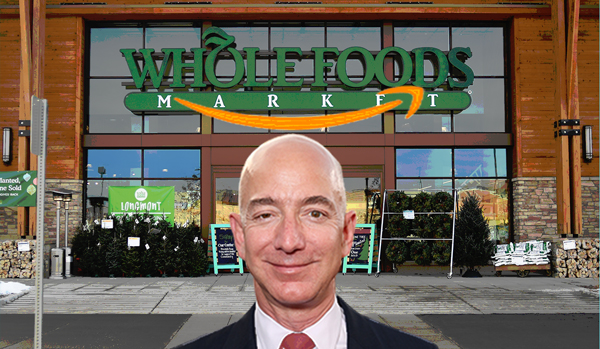

When Amazon announced its headline-grabbing deal to buy Whole Foods on Friday, the $13 billion question the real estate world asked was: Will the brick-and-mortar grocery chain become more like the e-tailing giant, or the other way around?

And while New York City’s retail players stressed they didn’t have a crystal ball into Jeff Bezos’ thinking, they said it’s probably a little bit of both – Amazon is likely to apply its omnichannel expertise to the grocer while using its enviably-located stores to expand its own brick-and-mortar operations.

“There’s boundless ideas and synergies, and I think it will inspire some other interesting combinations between online and brick-and-mortar going forward,” said Ripco Real Estate’s Peter Ripka. “It’s a multichannel world.”

Ripka had once compared nabbing Whole Foods as an anchor tenant to “going to the ball with one of the belles,” and his opinion on this has not changed, despite the new opportunities for online grocery shopping that Amazon’s purchase could open up.

Nationwide, the retail grocery and supermarket business totaled nearly $707 billion in revenue in 2016, according to U.S. Census data, and Amazon has made no secret of its intent to grab its share of that lucrative market. Whole Foods, meanwhile, saw six consecutive quarters of falling same-store sales and recently announced plans to close a number of stores.

Amazon, which has a market cap of nearly $500 billion, has been looking to break into brick-and-mortar. The company was reportedly looking to open a retail location below its offices at 7 West 34th Street, which was rumored to be a pick-up location for online purchases, though it seems to have abandoned those plans for the time being. Earlier this year, it opened a bookstore at the Time Warner Center.

The company also has plans to open its first distribution center in New York at a warehouse on Staten Island’s West Shore, where it will occupy 975,000 square feet.

With its acquisition of Whole Foods, Amazon acquires a portfolio of a dozen stores in New York City, including one at the Time Warner Center and another on the way at Manhattan West, as well as the grocer’s distribution-supply chain.

“I think it helps their distribution network. Whole Foods itself has a lot of warehouses,” RKF’s Jeff Fishman said.

Milstein Properties’ Michael Milstein, whose company has Whole Foods as a tenant at 1551 Third Avenue, said he sees three likely motivations for Amazon’s deal, with the company possibly looking to implement one or some combination of the three.

One could be acquiring data from Whole Foods shoppers – a demographic similar to Amazon’s existing customer base – in order to better learn their shopping habits. Another could be to use the retail locations as pick-up spots for online orders, and a third could be to serve as a distribution hub for home deliveries.

“If the motivation is acquiring a footprint for urban distribution hubs, that could totally flip the in-store model to optimize last-mile logistics for deliveries,” Milstein said.

Robin Abrams, vice chair of the retail group at Eastern Consolidated, said the deal gives Amazon a base to test other brick-and-mortar concepts, such as its bookstores.

“It makes it very easy for them to do a quick rollout of the bookstore concept,” she said. “They’ve already got a captive audience.”

Amazon may be able to turn Whole Foods into an even more desirable anchor tenant, CPEX Real Estate’s Tim King said, by tapping into its vast repository of other products.

“Rather than becoming just a destination for grocery shopping, now you’re bringing people in who can do their grocery shopping, as well as all manner of other retail and/or service activities,” he said.

Red Apple Group CEO John Catsimatidis thinks pharmacies will be the next target for the online giant.

“Just think about it,” he said. “It’s easier to ship a box of pills than to ship two liters worth of soda.”

(To view Whole Foods’ New York City retail leases, click here)