreetEasy says it has no plans to charge agents for sale listings. On the rental front, Daimler said the $3 fee “represents a single-digit share of the potential rental commissions earned, and is nominal for the service and advertising value that StreetEasy provides for agents and their listings.”

But CityRealty’s Levy believes that $3 is just the starter price.

“Presumably over time,” he said, “it goes up.”

Eddie Small contributed reporting.